Bitcoin halvings are a significant event in the world of cryptocurrencies. A halving occurs approximately every four years and has a direct impact on the issuance rate of new Bitcoins. Here’s how it works:

- The halving mechanism: Bitcoin’s block reward halves every 210,000 blocks (roughly every four years). Initially, miners received 50 Bitcoins per block, but after the first halving, this reward decreased to 25 Bitcoins. The halving in May 2020 further reduced the reward to 6.25 Bitcoins per block. During the last halving on April 19, the reward dropped to 3.125 Bitcoins per block. The total amount of Bitcoins is limited to 21 million coins, after which no more new tokens will be issued.

- Why halving matters: Halving events are crucial because they directly impact the supply of new Bitcoins. By reducing the issuance rate, halvings contribute to Bitcoin’s scarcity, making it a deflationary asset. This scarcity is one of the factors that contribute to Bitcoin’s value.

- Pre-halving nervousness: Prior to the May 2020 halving, Bitcoin experienced a significant price decline in the month leading up to the event. This trend has been observed in several halving events (with the exception of the recent 2024 halving). However, the market tends to react with optimism, anticipating the positive effects of reduced coin issuance.

In the night between April 19 and April 20, the 840,000th block was added to the Bitcoin blockchain, marking the occurrence of the fourth Bitcoin halving. During the halving, the Bitcoin price temporarily reacted with a small decrease, dropping to $63,564 on April 20. At the time of writing, the price is up slightly to $66,301.

Bitcoin Hits Record High Before 2024 Halving

Before the 2024 Bitcoin halving, Bitcoin (BTC) experienced a rally. Since the beginning of the year alone, Bitcoin’s price surged by 52%, and over the past twelve months, it recorded an impressive 134% increase. The cryptocurrency reached a preliminary peak of its rally on March 13, 2024, setting a new record high at $73,605.

However, as Easter weekend approached, buying interest waned slightly. On April 1, the most valuable cryptocurrency was trading at around $69,500. Later in the week, the cryptocurrency rebounded and reached $72,572 on April 8, marking the highest level since mid-March.

On April 14, Bitcoin plummeted below $62,000 because the crypto markets reacted sharply to major geopolitical shifts. Within just 30 minutes of the official confirmation of the Iran attacks on Israel, Bitcoin lost over 10% of its value. This decline also meant that Bitcoin had shed more than 20% from its recent all-time high.

Ethereum (ETH), the second largest cryptocurrency, also fell by around 10%, dropping below the key $3,000 mark.

Over this weekend, not only cryptocurrencies but also stock markets reacted nervously to Iran’s attacks on Israel.

As stock and bond markets are closed on weekends, it was obvious that investors would sell cryptocurrencies if new geopolitical tensions arose over the weekend, said Jeroen Blokland, founder of the Blokland Smart Multi-Asset Fund, on X.

“Bitcoin remains the most volatile asset in the planet.”

Understandably, people argue about the hedging characteristics of #Bitcoin, which remains the most volatile asset on the planet. Also true, with markets closed on weekends, including Bitcoin ETFs, what else is there to sell when geopolitical tensions spike? https://t.co/zDqQR24NGz

— jeroen blokland (@jsblokland) April 13, 2024

The strong price reaction in the crypto markets also has to do with the fact that many crypto investors are leveraged, a hedge fund manager explained. This means that when times are good, they make particularly large gains, but when things go down, the losses are particularly pronounced.

During the next week, the price of Bitcoin recovered a bit, and on April 19, the cryptocurrency’s valuation reached $66.351 per Bitcoin.

24h7d30d1yAll time

Bitcoin’s Rise in Adoption

Bitcoin has seen a significant increase in adoption and recognition this year. The US Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs for the first time earlier this year, making it much easier for numerous traders to invest in the cryptocurrency.

This development also contributed to the positive performance of the BTC price before the halving. Spot Bitcoin ETFs experienced a substantial surge in trading volume during March, reaching an impressive $111 billion. This represented a notable increase, nearly three times the trading volume reported in February ($42.2 billion).

MARCH MADNESS: Bitcoin ETFs traded $111b in March, which is just about triple what they did in Feb and Jan. I added the months where only GBTC was on market for further context. I can't imagine April will be bigger but who knows.. pic.twitter.com/AJEE0mPmpW

— Eric Balchunas (@EricBalchunas) April 2, 2024

Impact of the 2024 Halving on Bitcoin Price

It is expected that the halving will have a long-term positive effect on the Bitcoin price. Historically, the halving event has usually been followed by an upward movement in the price of the cryptocurrency. A look at Bitcoin’s price history on the day of the reward halving and 365 days later confirms this trend.

During the first halving in 2012, the BTC price was $12. A year later, it had surpassed the $1,000 mark. During the 2016 halving, the Bitcoin price was $648, and 365 days later, it had climbed to around $2,500. In 2020, during the third halving, the Bitcoin price was by $8,572. A year later, one coin was worth nearly $56,000. How high Bitcoin could go after this year’s halving remains uncertain for now.

4th halving 2024-04-20 00:09 UTC 63,976.64 pic.twitter.com/VJCFHWXPHu

— ChartsBTC (@ChartsBtc) April 20, 2024

Mining Landscape Impact

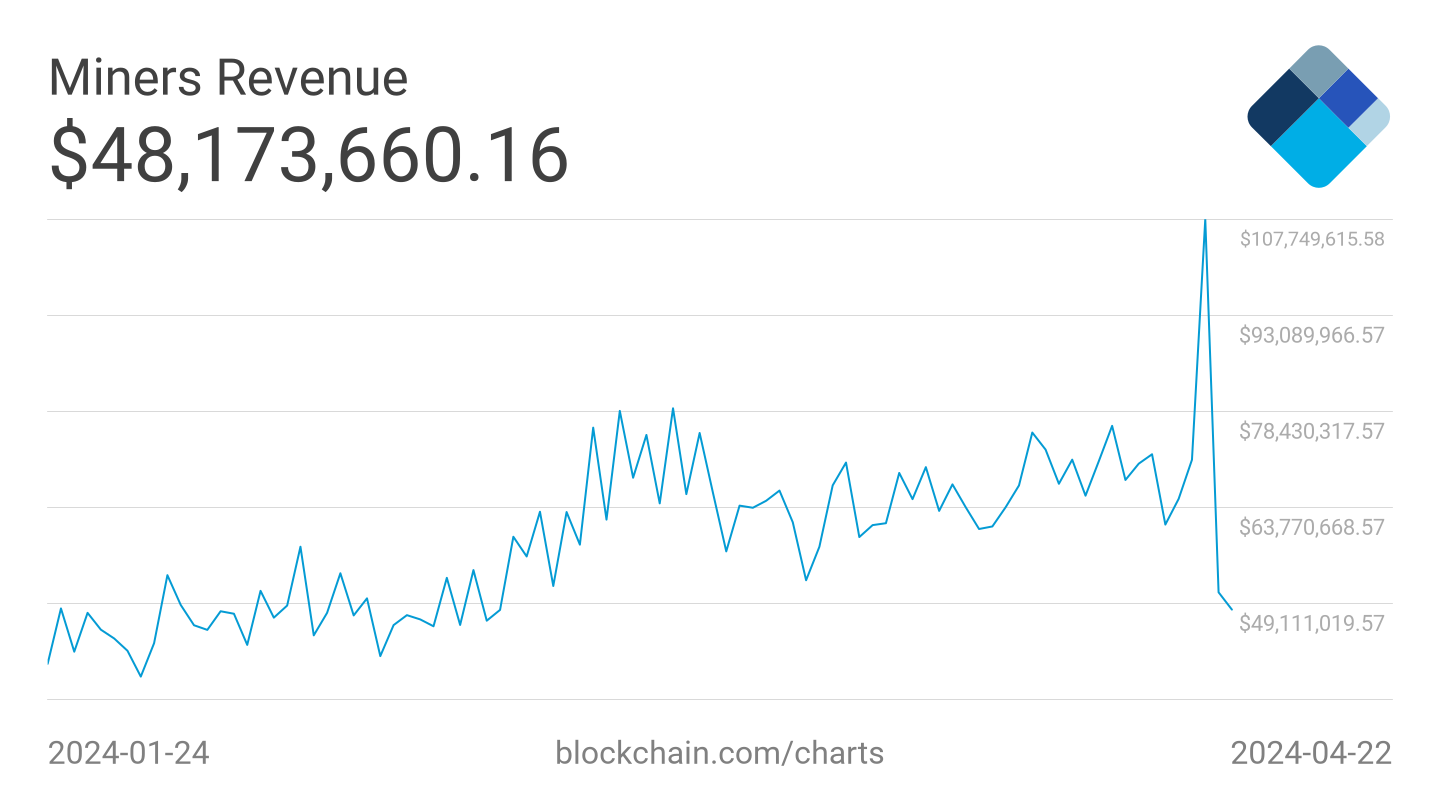

Revenue earned from Bitcoin mining exceeded the $100 million mark for the first time, recording an all-time high daily earnings on Bitcoin halving day, 2024.

On April 20, Bitcoin miners earned a total of $107.7 million in mining rewards and transaction fees as community members willingly paid exorbitant fees to get their transactions recorded on the 840,000th Bitcoin block.

Generally, the 2024 Bitcoin halving is expected to have significant effects on miners, the network, and the overall market, primarily due to the power costs associated with energy-intensive mining equipment. Miners will need to adapt to these changing conditions, and investors should closely monitor developments during this critical period.

Running mining rigs consumes a substantial amount of energy, which constitutes the largest expense for miners. On average, power costs account for 75-85% of a miner’s total cash operating expenses. Currently, the average power cost in the listed universe is around $0.04 per kilowatt-hour (kWh).

After the halving, the reward per block decreased from 6.25 BTC to 3.125 BTC. Global investment manager VanEck estimates in its report that the all-in cash costs for the top 10 listed miners will be approximately $45,000 per Bitcoin. While larger miners with lower per-coin costs may see their profit margins shrink, they should remain profitable, especially if Bitcoin’s price increases.

The halving often leads to industry consolidation, with smaller miners struggling while larger players expand their market share. Publicly traded miners already control a significant percentage of the hash rate, according to VanEck’s report.

Next Halving Expected in 2028

The next reward halving is expected to take place in 2028. During this halving, the block reward goes from 3.125 to 1.5625 BTC. The reward reduction intends to ensure that the maximum amount of 21 million Bitcoins is not reached too quickly.

Additionally, the halving is intended to prevent price inflation, as the supply of available coins increases more slowly while demand remains the same or even increases. The inflation rate of Bitcoin after the latest halving is estimated to be around 0.84%. Currently, it is assumed that the last Bitcoin will be mined in 2140. However, there are still 25 more halvings to come until then.

Bitcoin Price Predictions

Various crypto experts have already predicted how Bitcoin could develop after the halving event. Youwei Yang, Chief Economist of Bitcoin mining company BIT Mining, believes Bitcoin could reach $75,000 over the course of the year, as reported by CNBC.

Meanwhile, the cryptocurrency exchange CoinShares considers an increase to $80,000 possible.

Antoni Trenchev, co-founder of the cryptocurrency exchange Nexo, even sees Bitcoin reaching the $100,000 mark, a sentiment shared by Standard Chartered.

Jurrien Timmer, the Director of Global Macro at Fidelity Investments, thinks the value of a single Bitcoin could reach $1 billion by the year 2038-2040.

But that’s not all the bullish predictions: The analysis company Matrixport believes that the Bitcoin price could climb to $125,000 by the end of the year.

Venture capitalist Tim Draper sees potential for $250,000. Seth Ginns of CoinFund is perhaps the most optimistic. He has the “reasonable expectation” that the cryptocurrency could reach a price between $250,000 and $500,000 in 2024.

However, he also believes that a price of one million US dollars per coin is conceivable in “this next cycle.”In conclusion, the Bitcoin halving event has historically had a positive impact on the price of Bitcoin, and many experts believe that this trend will continue in the future, with the price potentially reaching new all-time highs.

However, it’s also essential to consider a broader context, including adoption, regulation, macroeconomic conditions and technological advancements, when predicting Bitcoin’s future price movements.

A Comprehensive Bitcoin Price Prediction: Bitcoin Price Prediction 2024 – 2034

The post Is Bitcoin Halving 2024 a Game-Changer for Investors? Find Out What Experts Predict appeared first on Cryptonews.

![[LIVE] Crypto News Today: Latest Updates for July 9, 2025 – Nasdaq-Listed GameSquare Announces $100M ETH Treasury Strategy](https://cryptomediaclub.com/wp-content/uploads/2025/07/1752029888-daily-news-350x250.jpg)

![[LIVE] Crypto News Today: Latest Updates for July 9, 2025 – Nasdaq-Listed GameSquare Announces $100M ETH Treasury Strategy](https://cryptomediaclub.com/wp-content/uploads/2025/07/1752029888-daily-news-360x180.jpg)