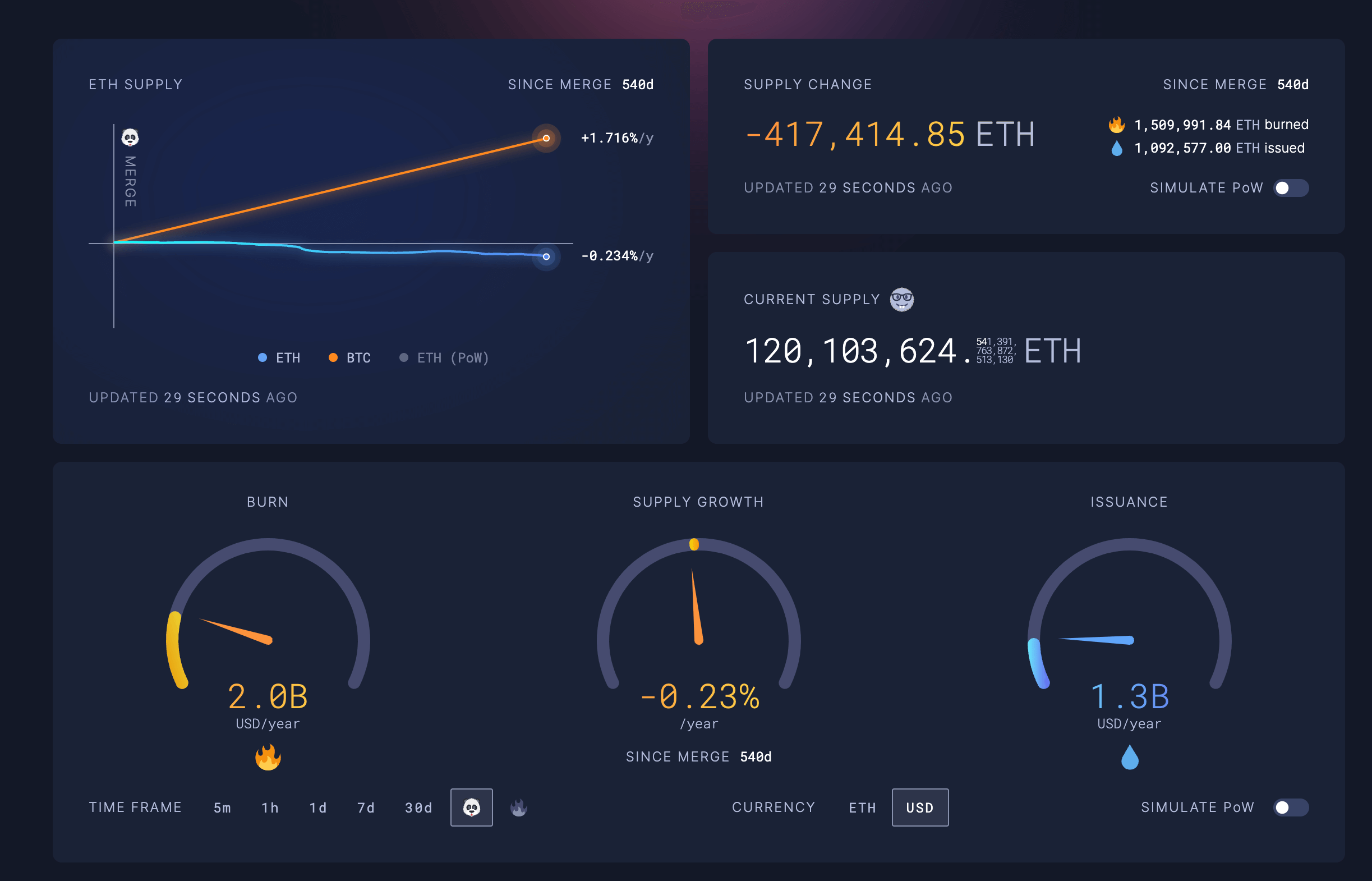

The Ethereum network has seen a reduction of 417,413 ETH in supply since transitioning to a Proof-of-Stake (PoS) consensus mechanism in September 2022, per data from ultrasound.money. In the 540 days since The Merge, 1,509,991 ETH has been burned while the network has issued 1,092,578 new ETH, resulting in a net decrease.

As of press time, the market value of the ETH removed from the supply stands at $1,653,797,635, marking an annual inflation rate of -0.23%.

In contrast, Bitcoin’s supply has grown by 1.716% over the same period. This highlights the divergent monetary policies of the two largest cryptocurrencies, as Bitcoin maintains a predictable issuance schedule. At the same time, the balance between staking rewards and transaction fee burning now determines Ethereum’s supply change.

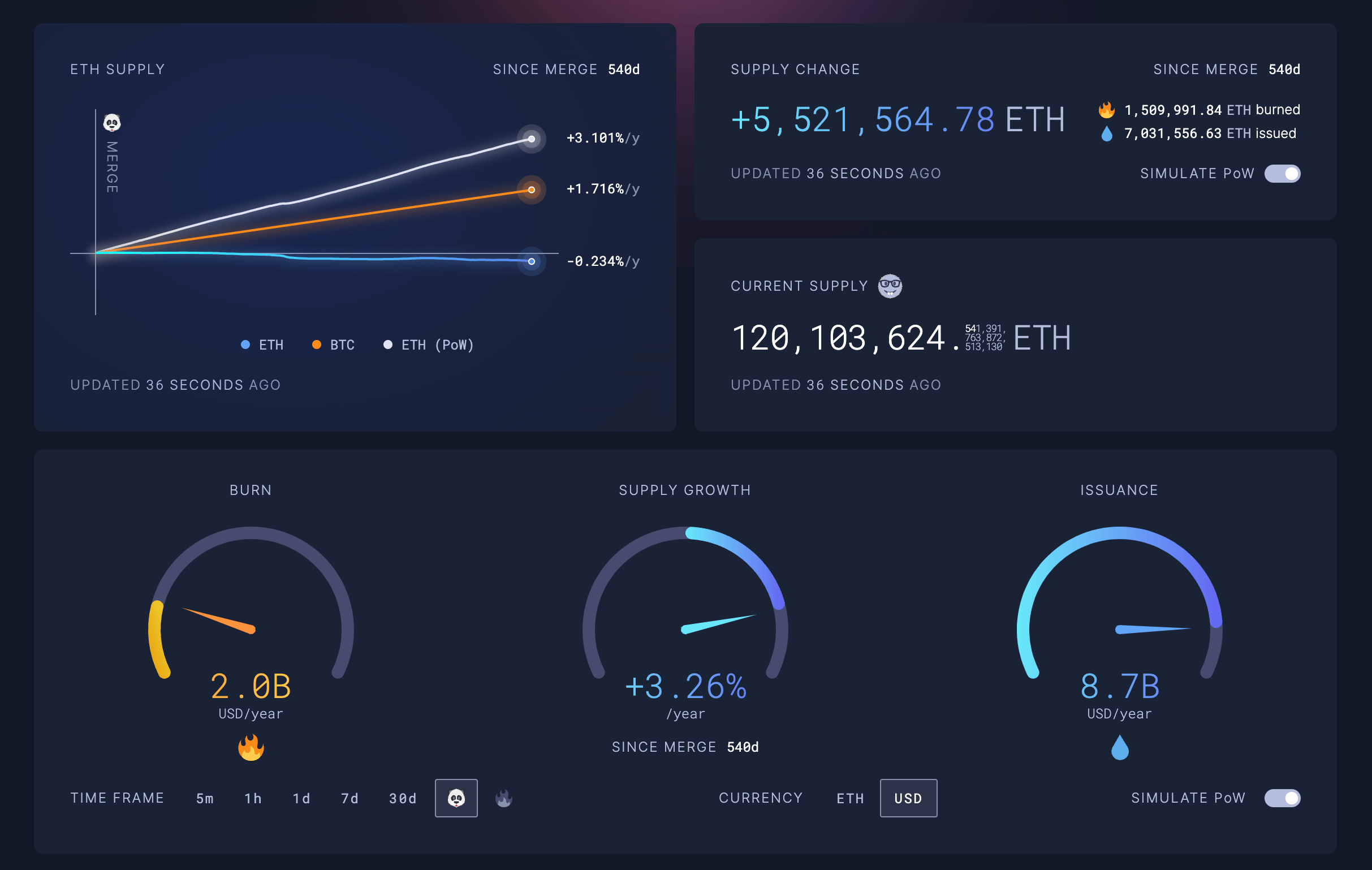

A Proof-of-Work (PoW) simulation on the ultrasound.money dashboard shows Ethereum’s supply would have increased by over 5.5 million ETH during the same period had the network not shifted to PoS. Under the PoW model, the simulation indicates 7,031,556 ETH would have been issued with the same 1.5 million ETH burn rate, leading to a net increase of 5,521,564 ETH since The Merge. The value of the ETH issued under this simulation would amount to $21,865,393,440, representing a theoretical inflation rate of 3.26%.

The stark difference highlights the deflationary impact of Ethereum’s new consensus design compared to its previous mining-based system. The transition to PoS has significantly reduced new ETH issuance, as validators staking ETH now secure the network instead of PoW miners. This shift, combined with the ongoing burn mechanism introduced in EIP-1559, has put downward pressure on Ethereum’s supply growth.

According to the real-time data, Ethereum’s total circulating supply currently stands at 120,103,624 ETH. Meanwhile, the PoW simulation estimates the supply would have reached 125,625,188 ETH if miners were still powering the network under the old model.

The supply reduction since The Merge aligns with the Ethereum community’s vision of making ETH a deflationary asset over time, diverging from Bitcoin’s fixed inflationary schedule. Proponents believe the combination of staking rewards and fee burning will continue to offset new issuance, potentially leading to net negative supply change periods.

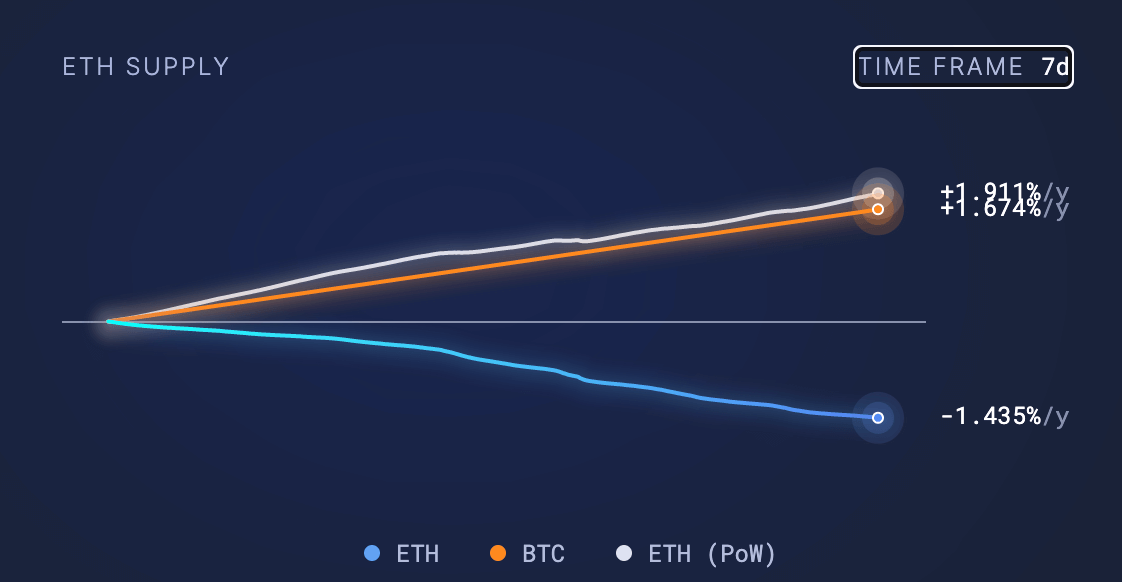

Over the past seven days, increasing ETH network fees has facilitated an uptick in deflationary behavior as it rose to -1.435%. Moreover, even under PoW, its inflation rate would have fallen to 1.911% due to the surge in network activity and its correlation with the burn mechanic.

However, critics argue the move to PoS has centralized control of the network in the hands of major staking entities and exchanges. Some warn that the concentration of staked ETH could undermine Ethereum’s decentralization and security guarantees, in contrast to Bitcoin’s more distributed mining network.

As Ethereum continues to evolve under its new PoS regime and Bitcoin maintains its established PoW model, observers will closely watch how their respective supply dynamics and security trade-offs unfold. With Bitcoin’s issuance about to half due to the upcoming halving, its inflation rate will drop to 0.8%, which is within 1% of Ethereum. Bitcoin, however, has a fixed supply and will eventually have an inflation rate of zero. Ethereum’s inflation rate is tied to network activity and the amount burned through network transactions.

Still, the deflationary trend in ETH over the past 540 days offers an early glimpse into the potential future of the two largest cryptocurrencies ahead of the first Bitcoin halving since The Merge. The long-term sustainability and implications for both networks remain to be seen, with Bitcoin currently thriving at a $1.3 trillion market cap and Ethereum next in line at $478 billion.

The post Proof of Stake cut $21 billion ETH from circulation as deflation falls to 1.4% appeared first on CryptoSlate.