Illiquid supply refers to the portion of Bitcoin’s supply that is not readily available for trading or selling. This typically includes coins held in cold storage or wallets with infrequent transactions, indicating a long-term investment perspective rather than short-term trading.

The significance of this metric lies in its ability to provide insights into investor sentiment. A high illiquid supply suggests strong holding behavior among investors, potentially leading to reduced selling pressure and a bullish outlook for the asset’s price.

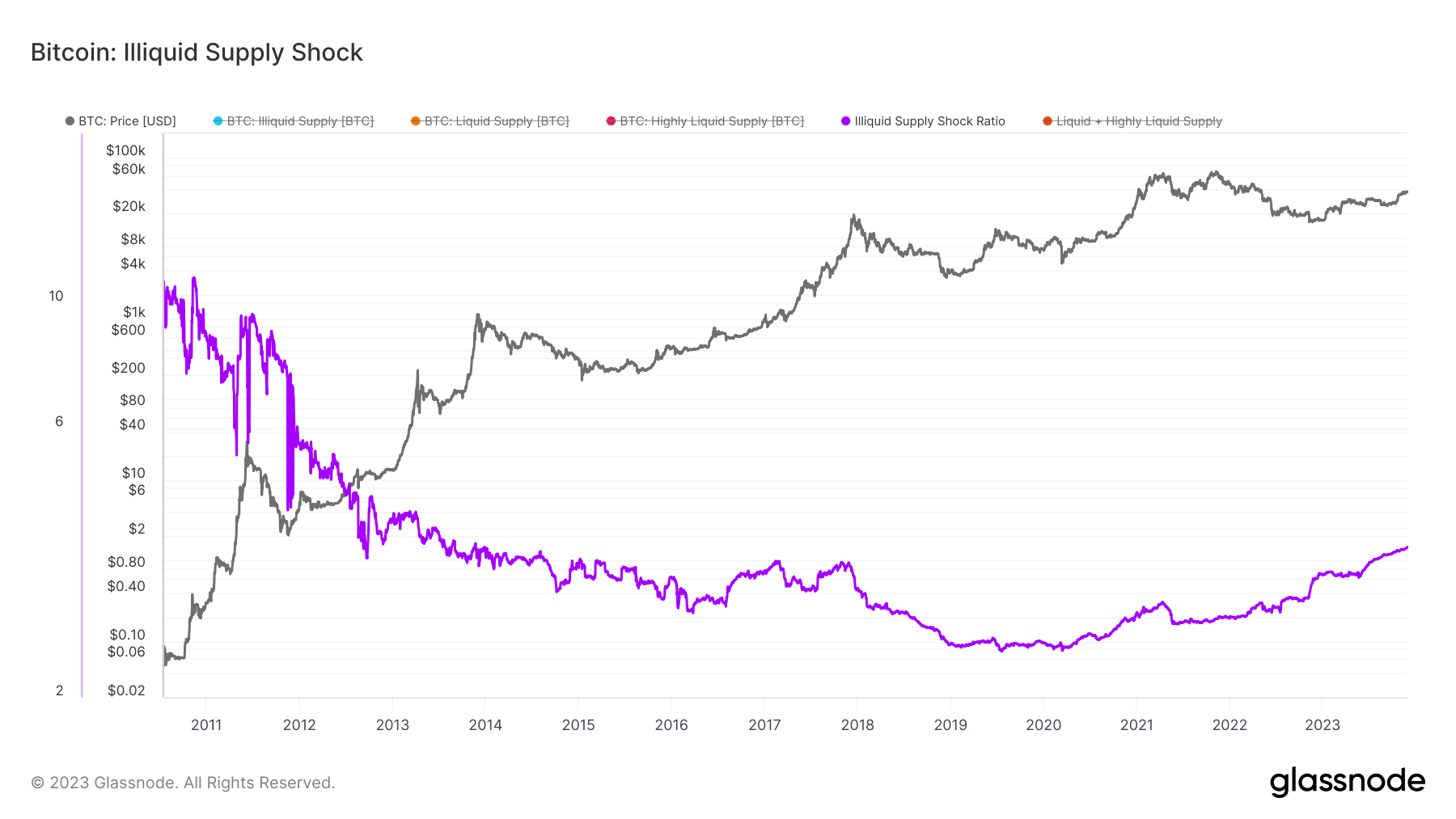

The Illiquid Supply Shock Ratio calculates the ratio of Bitcoin’s non-liquid supply to its liquid and highly liquid supply. An increasing ratio indicates a growing portion of Bitcoin being held as a long-term investment, while a decreasing ratio suggests increased trading activity.

Between 2010 and 2013, the illiquid supply was notably high, reflecting the nascent stage of the cryptocurrency market where early adopters and miners were predominant. As Bitcoin gained popularity and the ecosystem matured, this trend gradually decreased, leading to more liquidity and trading activity. The ratio bottomed in July 2019, indicating that the market was ripe with trading and that the least amount of Bitcoin’s supply was held in cold storage.

However, the illiquid supply began to rise in March 2020, following the huge market downturn caused by the onset of the pandemic. Several factors could have contributed to this, including increased institutional adoption, growing recognition of Bitcoin as a ‘digital gold’ and a hedge against inflation, and a general shift in investor sentiment towards long-term holding after a period of high volatility.

In 2023, Bitcoin’s illiquid supply trend has been particularly significant. Since the beginning of the year, it has increased by around 4.25%, amounting to a year-to-date growth of around 627,468 BTC. This trend correlates with Bitcoin’s upward price movement, suggesting that the growing illiquid supply could be contributing to a positive price trajectory. On Nov. 29, the ratio reached its 10-year high, surpassing the previous peaks set during the 2018 bear market.

Zooming out, the illiquid supply of Bitcoin saw a substantial increase of about 10.63%, or 1,478,470.92 BTC, since the beginning of 2022. This two-year trend further shows just how significant the shift towards long-term holding is.

The importance of monitoring illiquid supply in Bitcoin’s ecosystem cannot be overstated. It provides critical insights into the underlying investor behavior and market dynamics, essential for understanding the asset’s potential future movements. A high illiquid supply, especially at a 10-year peak, indicates a strong investor conviction in the long-term value of Bitcoin, signaling a bullish market sentiment.

The post Bitcoin’s illiquid supply hits 10-year high, signaling strong investor conviction appeared first on CryptoSlate.