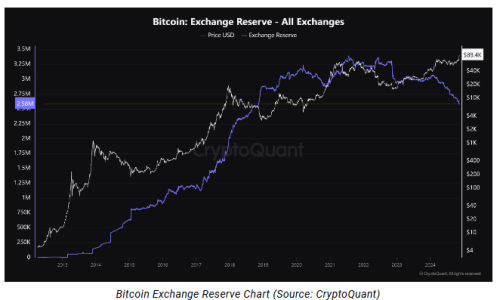

Bitcoin Exchange Reserves Hit Six-Year Low Amid Rising ETF Adoption and Investor Withdrawals

Bitcoin exchange reserves have fallen to 2.3 million BTC, marking their lowest level since November 2018, according to data from CryptoQuant. This trend reflects a combination of factors, including the surge in Bitcoin’s price, significant withdrawals by investors, and the growing popularity of Bitcoin exchange-traded funds (ETFs) as an alternative to traditional exchanges.

As Crypto Briefing reports, Bitcoin withdrawals from exchanges are happening at a remarkable pace, with $2.7 billion worth of BTC being moved off exchanges weekly. The monthly outflow has reached approximately $7.58 billion, highlighting a shift in how investors are managing their Bitcoin holdings.

Why Are Bitcoin Exchange Reserves Declining?

The steady decrease in Bitcoin reserves on exchanges is influenced by several interrelated factors:

1. Rising Bitcoin Prices

As Bitcoin’s price has surged—currently nearing the $100,000 mark—investors are increasingly transferring their BTC from exchanges to cold wallets for long-term holding. This behavior aligns with the expectation of continued price growth, as holders secure their assets in anticipation of future gains.

2. Increased ETF Adoption

The launch and rapid adoption of spot Bitcoin ETFs have provided investors with a regulated and convenient way to gain exposure to Bitcoin. Instead of holding Bitcoin directly on exchanges, many investors are choosing ETFs, which offer simpler custody solutions and are perceived as safer.

3. Shift Toward Decentralized Storage

The growth of self-custody solutions and hardware wallets has empowered more investors to store Bitcoin outside centralized exchanges. This shift reflects a broader trend toward decentralization and reduced reliance on third-party platforms.

4. Regulatory Concerns

Uncertainty surrounding exchange regulations has led some investors to withdraw their holdings. The collapse of major platforms like FTX has also heightened awareness of counterparty risk, prompting a flight to self-custody.

Key Data Points

| Metric | Value |

|---|---|

| Current BTC Reserves | 2.3 million (lowest since Nov. 2018) |

| Weekly Withdrawals | $2.7 billion worth of BTC |

| Monthly Outflow | $7.58 billion |

Implications for the Bitcoin Market

The decline in exchange reserves has significant implications for the broader Bitcoin market:

1. Reduced Selling Pressure

With fewer Bitcoin held on exchanges, the likelihood of large-scale sell-offs decreases. This reduced supply on trading platforms supports price stability and creates upward pressure as demand grows.

2. Market Maturation

The increasing adoption of Bitcoin ETFs and self-custody solutions indicates a maturing market. Investors are opting for diversified and secure ways to manage their holdings, moving beyond traditional exchange-based strategies.

3. Impact on Liquidity

While the decline in exchange reserves signals strong holding sentiment, it may also reduce liquidity. Lower liquidity can lead to greater price volatility, particularly during periods of heightened trading activity.

Historical Context: Bitcoin Exchange Reserves

The current trend mirrors previous periods when Bitcoin reserves on exchanges declined significantly:

- 2018: Exchange reserves peaked as the crypto market experienced a downturn, with investors selling off assets during the bear market.

- 2020-2021: Reserves began to decline as the market recovered and long-term holding increased, driven by institutional interest.

- 2024: The ongoing reduction in reserves is unprecedented, reflecting the combined effects of price growth, ETF adoption, and a preference for decentralized storage.

Analyst Perspectives

Industry analysts view the decline in Bitcoin exchange reserves as a bullish signal:

- James Check, a market strategist, noted:

“The sharp reduction in Bitcoin held on exchanges is a sign of strong conviction among investors. It indicates that holders are confident in Bitcoin’s long-term value.”

- Sarah Lane, a blockchain analyst, highlighted the impact of ETFs:

“Spot Bitcoin ETFs are reshaping how investors interact with Bitcoin. As ETFs become more accessible, we’re likely to see further reductions in exchange reserves.”

How This Affects Investors

For investors, the decline in exchange reserves underscores the importance of understanding market dynamics and choosing the right storage solutions:

1. Consider Self-Custody

If you’re holding Bitcoin for the long term, consider transferring it to a secure hardware wallet or decentralized custody solution to reduce counterparty risk.

2. Monitor ETF Trends

The growth of Bitcoin ETFs offers a regulated alternative to direct holdings. Evaluate whether ETFs align with your investment goals, particularly if you’re seeking a hassle-free option.

3. Stay Informed

Keep track of exchange reserve trends, as they provide insights into market sentiment and potential price movements.

Conclusion

The ongoing decline in Bitcoin exchange reserves, now at a six-year low of 2.3 million BTC, reflects a combination of rising prices, increasing ETF adoption, and a shift toward self-custody. This trend highlights the evolving preferences of Bitcoin investors and underscores the growing maturity of the cryptocurrency market.

For Bitcoin holders, the focus should remain on long-term strategies and securing assets in ways that align with their risk tolerance and investment goals.

For more insights on Bitcoin’s market dynamics, explore our article on how ETFs and self-custody are transforming crypto investment.