Stablecoin search interest reached an all-time high this month, days before the White House signed the GENIUS Act into law.

New Google Trends data shows that search activity for “stablecoins” peaked globally just as U.S. policymakers finalized a federal framework for payment stablecoins, the first of its kind in the country.

Interest in the term rose steadily in the weeks prior, coinciding with congressional movement on the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins).

Washington, D.C., registered the strongest local interest worldwide, followed closely by nearby Hyattsville and Arlington, suggesting that legislative and regulatory attention may have contributed to the search volume concentration.

Searches for “stablecoins” remained elevated the following week, registering 75 out of 100 on Google’s relative index. These levels outpaced even the lift that followed the implementation of the EU’s Markets in Crypto-Assets Regulation (MiCA) titles covering stablecoins, which marked the start of mandatory compliance for so-called asset-referenced tokens and e-money tokens in the bloc. Data from the 13-week window before and after MiCA’s activation shows a muted difference, with average global search interest remaining flat at approximately 11.7.

By contrast, the GENIUS Act appears to have produced a more immediate bump in awareness. Average search interest for “stablecoins” rose from 72.8 in the four weeks prior to 84.5 in the four weeks following the bill’s signing on July 18, a near 16 percent increase.

The law’s passage follows a wave of lobbying from fintech firms and traditional financial institutions seeking legal certainty for U.S.-issued stablecoins. Under the new regime, permitted issuers are subject to reserve composition rules, daily attestation requirements, and clear delineation from securities treatment, aiming to support use cases in payments and tokenized finance.

USDC vs USDT trends

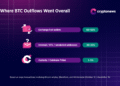

Despite the legislative milestone, search behavior around specific tokens remains unchanged. USDT continues to dominate global interest, with a current search index of 55 compared to USDC’s 8. The ratio reflects a 6.9-to-1 gap, wider than their market capitalization differential, with USDT holding approximately $163 billion and USDC about $63 billion in circulation.

This discrepancy mirrors adoption patterns across regions, where Tether’s USDT often plays a larger role in emerging markets due to deeper liquidity and existing infrastructure on networks such as Tron.

City-level comparison data further highlights the divide. USDC leads in developed, Western jurisdictions, including New Orleans (87 percent USDC share), Portland, Seattle, Boston, and San Francisco.

Conversely, USDT maintains more substantial traction in cities such as Lagos (96 percent), Phnom Penh, Da’an District in Taipei, and Singapore. Lisbon and San Jose also skew toward USDT in the latest dataset, reinforcing trends of East-West bifurcation in stablecoin preferences.

Stablecoin-related search activity is becoming a barometer for regulatory clarity and retail engagement.

While MiCA laid foundational guardrails in Europe, the GENIUS Act’s swift impact on U.S. search behavior may reflect pent-up demand for policy certainty domestically.

With both regions now operating under formal frameworks, stablecoins are increasingly being pulled into regulated financial architecture rather than remaining peripheral digital instruments.

The post Global stablecoin searches hit all-time high with Washington leading traffic appeared first on CryptoSlate.