Last week, Bitcoin’s price dropped from $29,400 to a low of $25,000. While this decline might appear modest given Bitcoin’s historical volatility, it signifies a notable departure from the tight trading range observed over the past two months.

Yet, even amidst this volatility, the confidence of long-term holders remains unshaken, a sentiment that is crucial to monitor as it often serves as a barometer for the market’s underlying health.

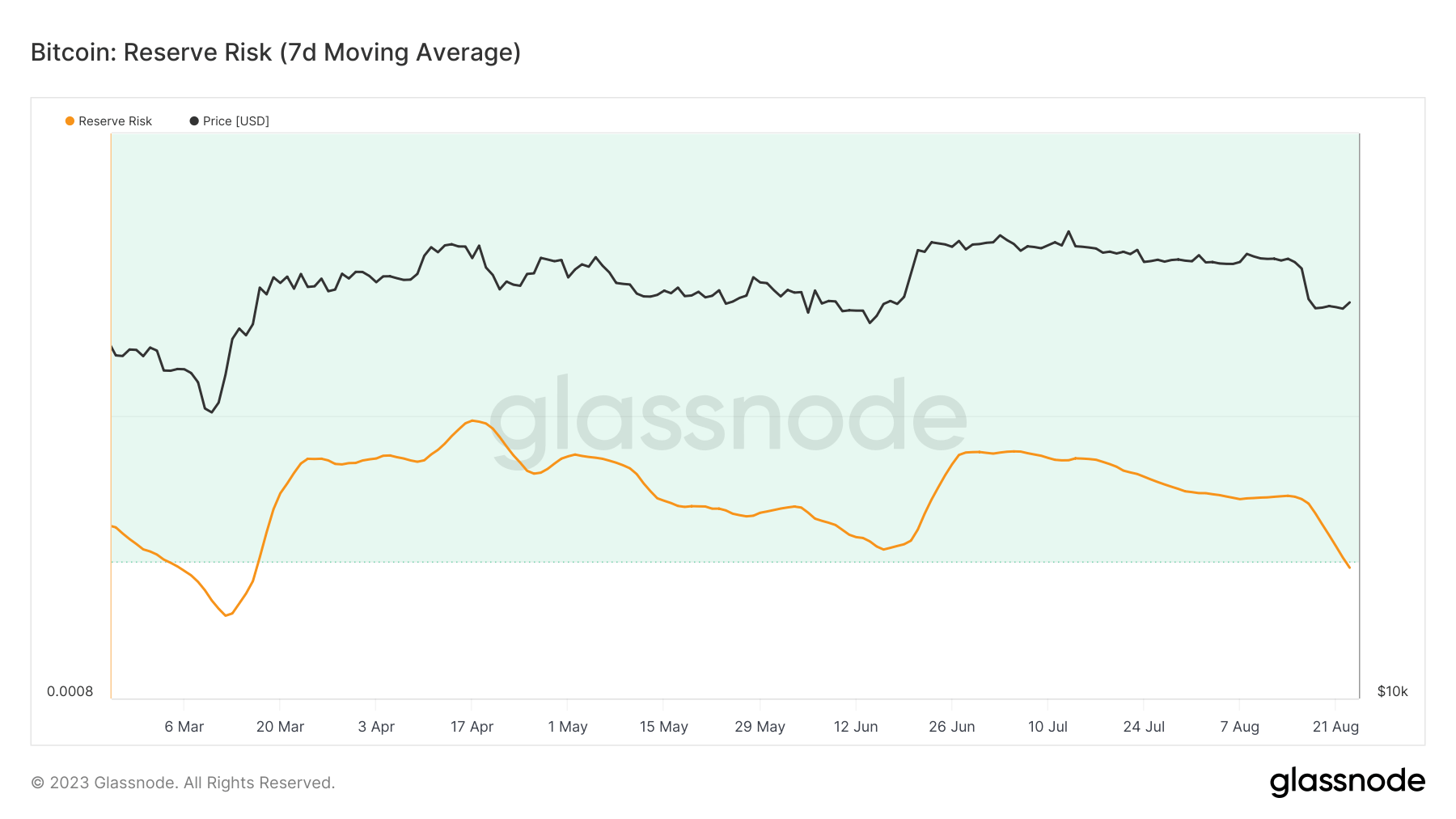

This unwavering confidence is seen in Bitcoin’s reserve risk, an often underutilized on-chain metric.

Reserve risk is a metric used to evaluate the risk/reward ratio of investing in Bitcoin at any given point in time. It’s calculated by dividing the price of Bitcoin by the HODL Bank. The HODL bank represents the value of all coins in terms of their age (i.e., how long they have been held without being spent). The more coins are being held for longer periods, the higher the HODL Bank.

The metric essentially gauges the confidence of long-term holders in relation to the coin’s current price. A low Reserve Risk indicates that long-term holders are confident in the asset, and the current price is seen as attractive for investment. Conversely, a high Reserve Risk suggests that long-term holders might be less confident, and the price might be considered high relative to that confidence.

From Aug. 14 to Aug. 23, Bitcoin’s reserve risk plummeted from 0.0011 to 0.00098. Bitcoin’s price also decreased during this same period, moving from $29,400 to $26,400. To put this in perspective, the last instance when Bitcoin’s reserve risk touched these levels was on March 15, with the price at $25,050.

The drop in both Bitcoin’s price and reserve risk implies that even as the price dipped, the confidence of long-term holders surged. This can be interpreted as long-term holders perceiving the price drop as a lucrative buying window, reinforcing their belief in Bitcoin’s long-term value.

Other on-chain data further supports this, most notably the supply of Bitcoin held by long-term holders.

Despite the price slump, the number of Bitcoins held by long-term holders has increased, growing from 14.62 million to 14.64 in the past week. It’s important to note that this uptick continues an upward trend that began in July 2022.

The diminished reserve risk and the increased long-term supply indicate a prevailing sentiment that the current price offers a favorable risk/reward balance for investment.

While market fluctuations are inherent to the volatile nature of cryptocurrencies, metrics like reserve risk offer a deeper dive into the underlying sentiments. The recent data underscores a bullish outlook for Bitcoin, showing that its long-term holders remain steadfast in their belief in its long-term value, even during short-term price declines.

The post How Bitcoin’s falling reserve risk counters its price decline appeared first on CryptoSlate.