After losing much of its market price following news of an upcoming delisting, Monero (XMR) partially recovered its value on Feb. 7.

XMR maintained a market value above $160 for several days before Binance announced plans to delist the asset on Feb. 6. The price of XMR plummeted to $100 alongside that news. Although initial losses were somewhat lower, the asset lost about 37% over approximately 12 hours.

Monero has now partially recovered since that price drop. XMR is priced at $130 as of 9:00 p.m. UTC on Feb. 7. That growth represents gains of 20% over 24 hours, or gains of 27% from its lowest point the day before.

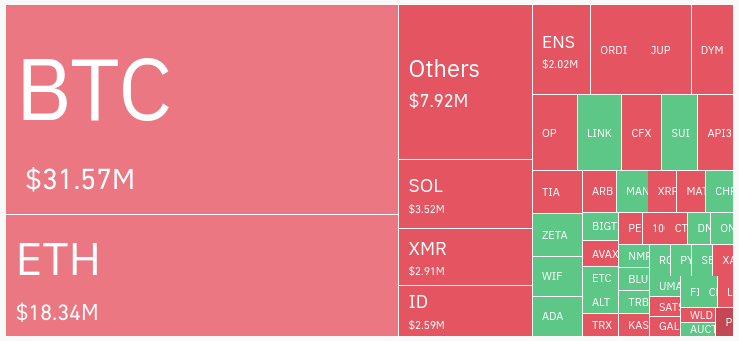

CoinGlass liquidation data indicates that XMR saw $2.91 million of liquidations over 24 hours. This accounts for about 3.1% of the crypto market’s $92.4 million in liquidations over that period, dominated by Bitcoin (BTC) and Ethereum (ETH).

Binance has not yet delisted XMR

Binance has not delisted XMR but plans to do so on Feb. 20. It is unclear how XMR prices will be affected as the policy is enacted.

Furthermore, the Feb. 20 deadline only ends XMR trading. Binance will continue to allow XMR withdrawals until May 20 and conversions of XMR to stablecoins until May 21. This means that XMR could flow out of Binance for months after the delisting. This could affect XMR prices over an extended period and affect prices in a more gradual or less noticeable way.

It is also unclear whether Binance intends to delist XMR permanently. The company noted that it “periodically reviews [s] each digital asset” based on several factors, seemingly allowing for XMR to be relisted if it meets those standards.

Other exchanges have similarly delisted Monero. Kraken delisted XMR for U.K. users in 2021. Huobi delisted XMR and several other privacy coins in September 2022. OKX delisted XMR and other privacy coins in December 2023.

The post Monero rebounds with 23% gain, marking recovery from news of Binance delisting appeared first on CryptoSlate.