- The Biden administration justified the proposed 30% tax on crypto mining companies earlier.

- The document is still subject to rigorous investigation and discussions in Congress.

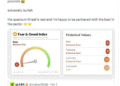

It became clear on Sunday that the Digital Asset Mining Energy (DAME) excise tax proposed by the Biden administration was blocked as part of the agreement between President Joe Biden and House Speaker Kevin McCarthy on the U.S. debt ceiling.

The Biden administration justified the proposed 30% tax on crypto mining companies as necessary to mitigate negative effects on the environment and society.

Whether “the Administration’s DAME excise tax proposal is gone?” was a query raised by Riot Platforms’ Vice President of Research Pierre Rochard, because Bitcoin mining wasn’t mentioned in the text of the measure, which was called the “Fiscal Responsibility 5 Act of 2023.”

Warren Davidson, U.S. Congressman Warren Davidson (R-OH-08), tweeted:

“Yes, one of the victories is blocking proposed taxes.”

Subject to Further Approval

The debt ceiling deal is a comprehensive 99-page law that aims to postpone the nation’s debt limit until 2025, averting a federal default, while also setting constraints on government spending. The document is still subject to rigorous investigation and discussions in Congress.

In March of this year, the concept of imposing a tax on the use of energy was first proposed. Despite the vast variations in energy use, the proposed Digital Asset Mining Energy (DAME) tax would be levied upon miners of digital assets running on both Proof-of-Work (PoW) networks like Bitcoin and Proof-of-Stake (PoS) networks like Ethereum.

The proposed tax system would require cryptocurrency miners to report their power use, the worth of that electricity, and whether or not it comes from renewable sources. Off-grid power production, including the recovery of otherwise lost natural gas, would be subject to this rule as well.