Robinhood has spent the past few years trying to outgrow its meme-stock reputation, and the clearest sign that it is thinking differently now sits far from Menlo Park.

In early December, the company said it would buy PT Buana Capital Sekuritas, a small Indonesian brokerage, and PT Pedagang Aset Kripto, a licensed digital asset trader, with closing scheduled for the first half of 2026 once regulators agree.

On paper, the targets are modest. But, in practice, they plug Robinhood straight into a country with more than 19 million capital-market investors and roughly 17 million people already trading crypto, all reachable through the same phone in their hands.

That combination signals where the next stage of growth for brokers with a crypto angle is meant to come from.

Instead of filing a fresh license application from the US and waiting in line, Robinhood is buying its way into Indonesia’s regulatory perimeter. Buana Capital gives it a conventional securities license and a seat in the domestic stock market.

Pedagang Aset Kripto is already within the country’s current crypto regime as one of the supervised digital financial asset traders.

The company is also keeping majority owner Pieter Tanuri on as a strategic adviser, which means the foreign entrant arrives not just with paperwork but also with local relationships and context.

For a company that has already had long conversations with regulators in the UK and Europe, walking into Jakarta backed by a pair of approved entities and a local fixer is a deliberate choice, not a quirk of deal flow.

Buying a regulatory foothold in Indonesia

Indonesia is attractive because its core ingredients align almost perfectly with Robinhood’s design.

The country has a young population that lives on Android phones and treats the brokerage app as another social icon.

Equity investing has become part of everyday financial life for millions of people, helped by low minimums and highly online marketing. Crypto arrived on the same rails but moved even faster.

Penetration for digital assets now sits close to equity penetration, which is not a sentence you can write about many developed markets.

For an app that wants users to think of stocks and tokens as tiles on one dashboard, this is precisely the kind of market you want to wire in.

The rulebook has also moved in a direction that suits global brokers. For years, Indonesian crypto trading sat under Bappebti, the commodity futures regulator, which treated cryptocurrencies as any other asset.

Legislators then decided that the line between crypto and finance had blurred enough to warrant a more familiar framework and placed responsibility on Otoritas Jasa Keuangan, the financial services authority.

OJK has since drawn a clean map: one licensed crypto exchange, a central clearing and settlement house, a dedicated custodian, and a whitelist of assets that can trade on these venues.

It talks about digital assets using the same language it uses for other financial products, which means the expectations around segregation, custody, disclosure, and cybersecurity are the same as in the rest of the system.

Against that backdrop, buying a local broker and a local crypto trader is not just for speed. It is also a way to inherit teams that already live inside that system.

Robinhood still has to pass fit-and-proper checks and convince the OJK that it will not turn the retail market into a casino. Still, it no longer has to argue over whether its business model belongs within the perimeter at all.

The Indonesian licenses then sit neatly alongside the Bitstamp license in Singapore, which Robinhood picked up earlier in the year, to form a regional triangle: a crypto venue in a financial hub, a domestic brokerage, and a domestic crypto trader, all feeding into the same global app.

Once that plumbing is in place, the company can do what it already knows how to do: pipe US equities and options into a new audience, wrap them in a familiar mobile interface, and cross-sell between local and international markets.

Robinhood's Indonesia bet is a template, not an exception

Once you zoom out from Jakarta, the deal starts to look less like an isolated adventure and more like the draft of a playbook.

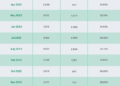

The countries that dominate crypto adoption charts these days are not your usual financial centers. India, Pakistan, Vietnam, and Brazil all sit near the top of grassroots usage rankings, with Nigeria, Indonesia, and the Philippines in the next bracket.

These are places where young populations live largely on mobile, where inflation or currency depreciation shapes how people think about savings, and where cross-border money is a normal part of family life.

That last point matters a lot to brokers because it makes stablecoins, dollar access, and FX rails more than just speculative tools.

In that environment, the old idea of “build first, license later” looks less attractive.

Regulators in these markets have already spent years dealing with local exchanges, peer-to-peer platforms, and the fallout from global blowups. They have learned, sometimes the hard way, what happens when platforms handle customer funds poorly or treat leverage as a marketing tool.

Most now keep a formal list of approved service providers and have no shortage of domestic players queuing up to join it.

For a foreign broker with shareholders watching the calendar, buying one of those companies beats waiting for a fresh application to crawl through the system.

You are still subject to local scrutiny, and you may inherit creaky back-office systems and legacy tech debt, but the core question of whether you belong in the market has already been answered.

The trade-offs are real. Small local shops often run on systems held together by habit and a few key staff. Hence, the buyer has to choose between slow, careful modernization and a faster rebuild that risks losing the institutional memory it just paid for.

Local relationships with banks, tax offices, and advertising regulators are often informal and personal, which makes staff retention more important than the headline customer count in an investor presentation.

Political sensitivities also loom large. Whenever a foreign broker arrives and starts pulling order flow, some part of the domestic industry will complain about capital leaving the country or young investors being targeted by outsiders, even when the foreign firm is operating under exactly the same rulebook.

The new map of crypto growth

What gives the Robinhood deal broader weight is what it says about the geography of crypto trading in the next few years.

For a long time, trading was concentrated in the US and a few Western European hubs. That era is fading as regulators in big economies tighten the screws and push more activity onshore.

The growth story now tilts toward countries that combine clear, if strict, licensing regimes with large pools of retail users who do not remember or do not know what finance looked like before smartphones.

Indonesia fits that profile neatly. So do Brazil, the Philippines, Nigeria, and Pakistan, though each has its own quirks.

For brokers and exchanges, this is less about chasing a single hot market and more about learning how to read a standard set of signals.

You watch for a regulator that has moved from blanket warnings to detailed supervision of digital assets. You look for mobile penetration that turns a new app into an overnight distribution channel.

You check adoption indexes and local exchange volumes to see whether people are already using crypto to solve daily problems rather than to punt on price.

When those boxes line up, the question is not whether someone will move in, but who will be first to find a willing license seller and stitch that license into a global stack.

Indonesia’s role in this story is to make that process concrete.

A US retail broker that grew up on meme stocks is now buying a small Jakarta broker and a local crypto trader, linking them to a Singapore crypto platform it already owns, and presenting the whole bundle through a single global app.

The deal shows how quickly a foreign firm can go from having zero standing in a market to sitting at the center of its retail investing experience, provided it is willing to pay for the right pieces of paper and do the integration work.

It also hints at what the next wave of press releases from Lagos, Karachi, or Manila will look like.

The names and acronyms will change, but the structure will feel familiar: local licenses, mobile-first users, and a foreign broker betting that this is where the real growth in crypto trading lives now.

The post Robinhood is constructing a “regional triangle” that unlocks the one thing US regulators won’t permit appeared first on CryptoSlate.