- An on-chain data revealed that 57% of all Bitcoin (BTC) hasn’t moved since at least two years ago.

As pointed out by Capriole Investments founder Charles Edwards in a post on X, the BTC supply, dormant since at least two years ago, has been hitting consecutive new all-time highs (ATHs) recently.

This metric is hitting all time high, after all time high. 57% of all Bitcoin is locked up with investors that haven't touched it in 2+ years. This creates a massive supply squeeze for Bitcoin, and has preceded all bull-runs.

But there's more… pic.twitter.com/jTUs2fPzEW

— Charles Edwards (@caprioleio) January 11, 2024

Crypto investors holding BTC supply for this long make up for a segment of the wider “long-term holder” (LTH) group. The LTHs refer to the investors who have been holding their coins since at least 155 days ago.

A statistical fact is that the longer holders keep their coins still on the blockchain, the less likely they become to move them at any point.

Because of this reason, the LTHs are considered the more stubborn side of the BTC market.

The 2+ years segment would then include the investors who would be the most stalwart of diamond hands even among these HODLers, as their holding time is significantly greater than just 155 days.

Now, here is a chart that shows the trend in the percentage of the total circulating Bitcoin supply held by this segment of the LTHs over the history of the cryptocurrency:

As displayed in the above graph, the supply held by these LTHs has been following an upward trajectory since the FTX collapse and has been continuously setting new ATHs.

Recently, the growth in the metric has slowed a bit, but it has still been going up. At present, around 57% of the Bitcoin supply is locked in the hands of these HODLers.

See Also: Bitcoin Is An Opportunity You Shouldn’t Miss: Andrew Tate To Crypto Investors

Edwards notes that this is creating a massive supply squeeze for the cryptocurrency.

The quant has also pointed out that a similar trend has been seen in the leadup to all past bull runs (marked with the green lines in the chart).

Now that the US SEC has finally approved the Bitcoin spot ETFs. Edwards explained that this could lead toward the supply shock only growing deeper since “the ETFs were only approved for CASH subscriptions (not in-kind). So every purchase takes more Bitcoin off the market.”

A chart analyst, James V. Straten, shared what could also provide another angle at a supply shock brewing in the asset.

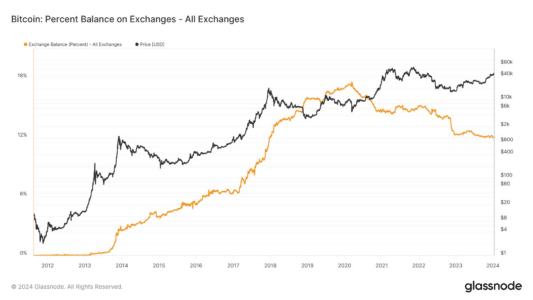

The above graph shows the data for the percentage of the Bitcoin supply sitting in the centralized exchanges’ wallets.

This metric has been going down over the last few days, and now, just 12% of all BTC is being stored on these platforms.

The exchange supply is significantly more likely to be involved in buying and selling activities (since that’s what these platforms are for, naturally), so going down means the effective trading supply of the asset is also decreasing.

BTC Price

At the time of writing, Bitcoin is trading at around $45,900, up more than 4% over the last week.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

The post Did You Know That 57% Of Bitcoin (BTC) Hasn’t Moved In 2 Years? appeared first on BitcoinWorld.