Chainlink has announced a collaboration with FTSE Russell to bring the index provider’s benchmarks on-chain via DataLink, Chainlink’s institutional-grade data publishing service.

We’re excited to announce that @FTSERussell, a leading global index provider with $18T+ in AUM benchmarked, is collaborating with Chainlink to publish its world-leading global indices onchain for the first time via DataLink.https://t.co/hCSHCvweNy

With this integration, the… pic.twitter.com/MIIhP6kTrl— Chainlink (@chainlink) November 3, 2025

In a press release shared with CryptoNews, the firm explains that this move marks the first time FTSE Russell’s data—including the Russell 1000, Russell 2000, Russell 3000, and FTSE 100 indexes, alongside WMR FX benchmarks and FTSE Digital Asset Indices—will be available directly on blockchain networks.

With over $18 trillion in assets under management benchmarked against its indices, FTSE Russell’s entry into the blockchain space represents a major step in bridging traditional finance and decentralized ecosystems.

The data will now be accessible across more than 50 public and private blockchains to 2,000+ Chainlink ecosystem applications, opening the door to new tokenized financial products.

Accelerating Institutional Adoption of Tokenized Assets

FTSE Russell’s decision to publish its index data on-chain reflects the growing demand among financial institutions for trusted, regulated data sources in digital markets. By using Chainlink’s oracle infrastructure, institutions and developers can build tokenized assets, ETFs, and next-generation financial products.

“We’re excited to bring our index data on-chain using Chainlink’s institutional-grade infrastructure,” said Fiona Bassett, CEO at FTSE Russell, an LSEG business.

“This marks a major step in enabling innovation around tokenized assets and next-generation financial products. DataLink allows FTSE Russell to securely distribute trusted benchmarks across global on-chain markets,” adds Bassett.

DataLink: A Bridge Between Traditional and Decentralized Markets

Chainlink’s DataLink serves as a turnkey solution, allowing data providers to publish information directly onto blockchains without building or maintaining new infrastructure.

It uses Chainlink’s oracle technology, which has allowed over $25 trillion in transaction value and actively secures nearly $100 billion in DeFi total value locked (TVL).

The service ensures that data from established providers like FTSE Russell is authenticated, tamper-proof, and accessible 24/7, allowing DeFi protocols to reference the same high-quality data that powers traditional financial systems.

A Defining Moment for On-chain Finance

Chainlink co-founder Sergey Nazarov described the collaboration as a “landmark moment” for both industries. “FTSE Russell bringing its trusted benchmarks to blockchains via Chainlink is a critical step toward enabling the next generation of data-driven financial products and tokenized assets,” Nazarov said.

With this integration, blockchain developers and financial institutions can verify, reference, and build with FTSE Russell’s data across multiple blockchains, setting the stage for broader adoption of regulated, data-backed financial instruments in decentralized markets.

U.S. Commerce Dept Partners with Chainlink to Bring Data On-chain

In August, the United States Department of Commerce (DOC) said it has teamed up with Chainlink to bring macroeconomic data from the Bureau of Economic Analysis (BEA) on-chain.

Chainlink shared that through its oracle infrastructure, key indicators such as Real Gross Domestic Product (GDP), the Personal Consumption Expenditures (PCE) Price Index, and Real Final Sales to Private Domestic Purchasers are now available across ten blockchain systems.

This move also marked the first time U.S. government economic data has been published on-chain in a verifiable way. According to the firm, developers can immediately integrate the Chainlink Data Feeds into decentralized applications (dApps), unlocking use cases such as automated trading strategies, composable tokenized assets, prediction markets, and risk management tools for DeFi protocols.

Chainlink Price Action

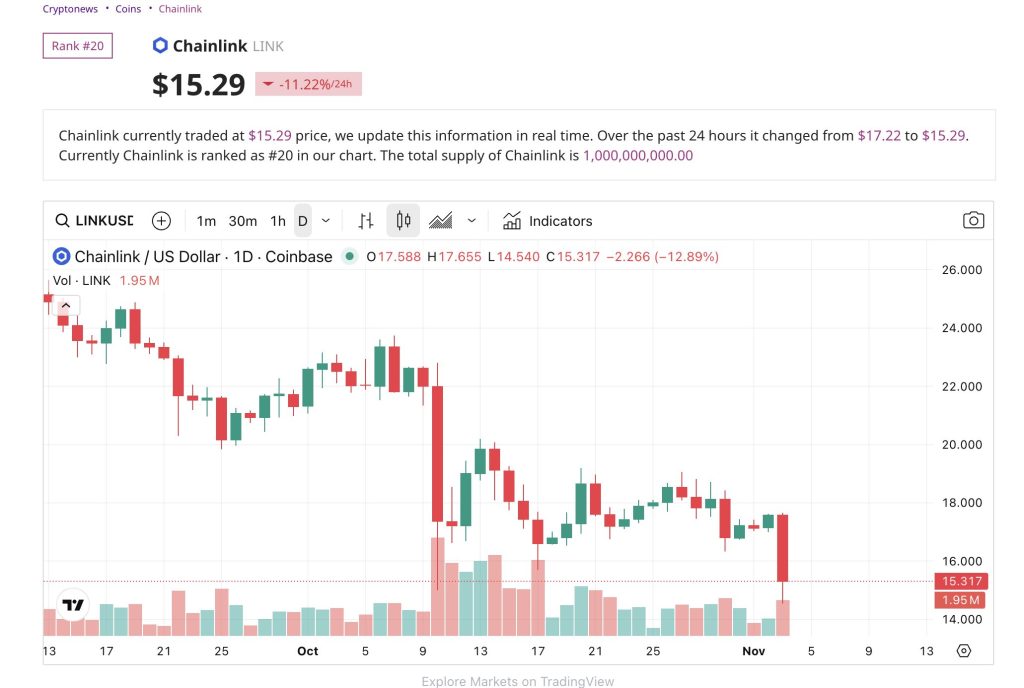

Chainlink’s native token, LINK, fell sharply over the past 24 hours, sliding 11.22% to $15.29 at the time of writing, according to data from CryptoNews.

The LINK/USD pair, trading on Coinbase, recorded a daily high of $17.65 and a low of $14.54, closing at $15.31—a drop of nearly 13% on the day. Trading volume surged to 1.95 million LINK, indicating strong sell-side activity. Chainlink currently ranks #20 by market capitalization, with a total supply of 1 billion tokens.

The post FTSE Russell Brings Its Indices Onchain Through Chainlink’s DataLink – Turning Point for Institutional Finance? appeared first on Cryptonews.