The cryptocurrency market has been experiencing significant fluctuations in recent months, with Bitcoin, the largest digital currency by market capitalization, remaining at the forefront of this volatility.

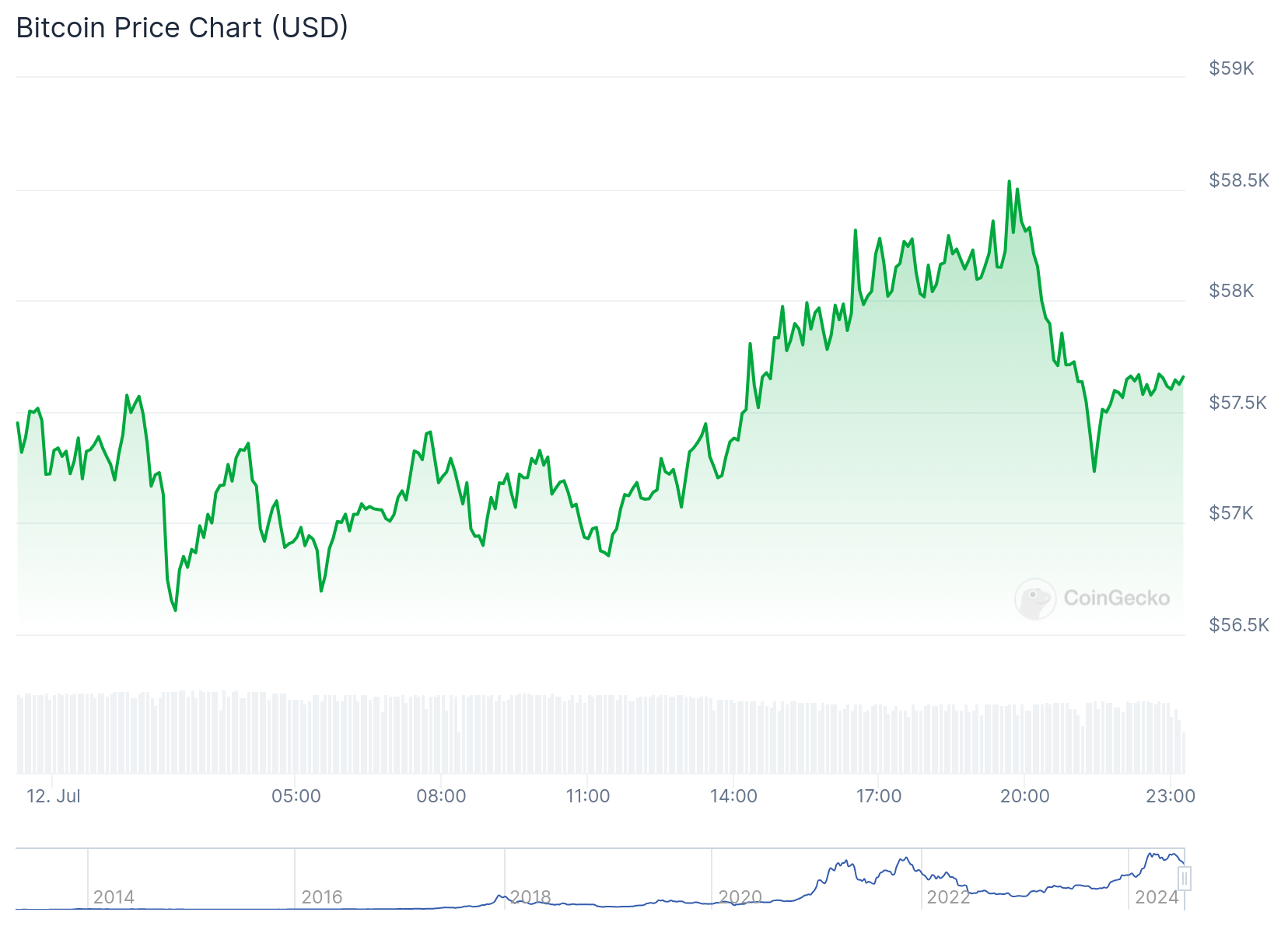

Bitcoin is currently trading slightly above $57,000, reflecting a 2.08% decrease within the last 24 hours.

Despite recent declines in trading volumes, reflecting a cautious stance among investors, Bitcoin remains a focal point in the financial landscape.

Bitcoin has shown resilience amidst broader market downturns, maintaining a market capitalization above $1 trillion.

Over the past month, macroeconomic factors and specific market events have influenced Bitcoin’s price movements. Notably, institutional inflows have been substantial, with over $800 million invested in U.S. spot Bitcoin ETFs within the last week alone.

This influx of institutional investment has bolstered continued confidence in Bitcoin’s long-term potential, even as short-term market dynamics remain turbulent.

But the recent decline from the $59K mark it reached yesterday, declining to $57K, is largely due to the new German government Bitcoin sale, following an earlier series of sales they’ve made in the past few weeks, causing a significant decline for Bitcoin amongst other crypto.

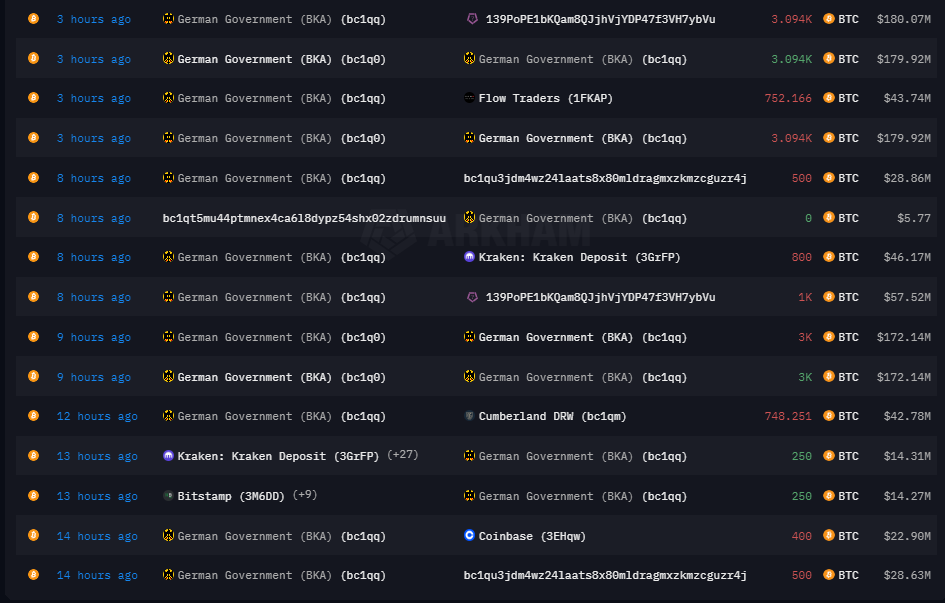

German Government’s Final Bitcoin Sales: Over $184 Million Worth of Bitcoin Sold Out

The German government has recently resumed selling its Bitcoin holdings, injecting additional volatility into the market.

On July 12, German authorities executed multiple transactions, transferring a total of 3,200 Bitcoin across several platforms, including Bitstamp, Kraken, and Coinbase, with each platform receiving 400 BTC.

Additionally, 1,000 BTC and 500 BTC were sent to two unknown addresses. This distribution strategy aims to mitigate extreme price swings that large sales typically cause. Historically, government-led Bitcoin sales have resulted in increased market volatility, as observed in recent movements.

Later in the day, Germany’s government offloaded the last of its Bitcoin holdings, according to data from Arkham Intelligence.

BREAKING: The German Government is now out of Bitcoin.

The German Government just sent 3846.05 BTC ($223.81M) to Flow Traders and 139Po (likely institutional deposit/OTC service).

The German Government has 0 BTC ($0.00M) remaining. pic.twitter.com/R2vfylR1b2

— Arkham (@ArkhamIntel) July 12, 2024

The final transaction included 3,093 Bitcoin sent to a wallet address ending in “ybVu,” following weeks of increased selling pressure from the German government, which offloaded tens of thousands of Bitcoin in several tranches.

Most of the 50,000 Bitcoins dumped by the German government over the last three weeks resulted from an asset seizure.

These Bitcoin sales were largely responsible for keeping the market below the $60,000 price point and its 200-day exponential moving average.

Price Prediction: Bitcoin Ready for a Moonshot as Sell-offs Come to an End

Currently, Bitcoin is trading above $57,500, showing signs of stability after heightened selling pressure. The consolidation above this level indicates a potential foundation for a renewed bullish move.

In the short term, Bitcoin faces a critical resistance level at $58,200, which it has struggled to surpass over the past week. Successfully breaking through this resistance could pave the way for a subsequent test of the $60,200 level.

Technical analysis reveals that Bitcoin is demonstrating strong bullish momentum. On the 4-hour chart, Bitcoin is approaching the 100-day Simple Moving Average (SMA), indicating a potential upward trajectory.

The break above the bearish trendline, followed by a successful retest, suggests that Bitcoin is positioned for a possible move higher.

Additionally, the Composite Trend Oscillator also points toward a bullish outlook and signals moving into the overbought zone.

As things are looking, the end of the German government’s Bitcoin sell-off could remove a significant source of daily selling pressure from the market.

As the German government runs out of Bitcoin, the crypto market may experience reduced volatility and renewed buying interest.

This could drive Bitcoin’s price higher, especially if macroeconomic conditions, such as anticipated Federal Reserve rate cuts, provide additional support.

Traders should monitor key resistance levels closely, as a break above $60,200 could signal the beginning of a more sustained upward trend for Bitcoin.

Wiener AI Presale Surpasses $7.3 Million – A Unique Meme Coin Gem Amidst Market Volatility

As the crypto market continues to navigate the ebb and flow of Bitcoin’s price movements, a unique meme coin project has emerged as a beacon of investor interest.

Wiener AI, a project that blends the whimsical elements of a dog, sausage, and AI-powered trading, has raised over $7.3 million in its ongoing presale, showcasing the community’s enthusiasm for its innovative approach.

Amid final Bitcoin sale by German Government, Wiener AI has managed to captivate investors with its impressive staking activity. The community has staked an astounding 64% of the total $WAI supply, generating substantial rewards for participants.

The project offers a range of features, including AI-enhanced trading, seamless sausage swaps, zero fees, and MEV sandwich bot protection, catering to the evolving needs of crypto enthusiasts.

The booming investor’s interest has also gotten them over 15K followers on X (formerly Twitter) and over 12,000 community members on Telegram.

The token is currently priced at $0.00073, and a price increase is scheduled to happen in a few days. The best time to buy is now.

Join the Community

Keep in touch with the project’s developments by joining its community on X and Telegram.

Don’t let the latest Doggie AI meme coin on the block get away – you could be missing out on a potential 100x ROI.

Contributors can join the WienerAI presale by connecting their crypto wallets and purchasing with ETH, USDT, or BNB.

Buy WAI Here

The post Bitcoin Price Prediction: German Government’s Final BTC Sale – Sell-Off Over? appeared first on Cryptonews.