Vitalik Buterin has argued that growing Ethereum’s L1 fuel capability is critical to assist transaction inclusion and software improvement when most exercise happens on L2. In a brand new weblog put up, Buterin outlined calculations suggesting {that a} roughly 10× growth in L1 capability would protect key community features at the same time as functions migrate to Layer 2 options.

The fuel restrict defines the utmost quantity of computational work that may be carried out in a single block, setting an higher sure on the transactions and operations processed. Rising the fuel restrict expands the protocol’s capability to course of extra computational work per block, permitting it to deal with a better quantity of transactions and extra advanced operations whereas influencing price dynamics.

Current 20% improve in fuel restrict

Buterin’s evaluation builds on the current improve within the L1 fuel restrict from 30 million to 36 million, which raises capability by 20%.

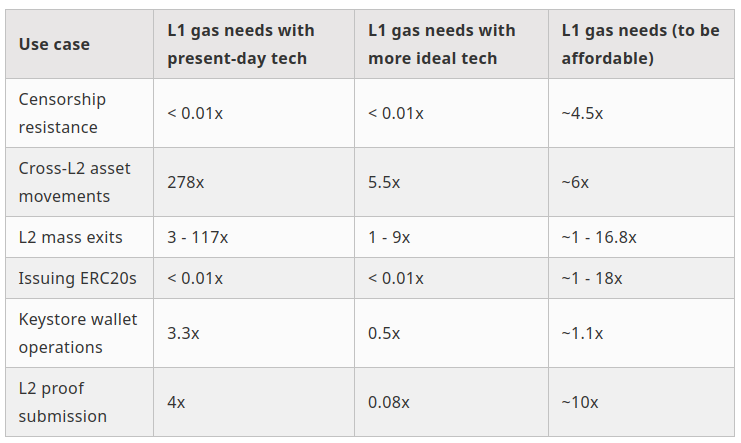

Buterin famous that additional will increase, enabled by effectivity enhancements in Ethereum purchasers, lowered historical past storage from EIP-4444, and eventual adoption of stateless purchasers, might provide long-term advantages. His dialogue frames the talk over scaling by evaluating present fuel wants with extra superb situations throughout a number of use instances.

As Buterin reported, censorship resistance stays a essential perform. He demonstrated that bypass transactions—designed to beat potential censorship on L2—might price roughly $4.50 at present fuel costs. By scaling L1 capability by roughly 4.5×, these prices may very well be pushed down, guaranteeing that legitimate transactions attain the blockchain promptly even beneath congestion. In the same vein, cross-L2 asset actions, together with transfers of high-volume property and NFTs, at the moment incur prices close to $14 per operation.

Buterin’s estimates counsel that with improved design and a scaling issue of about 5.5× to six×, such transactions could be executed at a fraction of that price, doubtlessly as little as $0.28 in a super setup.

Mass exits from L2s

Buterin’s evaluation extends to situations involving mass exits from L2. An exit refers back to the operation by which customers withdraw their property from a Layer 2 resolution again to Ethereum’s important chain (L1), sometimes to safeguard funds throughout community disruptions or different emergencies.

He calculated that beneath present parameters, an exit requiring 120,000 fuel per person would permit between 7.56 million and 32.4 million customers to exit over a one-week to 30-day interval, relying on the roll-up design. With optimized protocols—lowering the associated fee per exit operation to roughly 7,500 fuel—the variety of customers capable of exit safely might improve considerably, supporting thousands and thousands extra and lowering the danger of liquidity or safety points in periods of community stress.

Addressing token issuance, Buterin noticed that many new ERC20 tokens are launched on L2. Nonetheless, tokens issued on L2 could also be weak if a hostile governance improve happens, a threat mitigated by launching on L1. He cited examples such because the deployment of the Railgun token, the place the associated fee was over 1.6 million fuel.

Even when these prices have been lowered to round 120,000 fuel, the expense per issuance stays close to $4.50, implying {that a} scaling issue as much as 18× may very well be required for extra widespread, cost-effective token launches that meet decrease goal charges.

The dialogue additionally lined operations tied to keystore wallets. Buterin estimated that for widespread key updates—assuming 50,000 fuel per operation—a 3.3× improve in fuel capability could be wanted, although effectivity features lowering the associated fee to round 7,500 fuel per operation might decrease this requirement to almost 1.1×.

Equally, frequent L2 proof submissions, essential for sustaining up-to-date interoperability between chains, at the moment impose substantial prices that restrict the variety of viable L2s. With superior aggregation protocols doubtlessly reducing per-submission prices to about 10,000 fuel, a scaling issue of roughly 10× could be wanted to make common L2-to-L1 updates economically viable.

Buterin’s calculations spotlight that regardless of most exercise shifting to L2, sustaining strong L1 performance is crucial to protect censorship resistance, allow environment friendly asset transfers, assist mass exits, safeguard token issuance, and facilitate interoperability.

As Buterin concluded, growing L1 fuel capability gives worth by guaranteeing that basic blockchain operations stay safe and accessible at the same time as community utilization patterns evolve.

His evaluation frames a transparent argument for near-term scaling measures that would safeguard Ethereum’s core features whatever the long-term steadiness between L1 and L2 exercise.

The put up Vitalik Buterin suggests 10X improve in Ethereum fuel restrict to assist L2 progress and censorship resistance appeared first on CryptoSlate.