Bitcoin clawed its way over $27,000 on Sep. 18 after struggling to reclaim its tight summer trading range for most of the month. Although every price uptick brings a breath of optimism to the industry, on-chain data still suggests a dominant sell-side regime on the market.

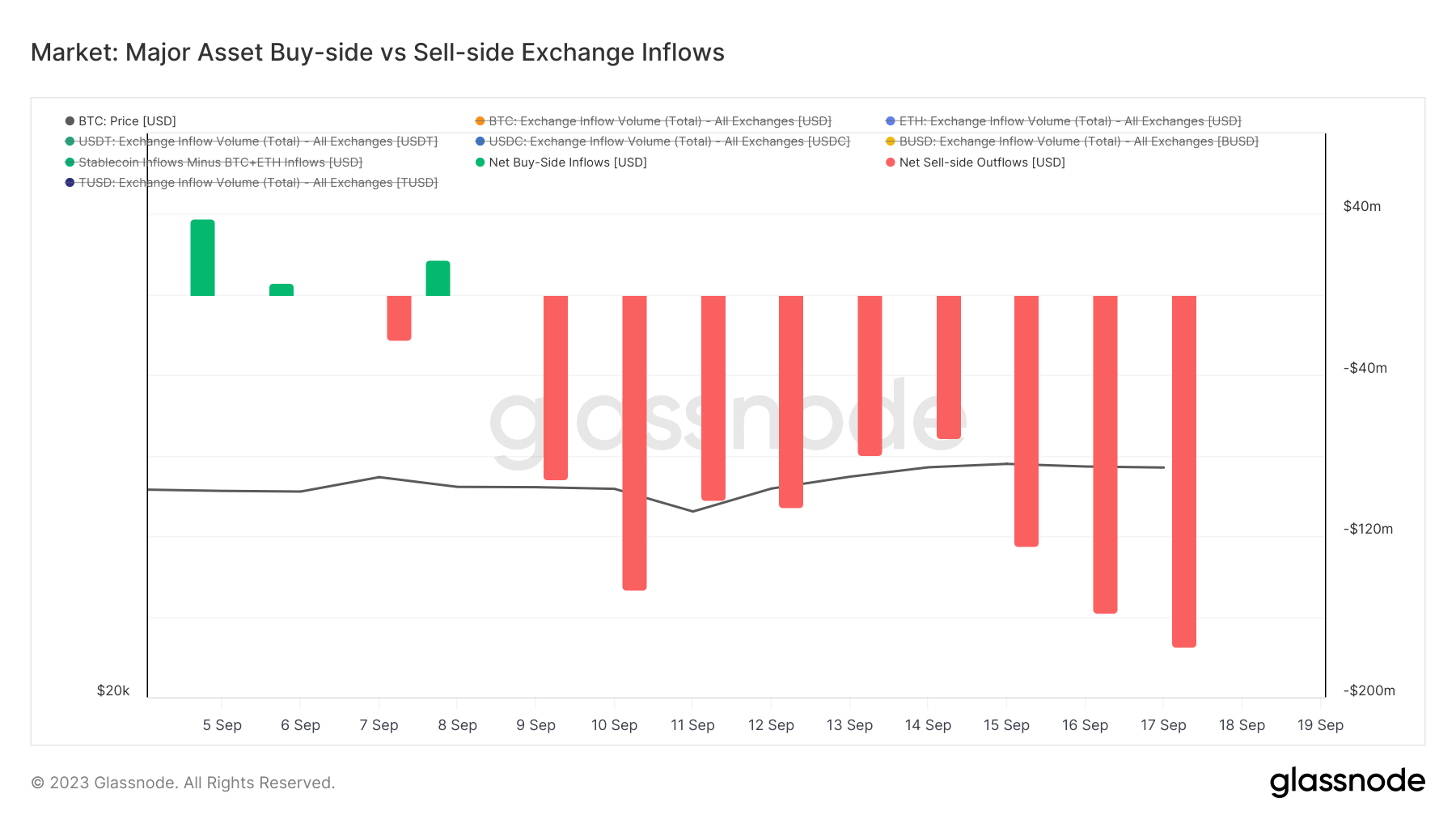

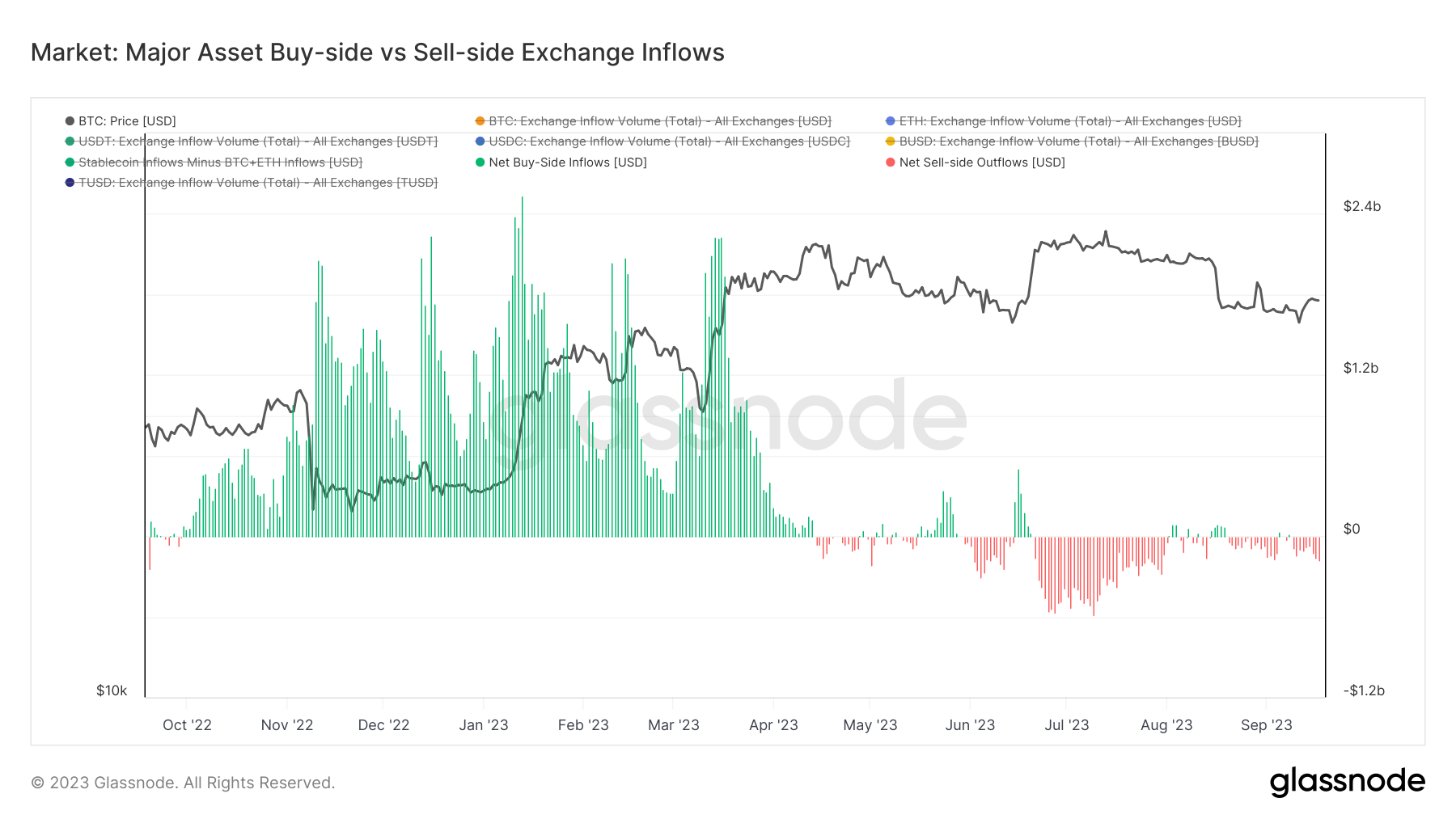

Buy-side and sell-side exchange inflows are critical in shedding light on this market sentiment. These inflows offer a tangible way to gauge capital shifts based on preferences concerning exchange volumes.

Specifically, the assumption lies in treating Bitcoin (BTC) and Ethereum (ETH) inflows, when denominated in USD, as indicative of sell-side pressure. Conversely, inflows of stablecoins are seen as representative of buy-side pressure.

The metric offsets the BTC/ETH sell-side volumes against stablecoin buy-side volumes, giving an overarching view of exchange inflows. Essentially, values hovering around zero suggest a market equilibrium. Positive values signify a buy-side dominance, while negative ones point to a sell-side dominance.

However, it’s important to note that this metric is based on the premise that BTC and ETH are deposited to exchanges to be sold, and stablecoins are deposited to exchanges to buy other major assets. Both stablecoins and other digital assets can flow into exchanges for myriad reasons, not limited to trade. These include custody considerations, collateral purposes, or maintaining position margins. Therefore, it’s more important to analyze shift changes than nominal amounts of outflows.

A heightened sell-pressure began last week, casting a shadow over Bitcoin’s ascension to $27,000. This means that market participants seem to be cashing out their positions despite the uptick in price.

A wider lens reveals a noticeable pivot from buy-side to sell-side began unfolding in April. After a tumultuous three months of quick regime shifts, the market sank into a sell-side dominance by mid-July, a trend that lasted till August.

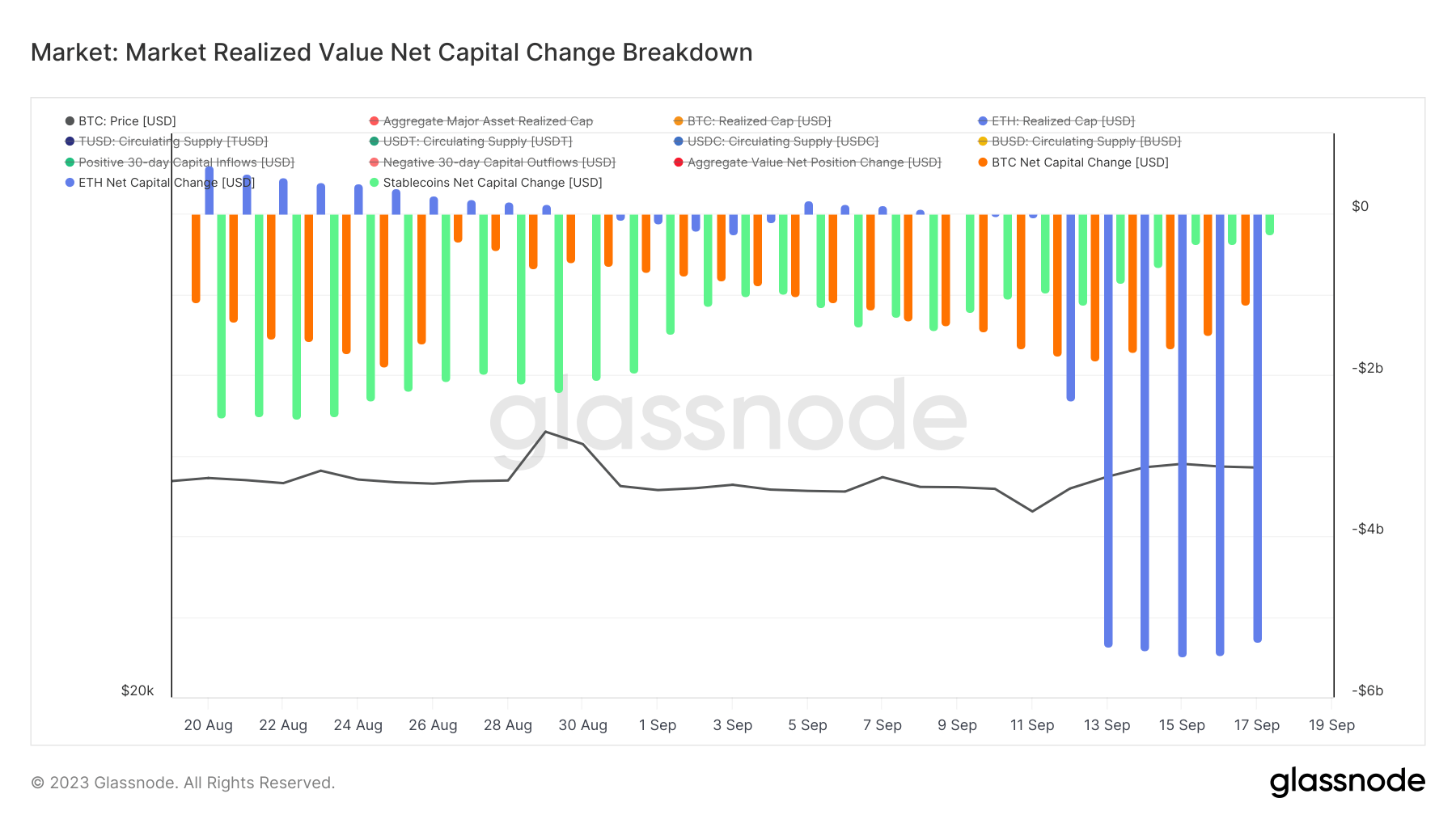

The market-realized value net capital change (MRVNCC) is another valuable metric for gauging capital inflows. It shows the aggregate 30-day net position change for the largest assets in the market, essentially representing the market’s financial health.

The MRVNCC considers the realized cap of major network assets more accurately representing genuine capital movements than the spot price. The realized cap assigns a value to each coin based on its last transacted price, accounting for coin liquidity and effectively filtering out speculative off-chain trading. This metric shows positive capital inflows, negative capital outflows, and the total capital flows for network assets (like BTC, ETH, and LTC) and stablecoins (USDT, USDC, and BUSD).

A negative capital outflow of Bitcoin began at the start of August. Its most significant dip occurred on Aug. 15, recording an outflow of $1.89 billion. As Bitcoin’s price initiated its upward journey on Sep. 11, Ethereum experienced a substantial drain.

Ethereum’s capital outflows were $35 million on Sep. 11, escalated to $2.3 billion by Sep. 12, and peaked at $5.48 billion on Sep. 15. In contrast, Bitcoin recorded an outflow of $1.66 billion the same day. By Sep. 18, Bitcoin’s capital outflows receded slightly to $1.12 billion.

While the recent price hike of Bitcoin rekindles optimism, the persisting sell-side pressure, evident from major asset outflows and contrasting stablecoin inflows, suggests that the market is still treading cautiously. This predominant sell-side trend might be indicative of several underlying market dynamics. Traders, especially short-term holders who accumulated throughout the year at lower prices, might be cashing out to realize profits.

The substantial outflows might signal a lack of market confidence or be attributed to increased institutional engagement in the crypto sector. Institutional investors manage much larger portfolios, so their trading strategies can cause more significant inflows and outflows than retail traders.

The post Bearish warning as sell-side pressure persists despite Bitcoin surge – on-chain data shows appeared first on CryptoSlate.