CFTC Approves Spot Bitcoin ETF Options, Paving the Way for Crypto Market Innovation

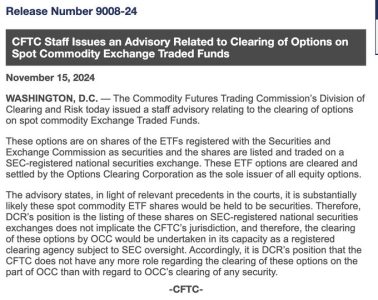

The U.S. Commodity Futures Trading Commission (CFTC) has approved the listing of spot Bitcoin ETF options, according to Eric Balchunas, senior ETF analyst at Bloomberg. This development marks a significant milestone in the expansion of Bitcoin-related financial products, following the Securities and Exchange Commission (SEC) approval of spot Bitcoin ETFs earlier this year.

With the matter now awaiting approval from the Office of the Comptroller of the Currency (OCC), trading for spot Bitcoin ETF options is expected to begin in early 2025. This move underscores growing regulatory acceptance of cryptocurrency investments and opens new opportunities for both retail and institutional investors.

What Are Spot Bitcoin ETF Options?

Spot Bitcoin ETF options are financial derivatives tied to the performance of spot Bitcoin ETFs. Unlike Bitcoin futures ETFs, which are based on futures contracts, spot Bitcoin ETFs track the current market price of Bitcoin.

Key Features of Spot Bitcoin ETF Options:

- Flexibility: Options contracts allow investors to hedge against price volatility or speculate on future Bitcoin price movements.

- Regulated Exposure: These options offer a regulated avenue for participating in Bitcoin’s price action without directly owning the asset.

- Institutional Appeal: Designed to attract institutional investors seeking advanced trading tools for risk management.

Significance of the CFTC Approval

The CFTC’s green light represents the second regulatory hurdle cleared for spot Bitcoin ETF options, following the SEC’s earlier approval of the ETFs themselves. This approval is pivotal for several reasons:

1. Enhanced Market Maturity

The introduction of options contracts tied to spot Bitcoin ETFs signals the cryptocurrency market’s growing maturity, providing sophisticated tools that are standard in traditional financial markets.

2. Increased Liquidity

Options trading could boost liquidity for spot Bitcoin ETFs, as traders and institutions leverage these derivatives to hedge positions and manage exposure.

3. Broader Adoption

With regulated options contracts available, Bitcoin is likely to attract more institutional participation, driving greater adoption and integration into mainstream finance.

Timeline for Spot Bitcoin ETF Options

According to James Seyffart, another Bloomberg analyst, spot Bitcoin ETF options could begin trading in the first quarter of 2025, assuming final approval from the OCC.

- Current Status: CFTC approval clears the way for listing.

- Next Step: Pending OCC review, expected to grant approval soon.

- Launch Date: Potential trading start in early 2025.

Why This Matters for Investors

The approval of spot Bitcoin ETF options offers several benefits for investors:

1. Diversified Strategies

Options allow investors to execute advanced trading strategies, such as:

- Hedging: Protecting portfolios from downside risk.

- Speculation: Taking advantage of potential price movements.

- Income Generation: Selling covered calls for additional returns.

2. Accessibility and Regulation

For retail investors, these options provide exposure to Bitcoin price movements within a regulated framework, addressing concerns about security and compliance.

3. Institutional Engagement

Institutional investors gain access to standardized products for managing Bitcoin exposure, paving the way for deeper integration of crypto into traditional portfolios.

Analyst Perspectives

Experts in the cryptocurrency and financial sectors view the approval as a pivotal moment:

- Eric Balchunas, Bloomberg ETF Analyst:

“The CFTC’s approval of spot Bitcoin ETF options clears another major hurdle, bringing us closer to a fully developed market for Bitcoin derivatives.”

- James Seyffart, Bloomberg Analyst:

“Spot Bitcoin ETF options are a logical next step. They provide the tools needed for advanced portfolio management and risk mitigation in the crypto space.”

Potential Market Impact

1. Boost to Bitcoin Adoption

Regulated options expand the suite of Bitcoin financial products, encouraging more participation from institutional and retail investors.

2. Price Volatility

Options trading may increase price volatility in the short term as traders use leverage and advanced strategies to capitalize on market movements.

3. Growth of Bitcoin ETFs

The introduction of options could drive further inflows into spot Bitcoin ETFs, as traders and institutions hedge or enhance their positions using derivatives.

Challenges and Considerations

While the approval is a major milestone, certain challenges remain:

- Complexity: Options are sophisticated instruments that may not be suitable for all investors.

- Regulatory Risk: Future changes in cryptocurrency regulations could affect the viability or scope of these products.

- Market Liquidity: Initial trading volumes may be lower until the market fully adapts to the new offerings.

Conclusion

The CFTC’s approval of spot Bitcoin ETF options is a significant step forward for cryptocurrency markets, reflecting increasing regulatory acceptance and market sophistication. With trading expected to begin in early 2025, these derivatives could provide new opportunities for hedging, speculation, and portfolio management, appealing to a wide range of investors.

As the cryptocurrency ecosystem continues to evolve, the addition of options contracts highlights Bitcoin’s growing integration into traditional financial markets, setting the stage for broader adoption and innovation.

For more updates on Bitcoin ETFs and cryptocurrency derivatives, explore our article on how Bitcoin ETFs are reshaping investment strategies.