In a bullish indicator for the broader cryptocurrency market, six stablecoins have technically led industry losses over the past 7 days, with the largest decline at 0.12%, underscoring the overall strength of the market.

The market remains robust, with stablecoins’ high trade volumes highlighting their fundamental role in the crypto ecosystem, holding their peg within a range of 0.15%. After the stablecoins, the next asset on the list is Loom Network (LOOM), which recorded a 2.69% gain in the past week.

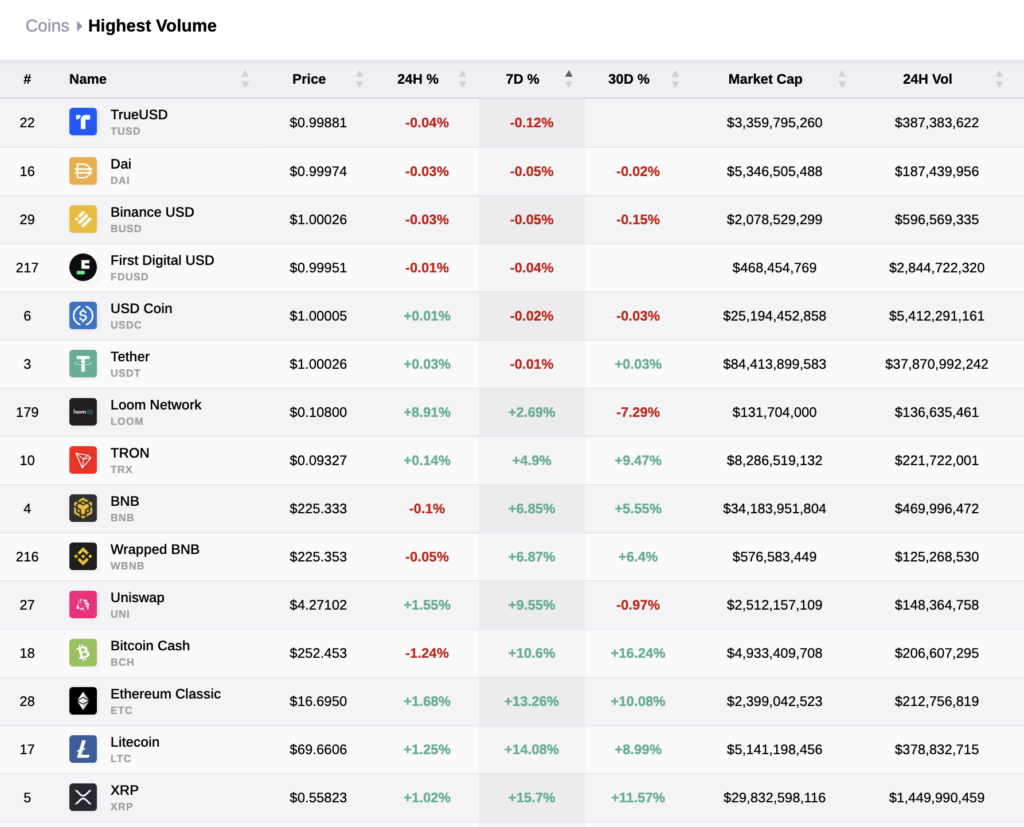

Only assets with trading volumes above $125 million were included in the table to analyze the movements of assets with high liquidity. Tether recorded the highest trading volume of the past 24 hours at $37,870,992,242, while the lowest volume within the data set was Wrapped BNB at $125,268,530.

According to CryptoSlate data, TrueUSD (TUSD), Dai (DAI), Binance USD (BUSD), First Digital USD (FDUSD), USD Coin (USDC), and Tether (USDT) secured the top 6 spots in terms of 7-day losses when viewing the highest traded tokens of the past week. This comes when the market displays a bullish sentiment, marked by a marked uptick in Bitcoin (BTC) and Ethereum (ETH).

Over the past week, TrueUSD posted a 0.12% decline, while Dai experienced a 0.05% dip. Similarly, Binance USD, First Digital USD, and USD Coin saw a 0.05%, 0.04%, and 0.02% decrease, respectively. Tether, currently leading the pack in terms of trading volume, saw a minute 0.01% decline.

The importance of stablecoins in the digital asset economy cannot be overstated. Their stability pegged to traditional fiat currencies, makes them the preferred choice for traders seeking to mitigate volatility risks inherent in the cryptocurrency market. These digital assets provide an efficient medium of exchange, a robust unit of account, and a practical store of value, contributing to their high trading volumes.

Meanwhile, Bitcoin and Ethereum, the second and third leading digital assets by volume, posted robust gains over the same period. Bitcoin rose by 20.07%, currently trading at $34,214, while Ethereum saw an increase of 17.67%, with its price climbing to $1,826.95 as of press time.

While the gains in the leading digital assets suggest a bullish market, the decrease in stablecoin values over the past week indicates a shift in investor sentiment. As stablecoins’ volume surges, traders use these digital assets as a launchpad, getting ready to venture into more volatile cryptocurrencies amid an optimistic market outlook.

Yet, these market movements should be seen in their broader context. Undoubtedly, the crypto market remains volatile and subject to rapid change. However, the high trading volume of stablecoins and the recent upswing in Bitcoin and Ethereum offer a promising glimpse into the present market dynamics.

As we continue to monitor these trends, it’s worth noting that such nuances in market behavior highlight the intricate dynamics of the crypto industry. When stablecoins

The post In a week where every high-volume digital asset is up, stablecoins lead losses with a mere 0.12% decline appeared first on CryptoSlate.