Bitcoin (BTC) price has finally broken the $30,000 level after the key price zone lasted as a ten months resistance level. BTC price rallied 6.5% on April 10 and the much-awaited price gain ended an agonizing 12-day period of extremely low volatility, which saw the price hovering close to $28,200. Bulls are now confident that the bear market has officially ended, especially considering the fact that BTC price has gained 82% year-to-date.

Another interesting note is that Bitcoin’s decoupling from traditional markets has been confirmed after the S&P 500 index presented a mere 0.1% gain on April 10, and West Texas Intermediate (WTI) oil traded down 1.2%. Bitcoin traders are likely anticipating the Federal Reserve’s interest rate policy to reverse sooner than later.

Stagflation risk could be behind the decoupling

Higher interest rates make fixed-income investments more attractive, while businesses and families face additional costs to refinance their debts. The reversal of the U.S. central bank's recent tightening movement is deemed bullish for risk assets. However, the fear of stagflation — a period of increased inflation and negative economic growth — would be the worst-case scenario for the stock market.

Fixed-income traders are betting that the Federal Reserve probably has one more interest-rate hike because the latest economic data displayed moderate resilience. For instance, the 3.5% U.S. unemployment rate announced on April 7 is the lowest measure in half a century.

The U.S. treasuries market suggests a 76% chance that the Federal Reserve will bolster the benchmark by 0.25% on April 29, according to Bloomberg. There’s also the added uncertainty of the banking crisis’s impact on the sector, with JPMorgan Chase, Wells Fargo and Citigroup scheduled to report first-quarter results on Friday.

Bitcoin's rally above $30,000 could be the first evidence of a shift in investors' perception from a risk market proxy to a scarce digital asset that might benefit from a period of inflation pressure and weak economic growth.

Two critical factors will determine whether the rally is sustainable: the high leverage usage increasing the odds of forced liquidations during normal price fluctuations, and whether or not pro traders are pricing higher odds of a market downturn using options instruments.

Bitcoin futures show modest improvement

Bitcoin quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, futures contracts in healthy markets should trade at a 5-to-10% annualized premium — a situation known as contango, which is not unique to crypto markets.

Bitcoin traders have been cautious in the past few weeks, and even with the recent breakout above $30,000, there has been no surge in demand for leverage longs. However, the Bitcoin futures premium has slightly improved from its recent low of 3% on April 8 to its current level of 4.2%. This suggests that buyers are not using excessive leverage and there is effective demand on regular spot markets, which is healthy for the market.

Bitcoin option traders remain neutral

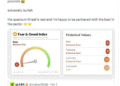

Traders should also analyze options markets to understand whether the recent correction has caused investors to become more optimistic. The 25% delta skew is a telling sign when arbitrage desks and market makers overcharge for upside or downside protection.

In short, if traders anticipate a Bitcoin price drop, the skew metric will rise above 7%, and phases of excitement tend to have a negative 7% skew.

Related: MicroStrategy Bitcoin bet turns green as BTC price climbs to 10-month high

Currently, the options delta 25% skew has shifted from a balanced demand between call and put options on April 9 to a modest 4% discount for protective puts on April 10. While this indicates a slight increase in confidence, it is not enough to break the 7% threshold for moderate bullishness.

In essence, Bitcoin options and futures markets suggest that pro traders are slightly more confident, but not excessively optimistic. The initial decoupling from traditional markets is promising because investors are showing confidence that crypto markets will benefit from higher inflationary pressure and it highlights traders’ belief the Fed can no longer continue raising interest rates.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.