Options are pivotal in gauging market expectations, allowing traders to secure the right to buy (call options) or sell (put options) Bitcoin at a predetermined price. The open interest – the sum of all active option contracts – and the ratio between puts and calls can reflect the market’s sentiment and conviction. At the same time, volume underscores the immediacy of trading activity.

Building on our previous CryptoSlate analysis, the Bitcoin options market has continued to exhibit subtle shifts in sentiment since the beginning of November.

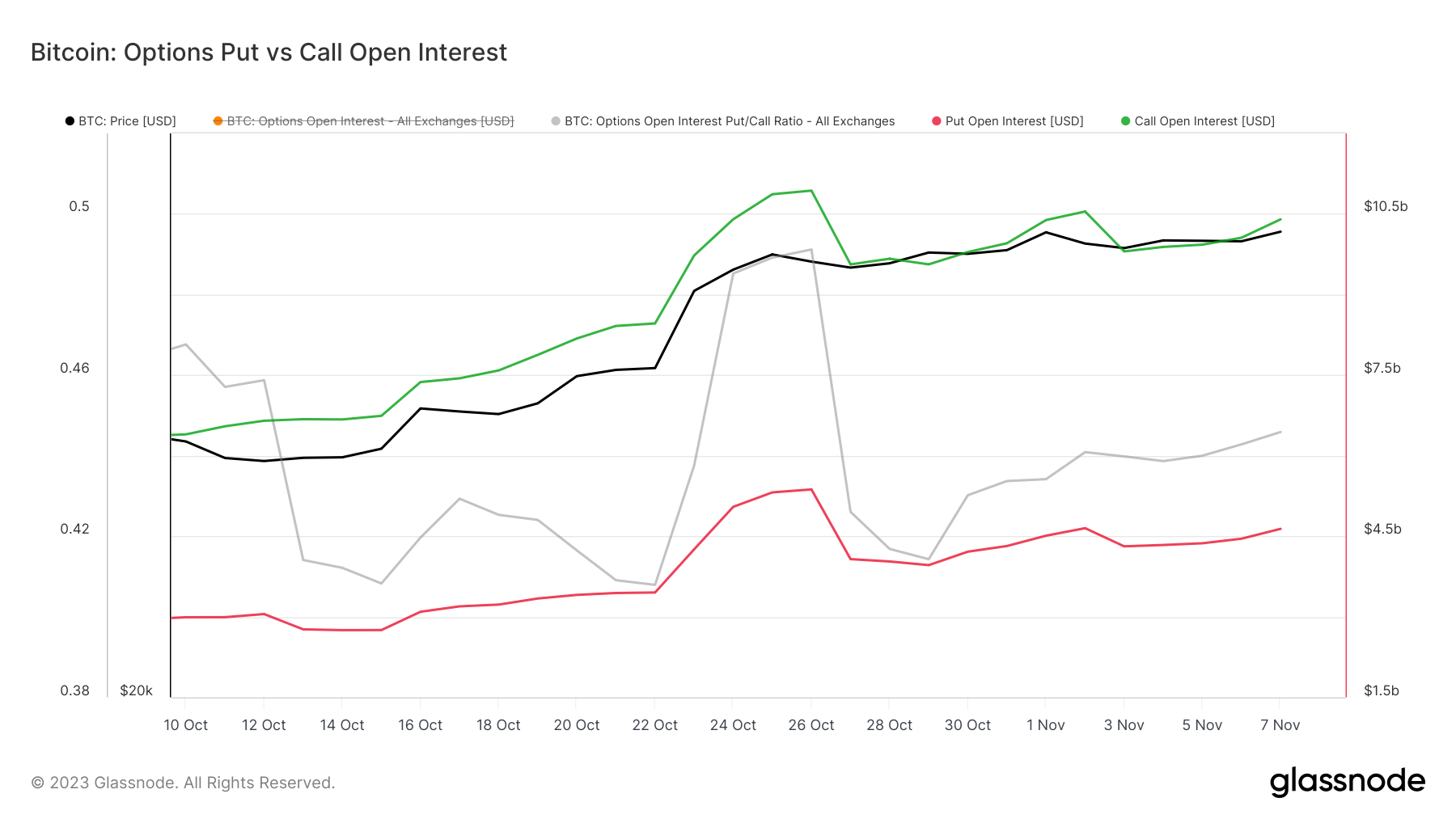

There has been a moderate increase in call open interest to $10.40 billion and a rise in put open interest to $4.63 billion. While the upward trajectory has persisted since October, the pace suggests a more cautious optimism among traders.

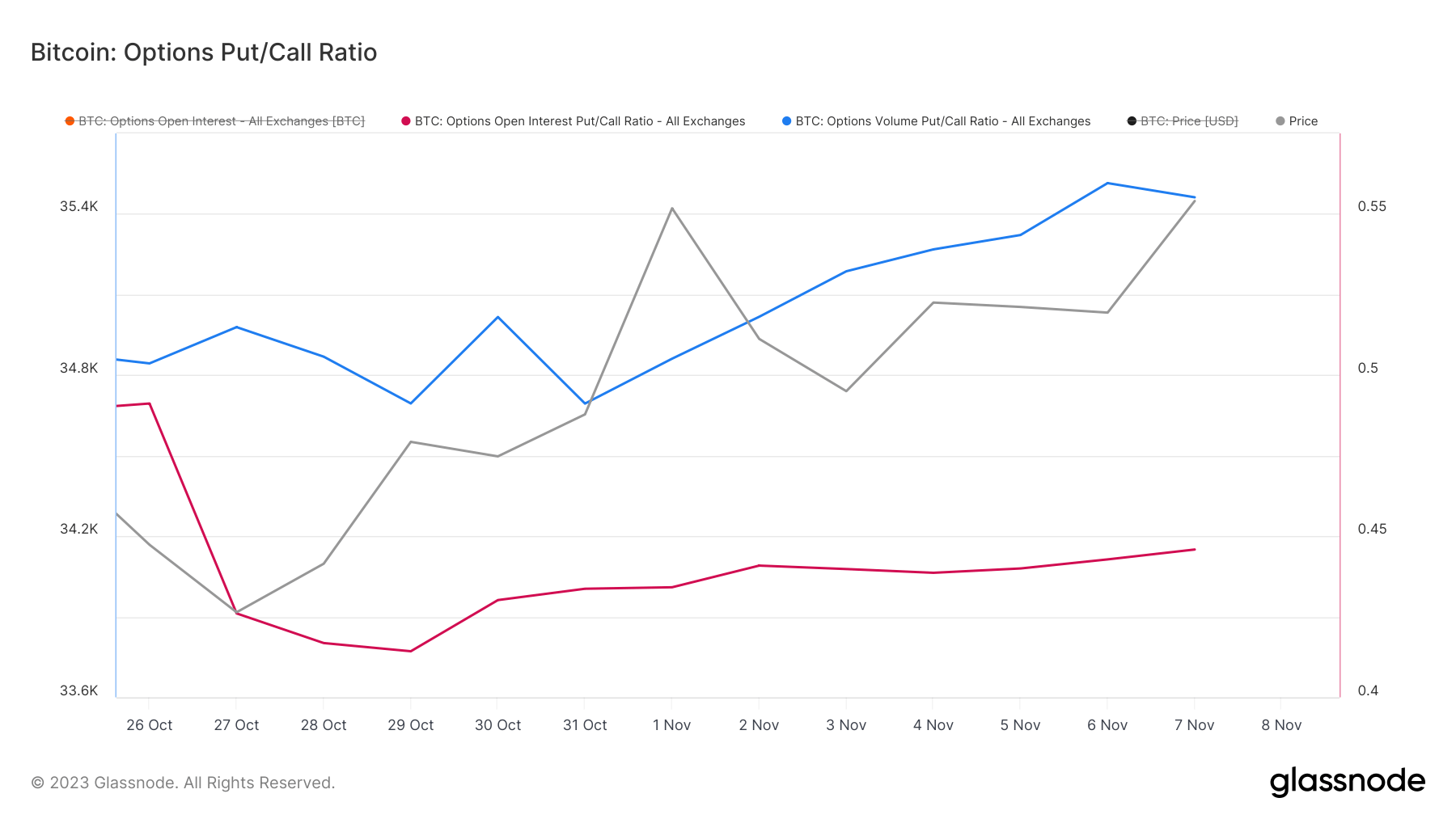

The put/call ratio of open interest has seen a slight increase from 0.433 to 0.445, indicating a subtle but noticeable shift. An increase in the put/call ratio usually indicates a bearish sentiment. However, as the ratio still remains well below 1, it’s more indicative of increased hedging activity.

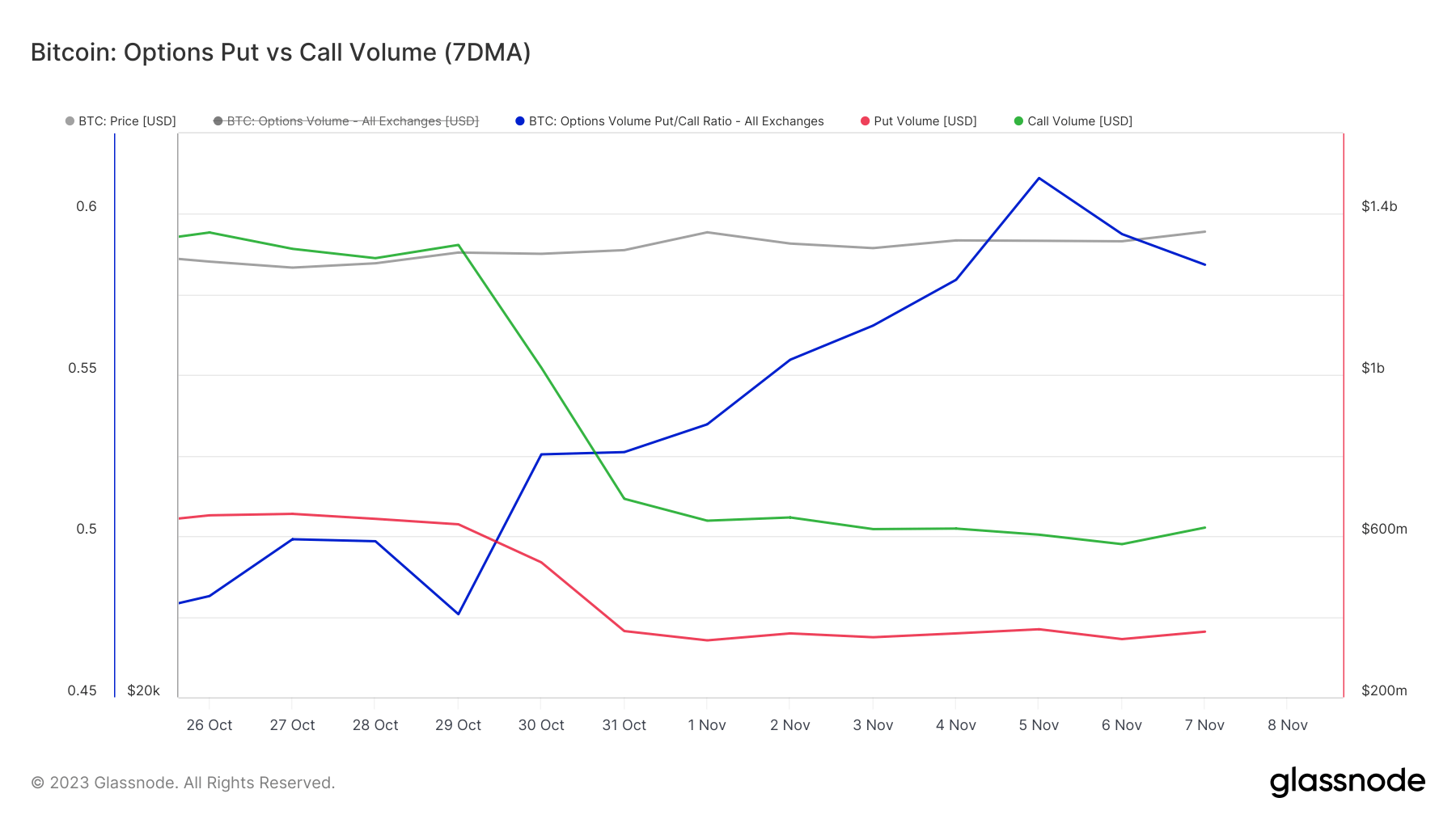

This is further reinforced by the volume ratio’s progression from 0.526 to 0.584, which emphasizes a defensive stance amidst an overall bullish market.

Since the beginning of the month, Bitcoin’s price has edged up from $34,600 and broken above $35,400, reinforcing this sentiment.

Contrasting with the all-time high call open interest from CryptoSlate’s last analysis, the current figures reveal a market that is optimistic yet more measured. The put/call ratio’s gradual increase reflects a market that, while still bullish, is becoming more cautious. The consistent increase in both call and put open interests points to an active market, with traders gearing up for potential price escalations and simultaneously guarding against downward risks.

Looking at strike prices suggests that optimism is persistent, but traders are also preparing for scenarios where the price might not meet their bullish expectations.

The post Bitcoin’s climb above $35,000 followed by surprisingly measured market appeared first on CryptoSlate.