The role of Bitcoin miners goes beyond block validation — they are fundamental in shaping the market through their BTC balances. Historically, these balances have been closely tied to Bitcoin’s price movements, making them a key metric for market analysis.

Bitcoin’s recent surge past the $40,000 mark was met with significant action from miners. At the beginning of December, Bitcoin was priced at $38,680. By Dec. 8, it climbed to a peak of $44,200 before consolidating at around $41,200 on Dec. 11. Despite this consolidation, the nearly 8% increase over ten days signals a bullish market phase.

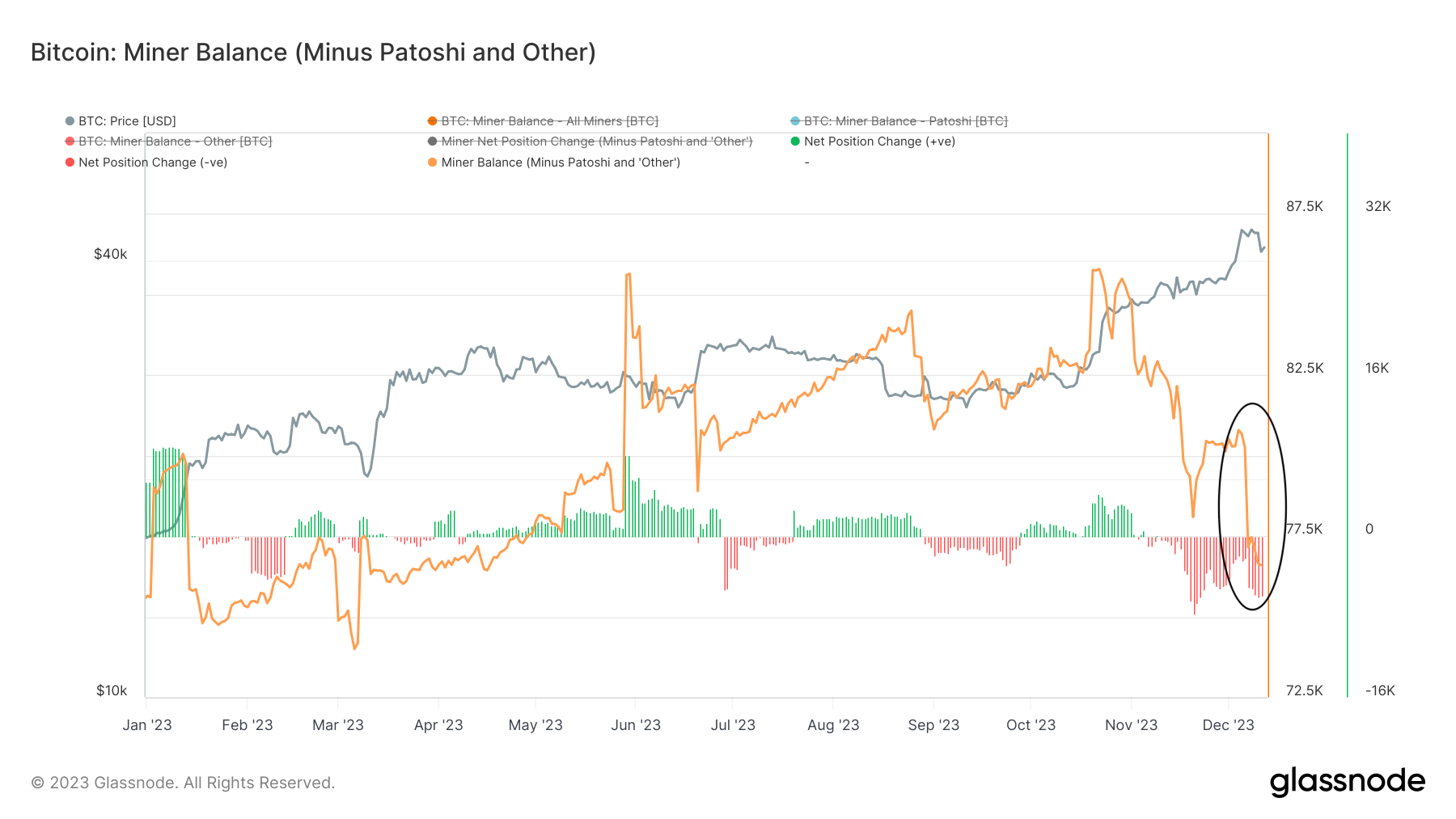

As Bitcoin’s price rallied, a noticeable decline was observed in miner balances. From 80,520 BTC on Dec. 1, the balance dropped to 76,602 BTC by Dec. 11, reaching its lowest point since April. This reduction of 3,918 BTC, or approximately 4.86%, suggests a strategic response from miners, likely aiming to capitalize on the rising prices by selling off their holdings.

While there are various reasons why miners might reduce their balances, operational costs are often at the forefront. The latest negative mining difficulty adjustment may have offered miners an opportune moment to secure profits amidst escalating prices.

The fluctuation in miner balances mirrors the adaptive nature of the Bitcoin mining sector. During bear markets, miners tend to accumulate revenue from block rewards and fees, betting on future price recovery. However, in bull runs, they often liquidate holdings, aiming to maximize profits from their operations.

The current trend of increasing Bitcoin prices coupled with decreasing miner balances points to a market phase characterized by miner confidence in the price stability or anticipation of further growth. Yet, this decline in miner balances also raises a flag of caution. A significant sell-off by miners could increase market supply, potentially exerting downward pressure on prices if not balanced by adequate demand.

As miners react to market conditions, their behavior provides valuable insights into the market’s health and future trajectory. It is a reminder of the need for continuous monitoring of various on-chain metrics to grasp the evolving landscape of Bitcoin’s market fully.

With the current market conditions, miners seem to be cautiously optimistic, possibly signaling a positive sentiment in the broader market. However, the potential impact of increased supply due to miner sell-offs should not be underestimated.

The post Bitcoin surge triggers miner sell-off appeared first on CryptoSlate.