Preliminary jobless claims are due on January 2nd, however stagflation considerations are the true elephant within the room for Bitcoin worth projections working into 2025.

In keeping with a Kobeissi Letter written in an X thread on December twenty ninth, “Buyers are anxious that we are going to see a repeat of the Nineteen Seventies inflation state of affairs. The Fed is slicing charges because of a weaker labor market whereas inflation rebounds.”

Whereas the Federal Reserve has one month to go till its subsequent assembly on rates of interest, markets proceed to cost out the probability of additional fee cuts subsequent 12 months.

The start of stagflation is right here and the Fed has but to acknowledge it. We might see 4%+ inflation subsequent 12 months.

What Does ‘Stagflation’ Imply for Bitcoin?

This potential stagflation state of affairs, marked by excessive inflation and stagnant financial development, might considerably influence Bitcoin’s efficiency.

Traditionally, Bitcoin has been seen as a hedge towards inflation, however its correlation with conventional markets and sensitivity to macroeconomic circumstances might introduce volatility.

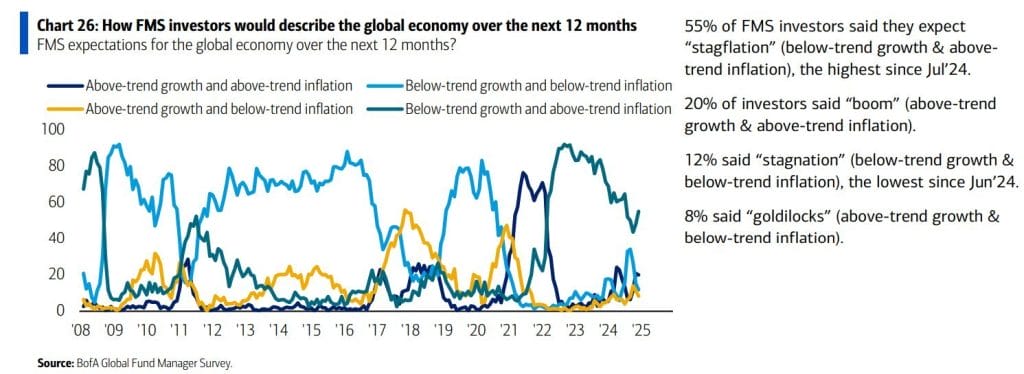

Whereas navigating a possible U.S. recession was the macroeconomic speaking level driving worth motion in 2024, Kobeissi mentioned it expects stagflation to turn into “the theme of 2025.”

“In truth, 55% of excessive internet price buyers anticipate stagflation in 2025,” it concluded, referencing information from a survey by Financial institution of America (BoA).

Bitcoin Faces Crucial Bull Market Part

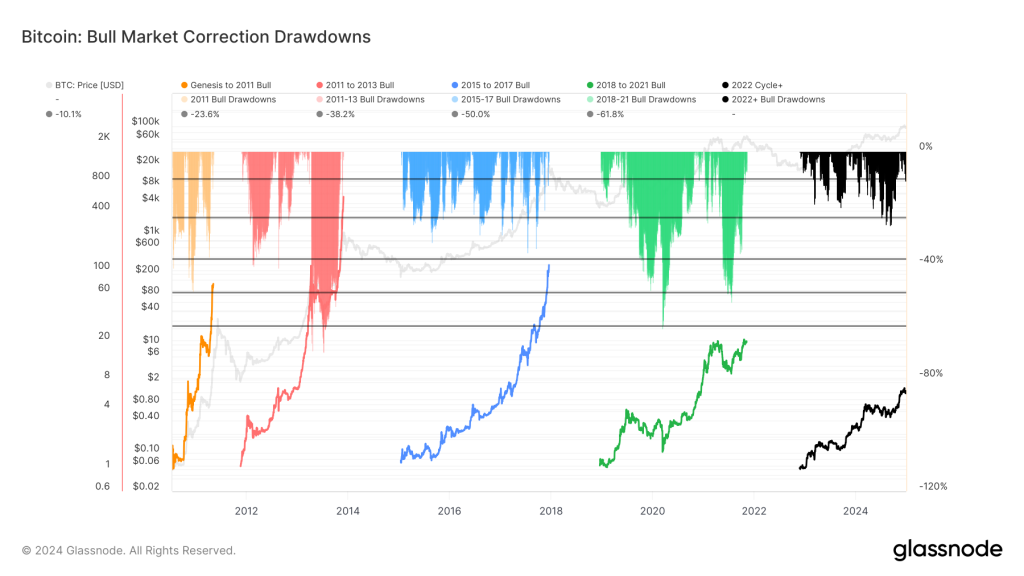

This all stands to outline a important part in Bitcoin’s bull market, with the late-month 15% correction over the previous week but to discover a decisive ground.

This drawdown is decidedly on the decrease finish of historic habits when evaluating bull market drawdowns to earlier cycles, in keeping with Glassnode information.

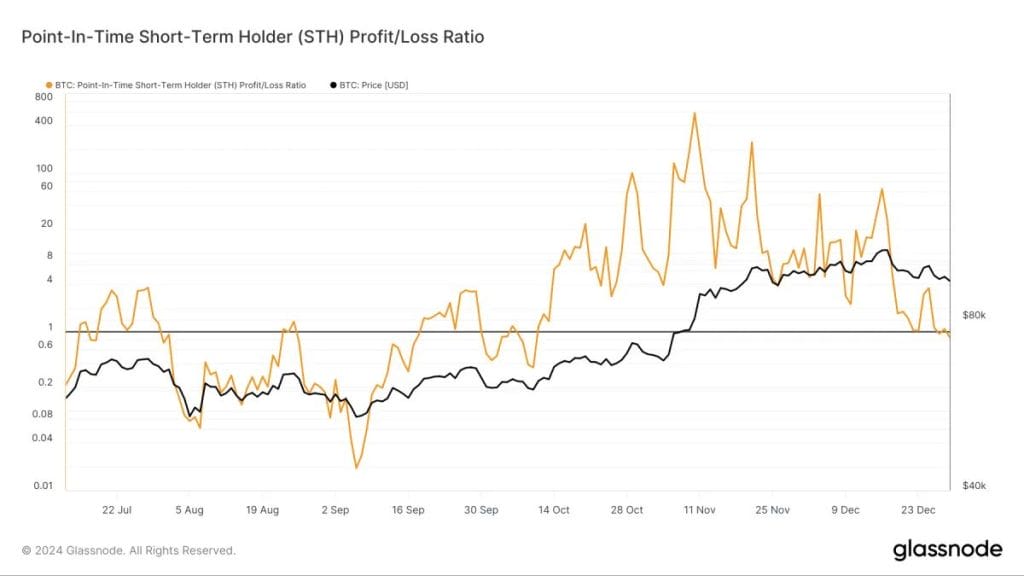

Whereas this might allude to a backside a lot deeper, Glassnode pointed to short-term holders (STHs) to establish when the market might bounce.

Bitcoin’s Market Worth to Realized Worth (MVRV) metric, evaluating STH provide in revenue to that in loss, suggests potential vendor exhaustion because it nears a break-even level.

Glassnode notes MVRV as a dependable indicator of “native bottoms in bull markets and native tops in bear markets.” The final time that Level-In-Time Brief-Time period Holder (STH) Revenue/Loss Ratio noticed ranges beneath 1 was in early October when BTC/USD traded at $60,000.

This bullish sentiment is echoed by a current Maxiport report, citing Bitcoin to have “matured” this cycle, with adoption leaving it higher leveraged towards volatility.

Market dynamics are shifting. Not like previous cycles characterised by sharp 80% drawdowns, Bitcoin’s rising base of dip consumers and institutional assist reduces the probability of extreme corrections.

With these indicators in thoughts, Bitcoin’s resilience amid present macroeconomic uncertainties highlights its potential to navigate via this important part.

The publish Analysts Title Stagflation ‘The Theme of 2025’ as Bitcoin Faces Crucial Zone appeared first on Cryptonews.