U.S. Spot Bitcoin ETFs Record $485.8 Million in Net Inflows on November 22

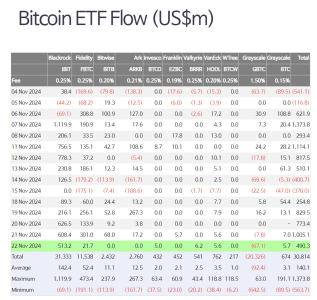

Spot Bitcoin ETFs in the U.S. recorded an impressive $485.8 million in net inflows on November 22, highlighting growing investor confidence in the cryptocurrency market. According to Farside Investors and an X post by Tree News, this marks the fifth consecutive day of inflows. BlackRock’s IBIT led the charge with $508.7 million, followed by notable contributions from Fidelity, Valkyrie, Grayscale, VanEck, and Invesco. However, Grayscale’s GBTC faced significant outflows of $67.1 million.

Spot Bitcoin ETFs: A Milestone Day in Crypto Investing

Breaking Down the Numbers

The $485.8 million inflows on November 22 underline the growing demand for regulated Bitcoin investment products. Here’s a snapshot of the top contributors:

- BlackRock’s IBIT: Dominated with $508.7 million in inflows.

- Fidelity’s FBTC: Added $21.7 million.

- Valkyrie’s BRRR: Brought in $6.2 million.

- Grayscale’s BTC: Recorded $5.7 million in net inflows.

- VanEck’s HODL: Attracted $5.6 million.

- Invesco’s BTCO: Contributed $5 million.

While the majority of funds experienced positive inflows, Grayscale’s GBTC saw notable outflows of $67.1 million, reflecting a nuanced investor sentiment within the broader market trend.

What’s Driving the Surge in Spot Bitcoin ETF Inflows?

Increased Institutional Adoption

Institutional interest in Bitcoin ETFs continues to rise, with leading players like BlackRock and Fidelity driving significant inflows. The regulatory clarity surrounding spot Bitcoin ETFs has further solidified their position as a preferred investment vehicle for exposure to Bitcoin.

Market Optimism

Bitcoin’s steady price action and increasing adoption as a hedge against economic uncertainty have contributed to renewed investor optimism. The positive sentiment is evident in the consistent five-day inflow streak across spot Bitcoin ETFs.

Spotlight on Key ETFs

BlackRock’s IBIT Dominates the Market

BlackRock’s IBIT emerged as the standout performer, capturing over 100% of the total inflows on November 22 with $508.7 million. This dominance underscores BlackRock’s reputation as a trusted asset manager capable of attracting large-scale investments in innovative financial products.

Fidelity and Valkyrie Follow with Strong Inflows

Fidelity’s FBTC and Valkyrie’s BRRR posted inflows of $21.7 million and $6.2 million, respectively. Their steady performance highlights the growing diversification of investor choices within the spot Bitcoin ETF market.

Grayscale’s Contrasting Performance

While Grayscale’s BTC fund managed $5.7 million in inflows, its GBTC product recorded outflows of $67.1 million. This dichotomy reflects shifting investor preferences, possibly driven by GBTC’s structural differences and competition from newer ETFs.

The Importance of Spot Bitcoin ETFs

A Gateway for Institutional and Retail Investors

Spot Bitcoin ETFs provide a regulated and straightforward way for investors to gain exposure to Bitcoin. Unlike futures-based ETFs, spot ETFs directly hold Bitcoin, offering a more accurate representation of its market value.

Impact on Bitcoin’s Market Dynamics

The rising inflows into spot Bitcoin ETFs can influence market sentiment and, indirectly, Bitcoin’s price. As these products gain traction, they contribute to Bitcoin’s acceptance as a mainstream asset class.

Challenges Facing Spot Bitcoin ETFs

Competition Among Providers

As major asset managers like BlackRock, Fidelity, and Grayscale vie for market dominance, the competition is likely to drive innovation but could also pressure fees and returns.

Regulatory Scrutiny

While regulatory clarity has improved, Bitcoin ETFs remain under the microscope. Any changes in policy or market conditions could impact their growth trajectory.

Volatility Risks

Bitcoin’s inherent volatility poses risks for ETFs, potentially deterring more conservative investors despite their rising popularity.

The Road Ahead for Spot Bitcoin ETFs

Continued Growth and Adoption

With consistent inflows and increasing investor interest, the future looks promising for spot Bitcoin ETFs. Their success could pave the way for similar products tied to other cryptocurrencies, expanding the crypto investment ecosystem.

Potential for Broader Market Influence

As spot Bitcoin ETFs attract more institutional capital, they may play a more significant role in stabilizing Bitcoin’s market dynamics and encouraging further adoption among traditional investors.

Conclusion

The $485.8 million inflows into U.S. spot Bitcoin ETFs on November 22 highlight a growing appetite for regulated Bitcoin investment products. Led by BlackRock’s IBIT, the inflows mark a pivotal moment in the market, signaling confidence in Bitcoin’s long-term potential. While challenges remain, the consistent inflows suggest a positive outlook for spot Bitcoin ETFs as they continue to bridge the gap between traditional finance and digital assets.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.