The introduction of Bitcoin (BTC) exchange-traded funds (ETFs) has triggered a significant sell-off, leading to a sharp decline in the Bitcoin price.

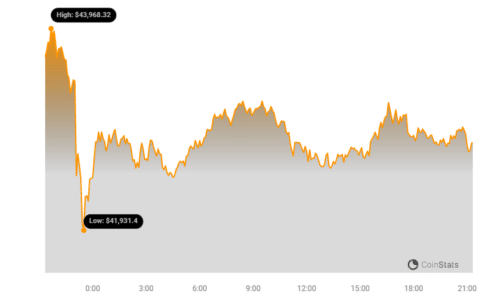

The highly volatile moves after the approval of the first US spot Bitcoin ETFs continued in the past 24 hours, with a massive dump to under $41,600.

After gaining approval and commencing trading on Thursday, the ETFs have prompted a “sell the news” event, causing Bitcoin’s value to plummet from its initial trading price of $46,500 at the time of approval to a low of $43,200 within a matter of hours on Friday.

Over the past 24 hours, Bitcoin, the largest cryptocurrency by market capitalization, has experienced a 7% drop.

Its gains over the past 30 days have been limited to a mere 4%, erasing much of the progress made during that period.

See Also: Vanguard Have No Plans To Allow Spot Bitcoin ETF Trading On Its Platform

BTC’s Volatility Returns

Bitcoin and the entire cryptocurrency industry had a very eventful week, in which the US SEC was expected to approve the first spot BTC ETFs in the country.

While that indeed transpired on Wednesday, it didn’t go without its own set of hiccups, including a hack on the previous day with fake news, deleted and reposted statements, as well as controversial words from the agency’s chairman – Gary Gensler.

Naturally, this all resulted in enhanced volatility, with multiple massive price movements from BTC.

After the ETFs reached the US markets on Thursday, the asset first soared to a 21-month peak at over $49,000 before it crumbled by three grand in minutes.

The landscape was less volatile on Friday, but only during the Asian and European trading hours.

As the US trading hours were coming to an end, the primary digital asset slumped to under $41,600 for just the second time since the start of 2024.

As of now, it has reclaimed some ground and stands close to $43,000. Its market cap, though, is down to $843 billion, and so is its dominance – 50% on CMC now. The metric had soared to over 53% earlier this week.

See Also: Robinhood Lists All 11 Spot Bitcoin ETFs On Trading App

Altcoins See Red

Although most altcoins are in the red now, some have suffered less than others. Such is the case with Ethereum, which is down by a more modest 2.6% to $2,550.

Binance Coin (BNB), Ripple (XRP), Dogecoin, and Toncoin have also declined by less than 5%.

At the same time, assets like SOL, ADA, AVAX, MATIC, BCH, DOT, and ATOM have slumped by more than 5% and up to 11% in the case of BCH.

The total crypto market cap has seen $80 billion gone in a day and is down under $1.7 trillion on CMC.

The post BTC ETFs Hype Is Over As Bitcoin Price Drops To 2024 Lows appeared first on BitcoinWorld.