Total fees generated from the top 10 DeFi dApps tracks via DefiLlama will amount to $4.8 billion annually based on the past 24 hours of activity. Across staking, dexes, lending, and wallets, $13.15 million in fees were generated in the past day.

| Name | Category | 24hr Fees | 24hrs Revenue |

|---|---|---|---|

| Lido | Liquid Staking | $3.38m | $337,749 |

| Uniswap | Dexes | $2.62m | $0 |

| PancakeSwap | Dexes | $2.1m | $426,372 |

| Curve Finance | CDP | $1.54m | $659,343 |

| AAVE | Lending | $1.2m | $172,860 |

| Maker | CDP | $1.08m | $545,105 |

| Raydium | Dexes | $1.01m | $124,524 |

| Trader Joe | Dexes | $623,784 | $69,357 |

| MetaMask | Wallets | $391,846 | $391,846 |

| Camelot | Dexes | $271,722 | $63,802 |

However, the total revenue for the past day comes to just $2.78 million, which is 21% of total fees.

Lido tops the chart for fee generation, while Curve retains the number one slot for revenue, with Maker and Lido just behind. Two of the biggest gaps between fees and revenue can be seen in Aave and Raydium, which generated over $1 million in fees over the past day. Still, revenue was $172,860 and $124,524, respectively.

Notably, while Uniswap is positioned second in fee generation, DefiLlama reports $0 in revenue as Uniswap facilitates the collection of fees. Still, it does not retain these fees as revenue for the protocol. Instead, the fees increase the value of liquidity tokens, functioning as a payout to all liquidity providers proportional to their share of the pool.

There have been discussions and proposals within the Uniswap community regarding implementing a “protocol fee,” which could be turned on by UNI governance. This fee would allow the Uniswap protocol to earn revenue by taking a percentage of the swap fees that would otherwise go to liquidity providers.

The poll was the first step, “temperature check,” which passed at a rate of 55 million to 144, meaning the upgrade has not yet been implemented. Therefore, Uniswap does not record this as revenue.

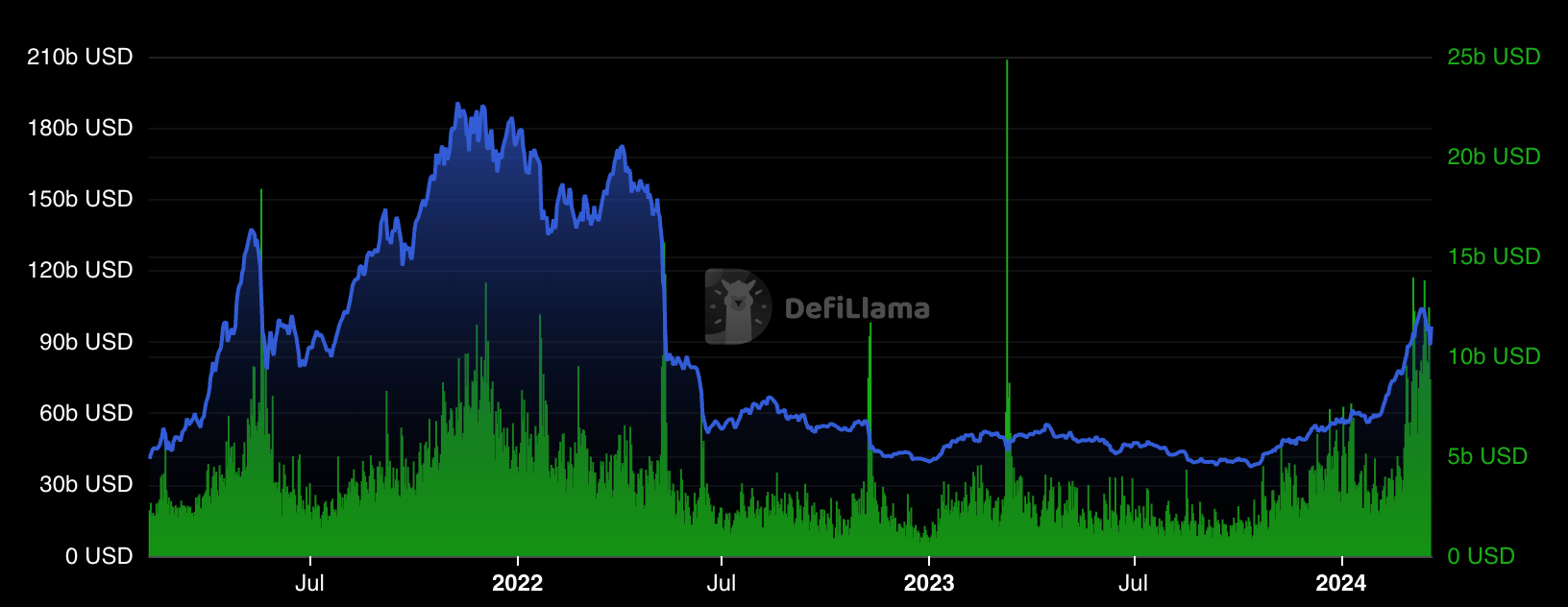

The DeFi market currently has a combined market cap of $101 billion per CryptoSlate data, with the sector up 5% over the past day. DefiLlama data shows that DeFi’s market cap resurgence has yet to hit its 2021 peaks. However, volumes have risen to equivalent levels, showing a more consistent trend. Over the past month, volumes around $10 billion have been commonplace after starting the year closer to $5 billion.

The post Top 10 DeFi dApps generating an average of $4.8 billion in fees annually appeared first on CryptoSlate.