Bitcoin’s (BTC) usual strong performance in October is threatened by high open interest in futures contracts and flattening buying activity by spot investors, according to the Sept. 30 edition of the “Bitfinex Alpha” report.

The report highlighted that October has consistently delivered strong results for Bitcoin, with an average return of 22.9% and a median return of 27.7% since 2013.

As a result, the industry has termed this trend “Uptober,” which usually leads to a longer upward movement throughout the fourth quarter, with the market recording an average return of 88.8% over the period.

Bullish signs for ‘Uptober’

According to the report, the Fed’s potential rate cuts also add to optimism as Bitcoin enters this year’s final quarter.

Notably, Fed Chair Jerome Powell stated during his keynote at the National Association for Business Economics on Sept. 30 that another 50 basis point cut should be expected this year.

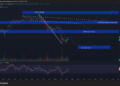

Adding to the bullish sentiment, Bitcoin has surged 26.2% since its sharp correction on Sept. 6 to $52,756, breaking through the $65,000 mark and surpassing the Aug. 25 local top of $65,200. This marks the first time Bitcoin has moved above a local top since March.

Furthermore, Bitcoin’s consolidation between $50,000 and $68,000 mirrors its 2020 pre-halving pattern, where an October rally led to significant price increases.

Warning signs

Despite the various optimistic signs related to a potentially bullish fourth quarter, the report also highlighted a few warning signs that still threaten Bitcoin’s performance.

The first sign is the flattening of aggressive buys in the spot market. Since Sept. 6, spot investors have accumulated BTC heavily, but this movement has been weakening since last week.

This suggests a temporary balance in the market between buyers and sellers, potentially related to the lack of interest from traders who don’t want to make aggressive moves before the fourth quarter.

The second sign relates to Bitcoin futures, which registered $35.3 billion in open interest. The report stated that this level is often associated with local market peaks, raising concerns about potential “overheating” in the market.

Nevertheless, Bitfinex analysts believe a 5% to 10% pullback should be enough to cool the market and would not end Bitcoin’s recent uptrend.

The post Bitcoin’s historic ‘Uptober’ trend faces challenges amid high futures interest, cooling spot buys appeared first on CryptoSlate.