In a heated US political climate, financial analyst Michael A. Gayed recently remarked that the rising national debt exceeding $35 trillion is a more significant threat to democracy than political leadership. Gayed emphasizes that the increasing rate of debt outpaces both tax revenues and inflation, creating a precarious fiscal environment.

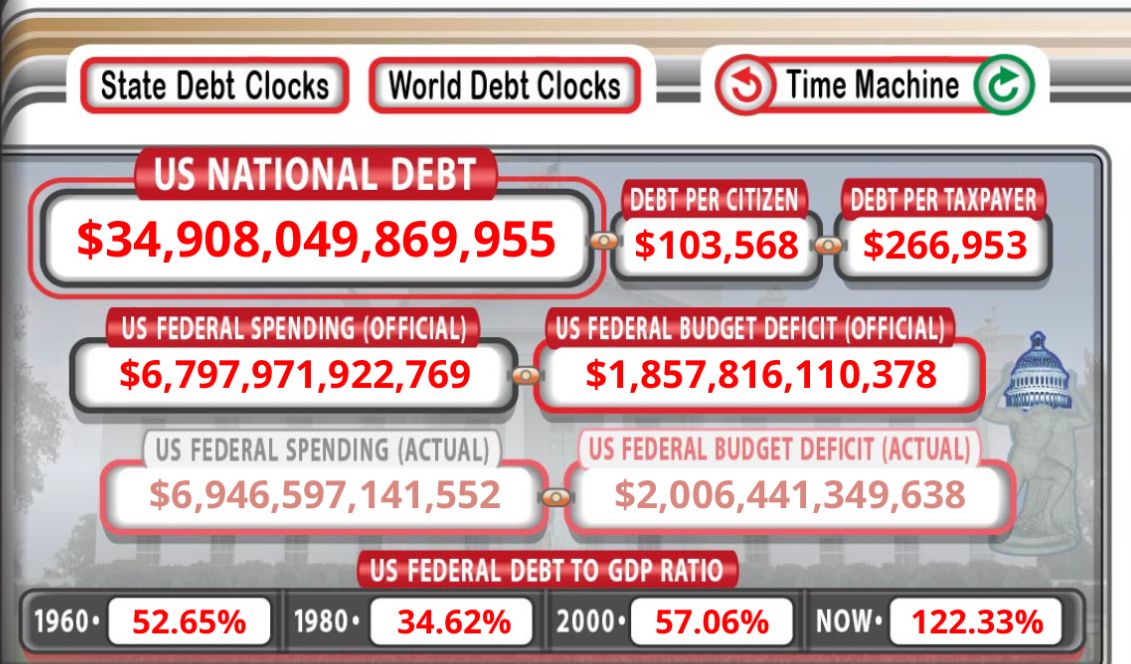

The US federal debt-to-GDP ratio, which has escalated from 52.65% in 1960 to 122.33% currently, further illustrates the unsustainable nature of the nation’s fiscal policies. The likelihood of a severe economic downturn becomes more pronounced as the debt grows unchecked.

The United States national debt has now reached $34.9 trillion. Debt per citizen stands at $103,568, while the debt per taxpayer has risen to $266,953. The US federal budget deficit is also significant, with the official figure at $1.8 trillion and the actual deficit exceeding $2 trillion.

In response to Gayed, Erik Voorhees, founder of ShapeShift and a prominent voice in crypto, highlighted the gravity of the situation. Voorhees asserts that the increasing debt, irrespective of presidential administrations, poses an unavoidable economic threat. He predicts that the relentless growth in national debt will culminate in a catastrophic bond market collapse, resulting in widespread financial ruin.

Voorhees also suggests that the current political landscape, represented by leaders like Trump and Biden, cannot mitigate this trajectory. The projected annual increase in debt by more than $1 trillion under any plausible scenario illustrates the dire financial outlook. This unsustainable debt growth, Voorhees argues, is a more substantial threat to democracy than any single political figure.

The implications of such an economic collapse are profound. Voorhees envisions a scenario where society might navigate this turmoil with dignity and principles, potentially emerging more prosperous. However, this would significantly depart from the 20th-century notion of large nation-states. He posits that Bitcoin or similar decentralized assets are crucial for this transformation. Through its inherent economic game theory, Bitcoin could prevent the monetary debasement that facilitates the growth of large nation-states.

Bitcoin’s status as a more enduring asset than fiat currencies, which has yet to be fully realized, could be pivotal in this shift. Voorhees believes that as Bitcoin is perceived as a more stable store of value over generations, it may constrain the expansion of large nation-states by limiting their ability to inflate their currencies.

Should Republicans win in November, Voorhees states that Trump and Vance are unlikely to reduce the debt materially, but they could provide an environment where crypto can thrive. By doing so, they would enable the roots of crypto to deepen in the cultural and economic landscape, potentially making them resilient enough to withstand the anticipated financial upheaval.

“The best thing Trump/Vance can do during their administration, since they cannot (and won’t) materially reduce the debt situation, is to create four years of permissive space in which crypto may thrive, unpersecuted.”

Voorhees’ perspective reflects a broader sentiment within the crypto community, which views decentralized digital assets as a potential safeguard against the economic instability of massive national debts. The crypto industry’s ability to provide an alternative to traditional fiat systems may be critical in navigating future financial challenges.

The post US debt nears $35 trillion, Bitcoin key to surviving ‘catastrophic’ collapse – Voorhees appeared first on CryptoSlate.