Delving into the unique financial ecosystem of Bitcoin involves unpacking the concept of Unspent Transaction Outputs (UTXOs), a distinct characteristic that sets Bitcoin transactions apart from traditional financial transactions and offers a unique lens through which to analyze market behavior and investor sentiment.

Unlike traditional financial transactions where balances are tracked, Bitcoin uses a system of UTXOs, which represent the unspent value from Bitcoin transactions. A UTXO is the amount of digital currency remaining after a cryptocurrency transaction is executed. This output waits to be used as an input in a future transaction.

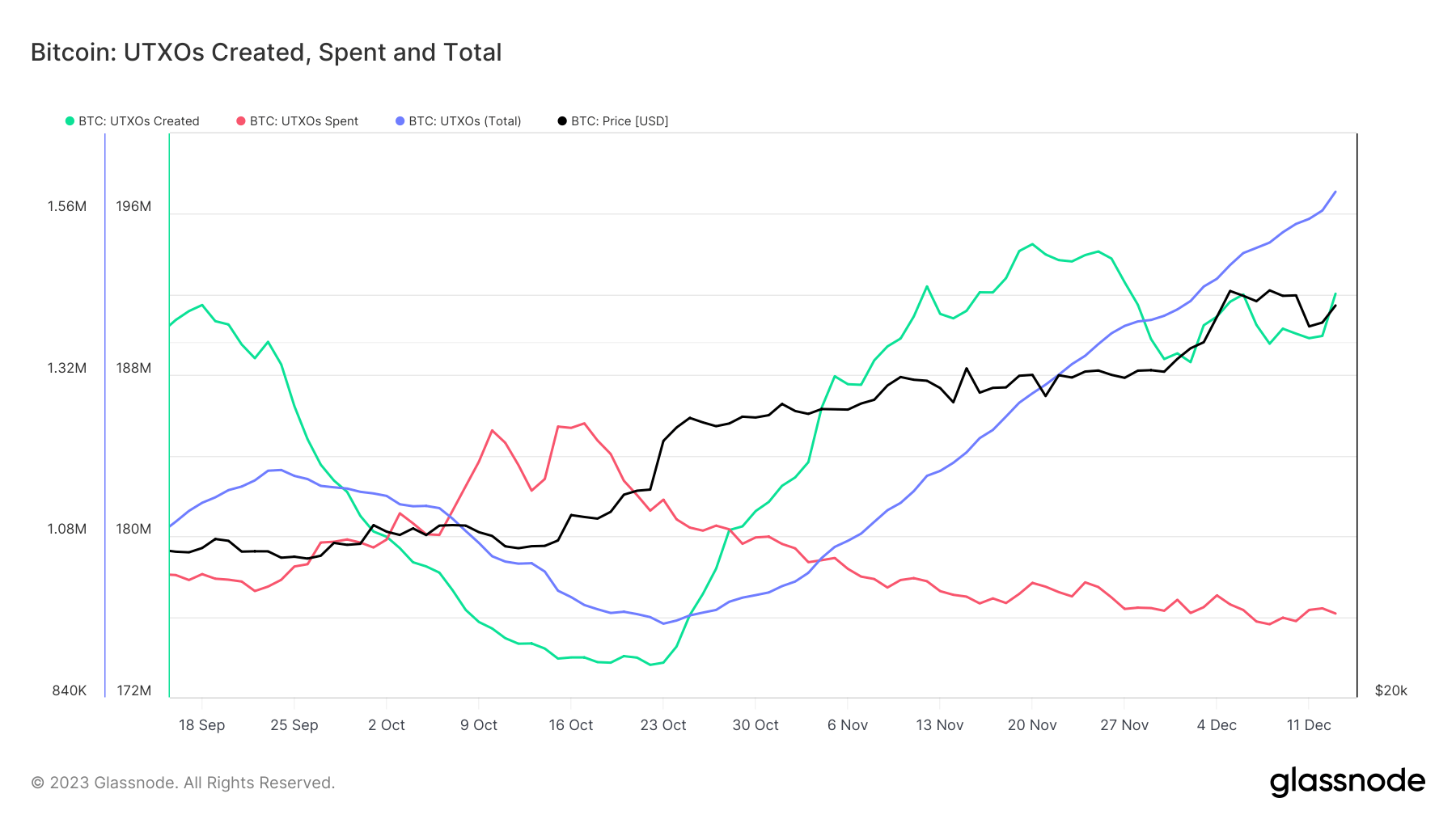

Bitcoin’s surge past the $40,000 mark has led to a notable trend in UTXOs. Since Oct. 28, the creation of UTXOs has consistently outpaced their spending. A ‘created UTXO’ refers to the output of a new transaction that hasn’t been spent, while a ‘spent UTXO’ is an input used in a transaction and is thus no longer available. The distinction between these two types of UTXOs reveals insights into how Bitcoin is used and stored.

This indicates a growing trend of Bitcoin accumulation, as new UTXOs represent new Bitcoin holdings that have not yet been spent. In contrast, spent UTXOs indicate Bitcoins that have been transferred or used in transactions. This distinction between created and spent UTXOs is pivotal in understanding market sentiment and behavior.

Between Oct. 28 and Dec.14, 2023, the daily average of created UTXOs was approximately 1.43 million, significantly higher than the 984,000 UTXOs spent on average per day. This resulted in a net increase in UTXOs, averaging around 442,000 daily. Despite some variability in the daily figures, as indicated by the standard deviation for UTXO creation and spending, the overall trend remained consistent. This trend signifies not only an increase in network activity but also a potential expansion in Bitcoin ownership, as indicated by the growing total count of UTXOs.

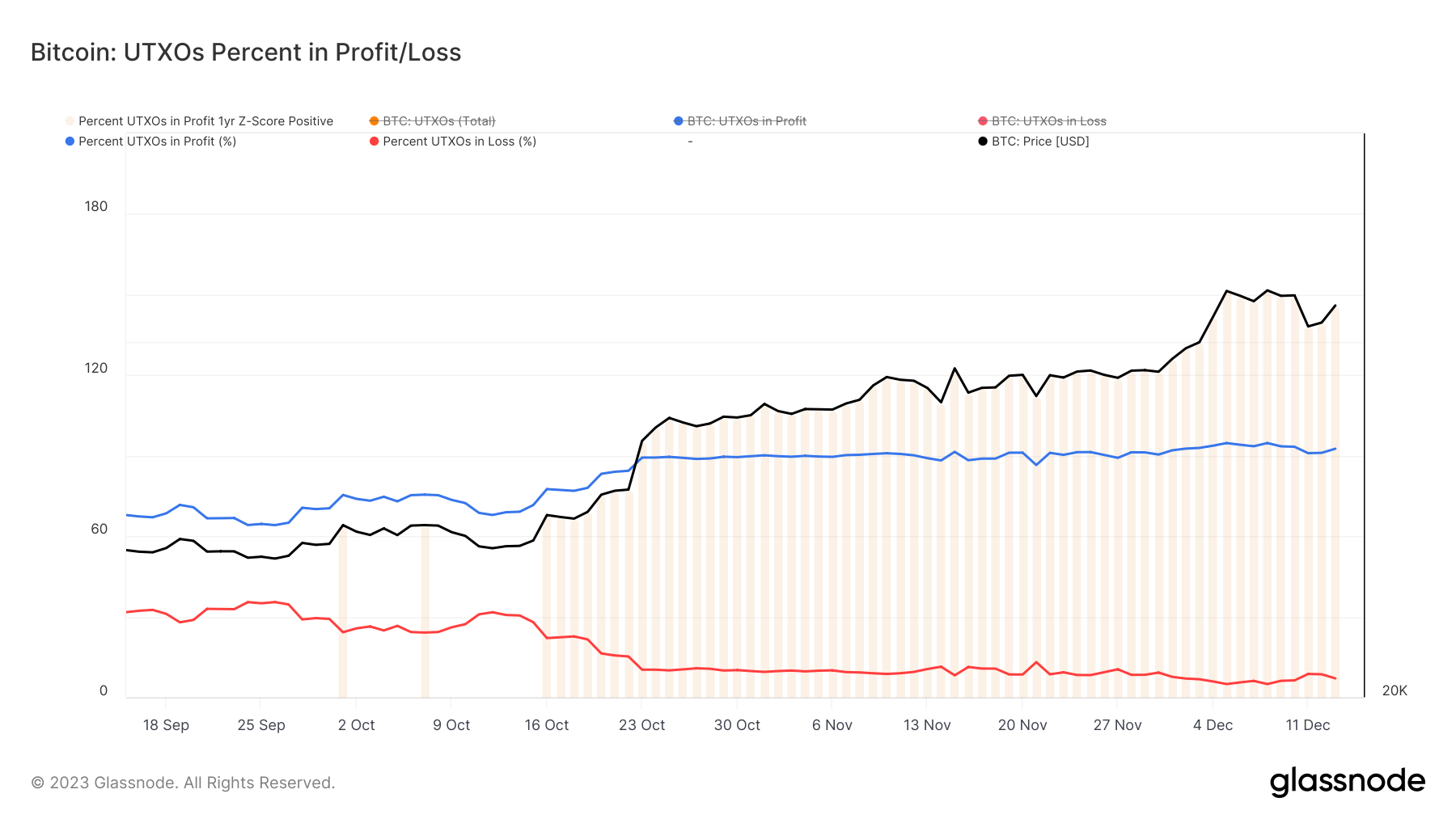

Concurrently, the percentage of Bitcoin UTXOs in profit rose from 88% to 92% during the same period. A UTXO is considered ‘in profit’ if the current market price of Bitcoin exceeds the price at which the Bitcoin in that UTXO was last transacted. This increase suggests that if these UTXOs were to be transacted or sold at the current market price, a profit would be realized, indicating a bullish sentiment in the market.

The observed patterns suggest a holding behavior among investors, possibly due to expectations of further price appreciation. This behavior is a hallmark of bullish market conditions, where the anticipation of future gains discourages selling or spending. The combination of a growing number of UTXOs and an increase in profitable ones might signify the entry of new investors or the augmented holdings of existing ones.

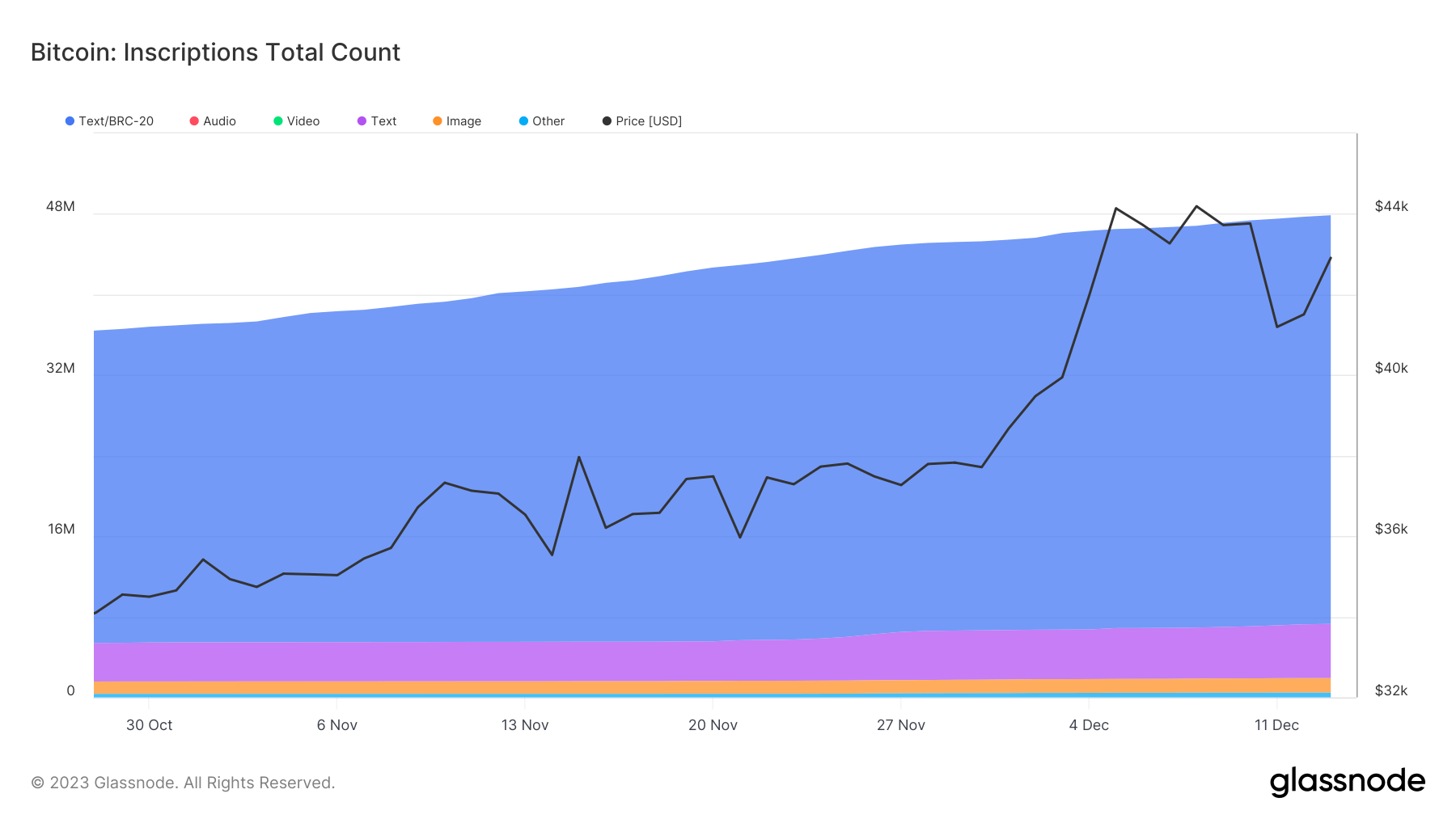

Another factor influencing this trend could be the significant rise in Bitcoin Inscriptions. Between Oct.28 and Dec. 14, 11.4 million new Inscriptions were created. While not every Inscription results in a new UTXO, the notable increase likely impacted the number of UTXOs created.

The trend of UTXOs created outpacing those spent has multiple implications for the market. Primarily, it suggests a preference for holding Bitcoin, indicating a positive market sentiment. This trend, coupled with the rise in profitable UTXOs, which signifies the potential earnings if these were to be sold at current market prices, reinforces the notion of Bitcoin as a promising investment, potentially attracting more investors and leading to more stability in the Bitcoin ecosystem.

This trend, influenced by both investor behavior and technological factors like Inscriptions, points to a period of accumulation and optimism among Bitcoin investors, which is mirrored in the strong support Bitcoin seems to have created above $40,000.

The post Bitcoin owners hold tight as new UTXOs outstrip spending appeared first on CryptoSlate.