The current state of Bitcoin’s options and futures markets is witnessing a notable shift, reflecting a broader transformation in the crypto trading landscape.

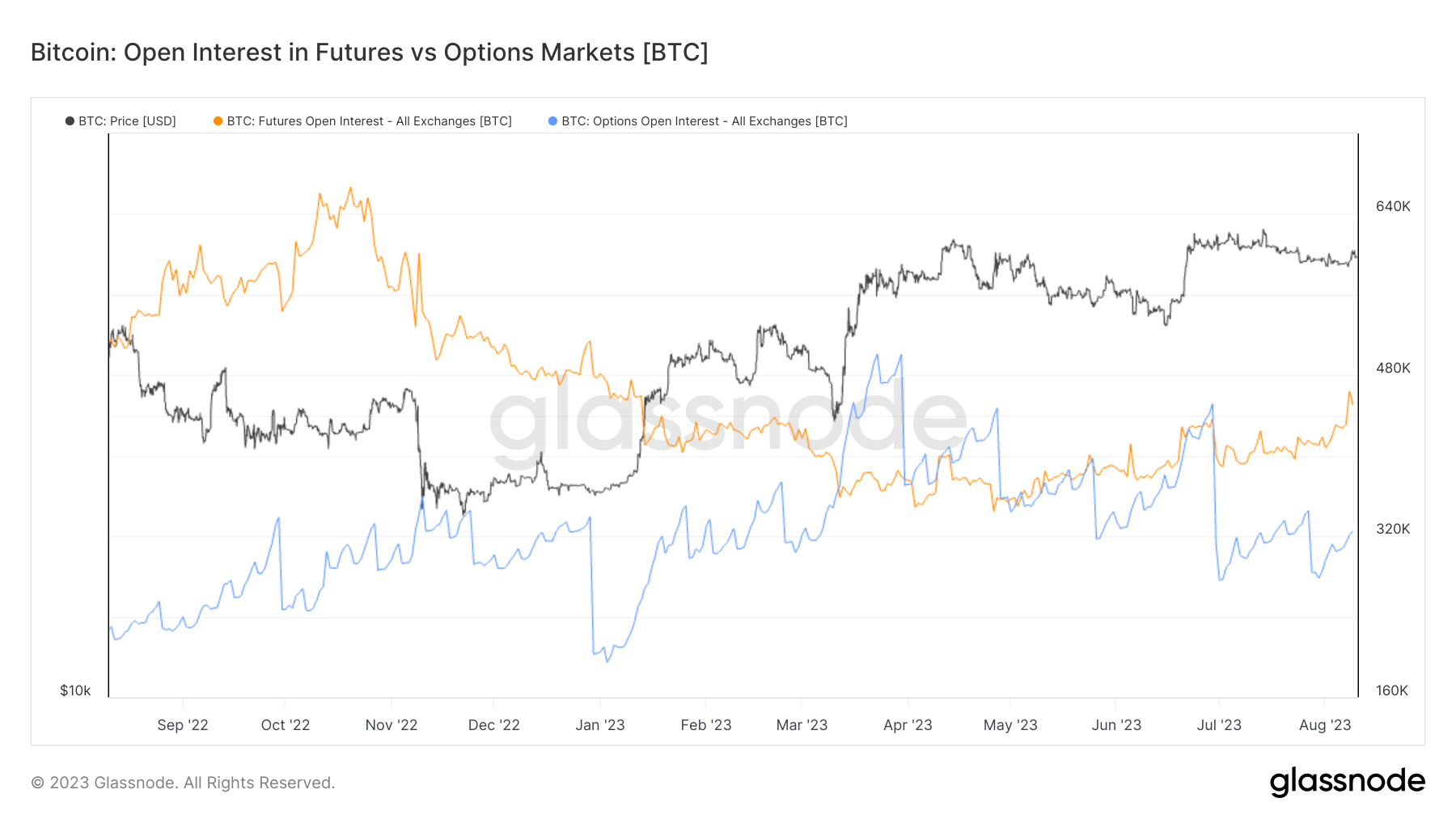

Over the last 12 months, Bitcoin options markets have seen a significant uptick in growth, with open interest more than doubling. This growth in options trading indicates an increased interest in strategic financial products that offer flexibility and risk management capabilities.

Options now rival futures markets in terms of open interest magnitude, signaling a shift in trading strategies and possibly a sign of market maturity.

On the other hand, futures open interest has been in steady decline since the collapse of FTX in November 2022.

This decline may be interpreted as losing confidence in the futures market, raising concerns about stability and risk management practices. However, 2023 has seen a slight increase in futures open interest, indicating a cautious return of traders, but the overall trend remains negative compared to the options market.

The open interest on Bitcoin futures is currently 420,000 BTC, while the open interest on Bitcoin options is 312,000 BTC.

The growth in Bitcoin options trading reflects a more strategic and risk-averse approach to trading Bitcoin. Options, which provide the right but not the obligation to buy or sell an asset at a specific price, are favored over futures, which obligate the buyer to purchase or the seller to sell the asset at a predetermined future date and price.

This shift has far-reaching implications for market structure, regulation, and overall market behavior. The rise in options trading could lead to different price dynamics, affecting the overall volatility of Bitcoin’s price.

Options provide leverage, which can amplify both gains and losses, attracting more speculative trading. While this can increase liquidity, it might also increase short-term volatility as traders quickly enter and exit positions.

However, it’s important to note that options can also act as a stabilizing force for the broader crypto market. As options are often used as a hedging tool to protect against adverse price movements, they can effectively set a floor on potential losses, potentially mitigating sharp declines during market downturns.

The shift between futures and options might also change the competitive landscape of exchanges offering these products. Those focusing on options might see growth, while futures-centric platforms might face challenges.

The data might also reflect changes in investor behavior, with perhaps more institutional participation in options as a risk management tool and possibly a decrease in speculative trading in futures.

The post The changing landscape of Bitcoin futures and options markets appeared first on CryptoSlate.