Bitcoin Futures Surge After Trump Win as Crypto Market Strengthens

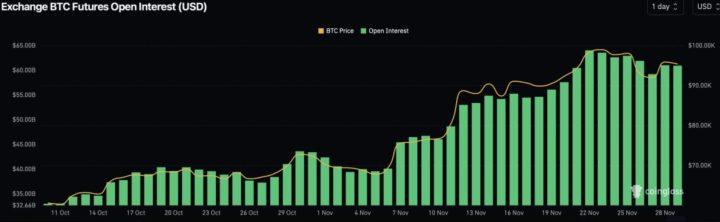

The Bitcoin futures market has seen a dramatic rise in open interest, reaching $60.9 billion following Donald Trump’s re-election victory on November 5, 2024. This sharp increase from $39 billion reflects growing investor confidence and expectations of continued price gains, according to Bitfinex analysts cited by The Block.

Key Highlights of the Market Activity

Bitcoin Market Trends

- Pullback to $94,000: Despite the surge in futures interest, Bitcoin’s spot price recently retraced to $94,000, which analysts view as a healthy correction in an otherwise bullish market.

- Dominance: Bitcoin continues to dominate the global crypto market, holding a 54.7% share.

Ethereum’s Gains

- Price Movement: Ethereum (ETH) climbed 5% on November 27, reaching $3,600.

- ETF Inflows: Strong inflows of $90.1 million into Ethereum ETFs indicate increasing institutional interest.

- Potential to Test ATH: Analysts suggest Ethereum could test its all-time high of $4,868 as momentum builds.

Global Market Cap

- The global cryptocurrency market cap hit an impressive $3.4 trillion, underscoring the sector’s growth and investor interest.

Factors Driving the Surge in Bitcoin Futures

1. Post-Election Optimism

The Trump administration’s policies are widely anticipated to be crypto-friendly, with expectations of favorable regulatory changes and institutional adoption.

2. Market Momentum

- Futures markets often respond to positive sentiment and price forecasts, magnifying upward trends.

- The jump in open interest suggests traders are positioning for a potential BTC price breakout following the correction to $94,000.

3. Institutional Participation

The rise in futures trading volume highlights increasing participation from institutional investors, who are leveraging futures to hedge and speculate in a growing market.

Ethereum’s Performance and Market Outlook

Strong ETF Inflows

- Ethereum’s $90.1 million ETF inflows on November 27 signal robust institutional demand.

- These inflows, combined with positive market sentiment, could drive Ethereum toward its all-time high.

ETH Market Share

- Ethereum holds a 12.4% dominance in the global crypto market, maintaining its position as the second-largest cryptocurrency.

What’s Next for the Crypto Market?

For Bitcoin

- The $60.9 billion futures open interest suggests sustained optimism for Bitcoin’s price recovery.

- Analysts expect Bitcoin to consolidate above $93,580, a critical support level, before attempting a new high.

For Ethereum

- Ethereum’s ability to test its all-time high depends on sustained ETF inflows and broader market sentiment.

Global Trends

- The growing crypto market cap points to increasing adoption and liquidity across the sector.

- Investors are watching macroeconomic factors and regulatory developments for potential market catalysts.

Conclusion: A Bullish Outlook Amid Market Corrections

The surge in Bitcoin futures open interest to $60.9 billion reflects strong investor confidence in the cryptocurrency market following Trump’s election victory. While Bitcoin undergoes a healthy correction, Ethereum’s performance and ETF inflows highlight the continued appeal of altcoins.

As the global crypto market surpasses $3.4 trillion, traders and investors are positioning themselves for the next phase of growth, driven by institutional adoption, favorable policy expectations, and market momentum.

To explore the implications of futures markets and institutional inflows, check out our article on crypto market trends and forecasts.