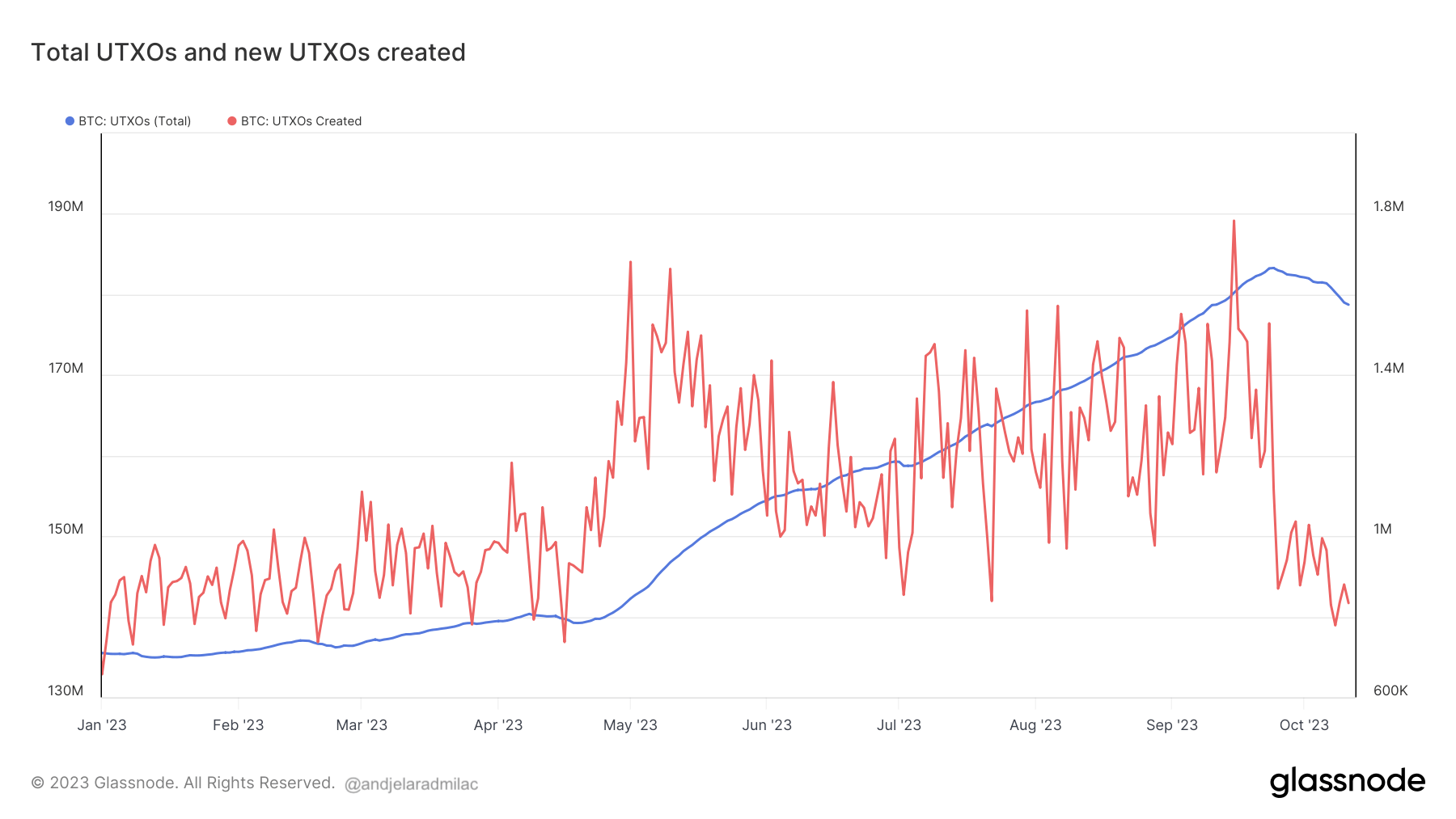

One of the foundational concepts of Bitcoin is the Unspent Transaction Output, or UTXO. Every Bitcoin transaction results in the creation of these UTXOs, which represent a piece of Bitcoin that can be spent in future transactions. When you send or receive Bitcoin, you’re essentially working with UTXOs: combining them, splitting them, and creating new ones.

The entire history of Bitcoin transactions is available on the blockchain, and UTXOs provide a clear snapshot of which pieces of Bitcoin are yet to be spent, offering a transparent view of Bitcoin’s liquidity. Analyzing the number and size of UTXOs can offer insights into network activity, congestion, and users’ transactional habits.

UTXO consolidation refers to the process of combining multiple smaller UTXOs into a single, larger UTXO. It’s akin to exchanging several smaller denominations of money for a larger note. Consolidation can benefit users as it can lead to simpler and often cheaper future transactions. However, it can also be a response to specific network or market conditions, such as fee optimization, wallet management, or preparations for significant fund movements.

Given the importance of UTXOs in the Bitcoin ecosystem, analyzing related trends can provide valuable insights into user behaviors, network health, and potential future market movements.

In recent weeks, the Bitcoin network displayed intriguing patterns that may signify UTXO consolidations by its users. CryptoSlate’s analysis of data in 2023 found notable shifts in transactional behavior.

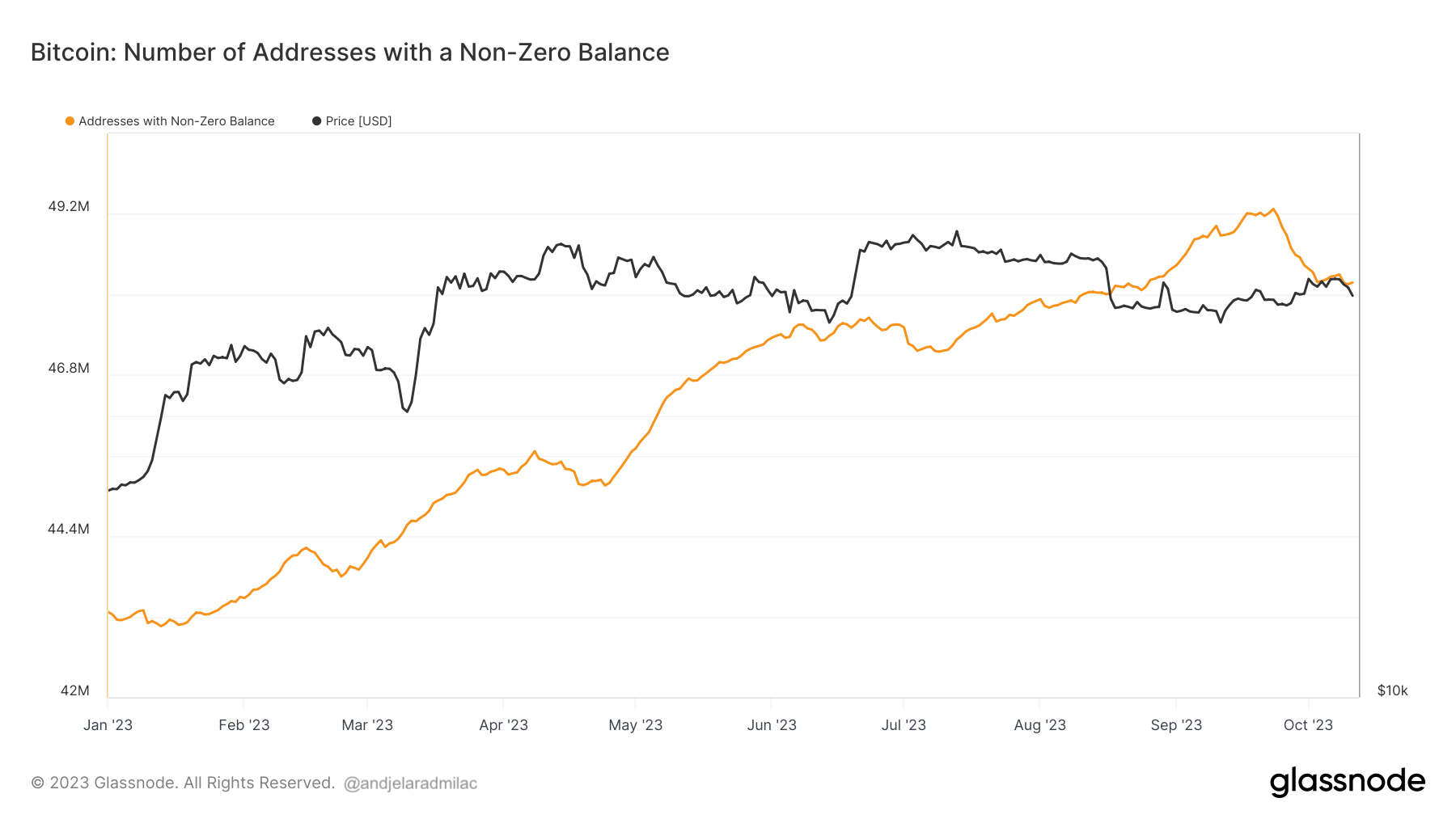

From January to September, there was an addition of 6.01 million new addresses with non-zero balances. However, this momentum reversed by October, witnessing a decrease of 1.1 million.

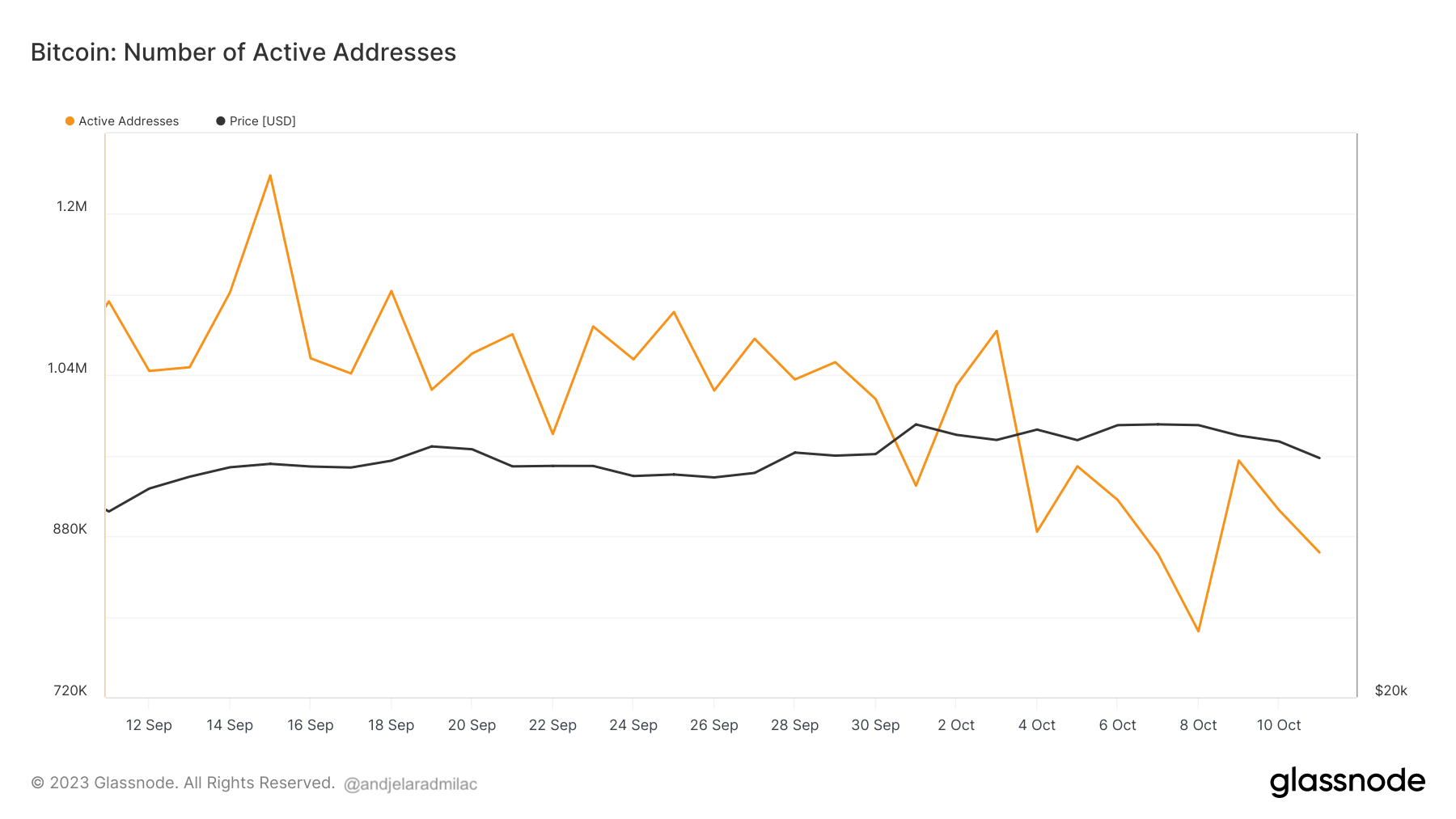

A sharp decline of 367,000 active addresses in October hints at potential fund consolidations or transfers out of Bitcoin.

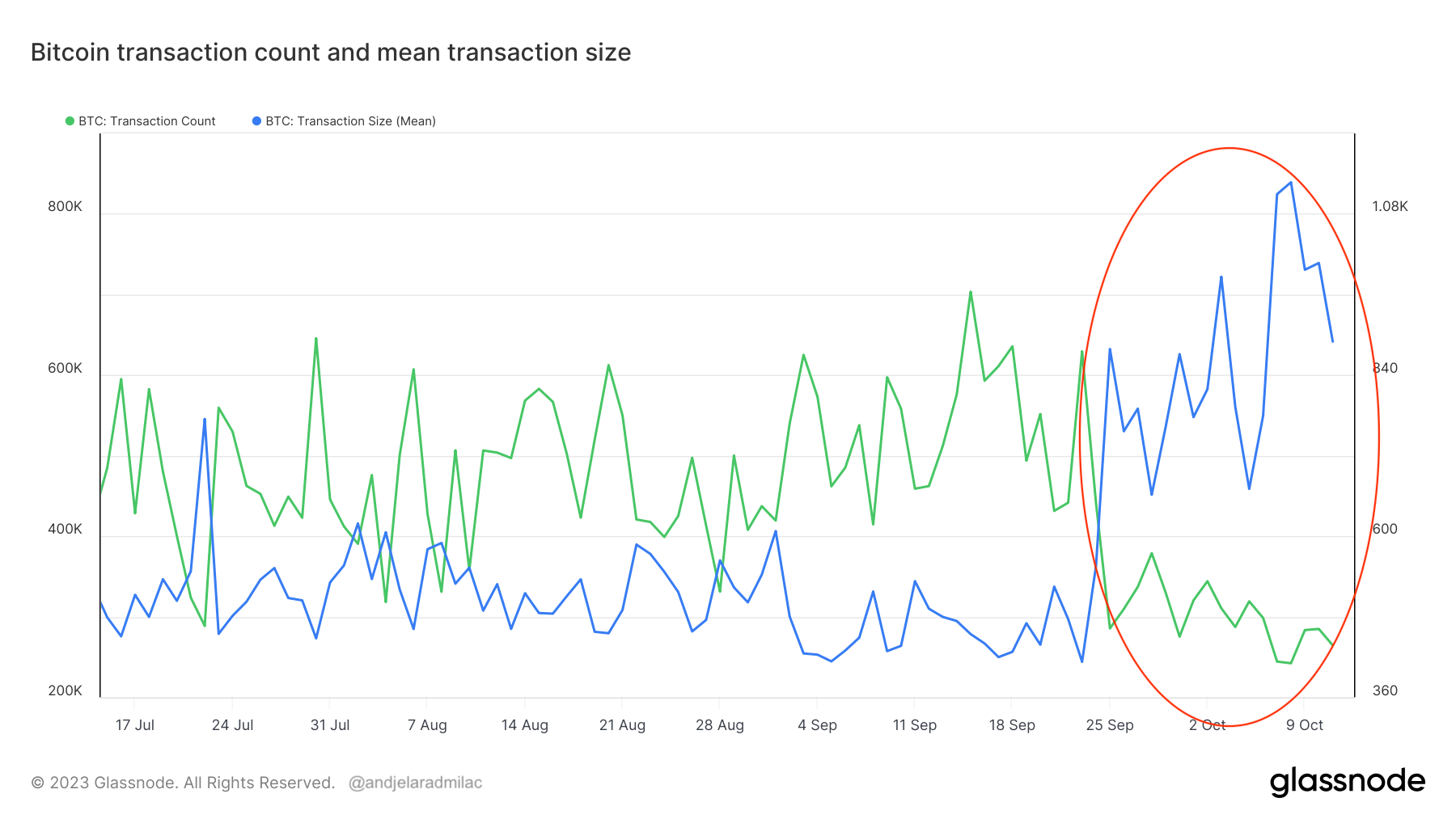

There was also a significant increase in transaction counts, which grew by over 516,000 from January to September. But this tide turned in October, plummeting by 439,000.

However, during this period, the mean transaction size expanded significantly. This enlargement suggests transactions have become more intricate, potentially due to multiple inputs, which indicates fund consolidations.

The UTXO data furthers this narrative. While there was a marked increase in total UTXOs from January to September, a slight dip was observed by October. This decline and the reduced number of new UTXOs created in October signals UTXO consolidation activities.

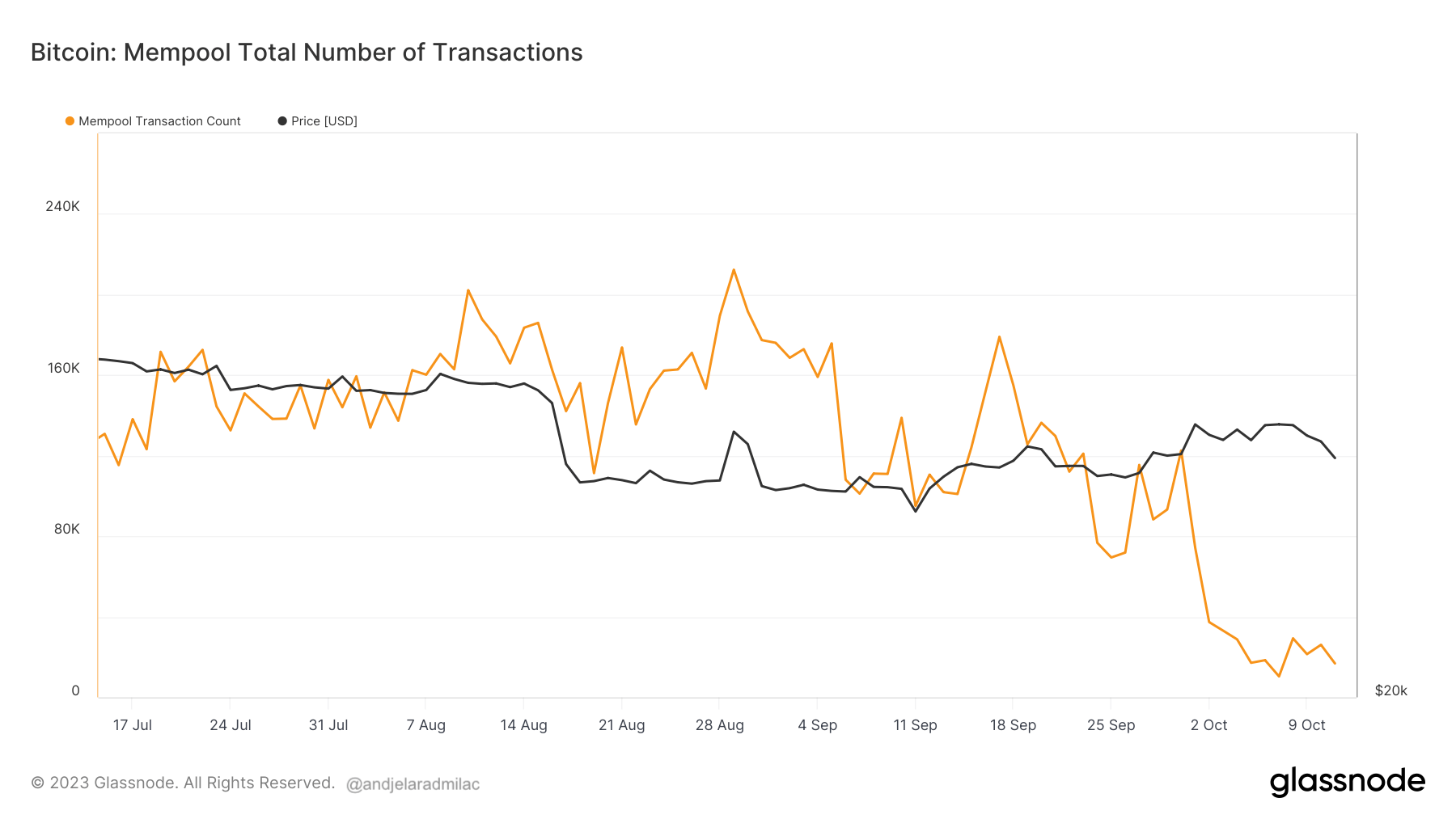

Delving deeper into network behaviors, September 2023 showed signs of congestion. The mempool, Bitcoin’s transaction waiting area, ballooned with 120,900 transactions, a sharp rise from 1,500 transactions recorded at the beginning of the year.

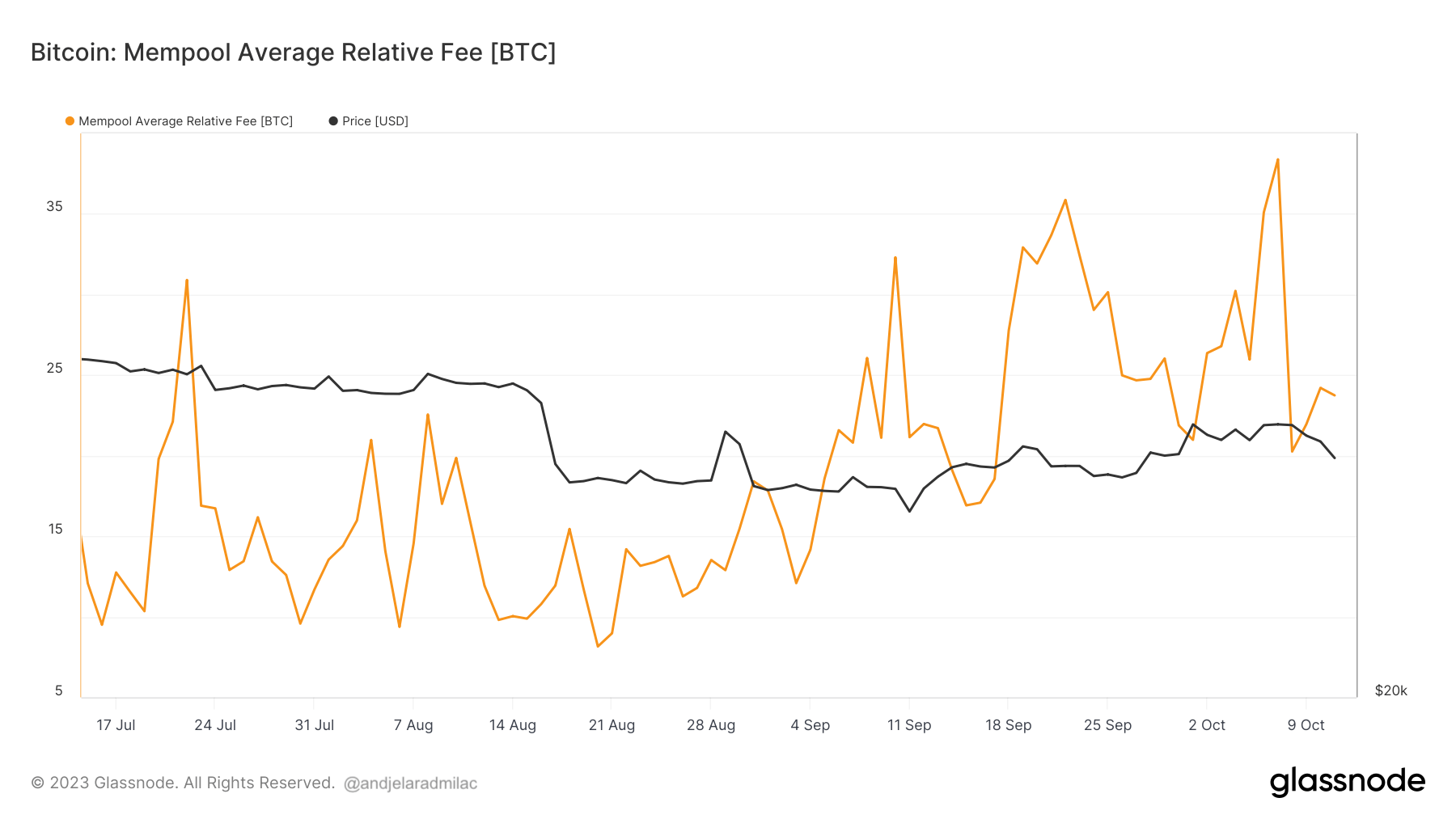

This bottleneck was accentuated by the elevated average relative fee of 32.4 BTC, denoting users’ willingness to pay higher for transaction prioritization. However, October ushered in relief. The transaction count in the mempool and the associated fees descended notably, suggesting a respite from the September congestion.

The congestion in the Bitcoin network during September 2023 likely deterred users from undertaking UTXO consolidations. However, when October ushered in a period of reduced congestion and lower fees, users seem to have taken advantage of this to consolidate their UTXOs, leading to more economical transaction costs and faster confirmations.

The post Deciphering the role of UTXOs in Bitcoin consolidation patterns appeared first on CryptoSlate.