U.S.-listed spot Bitcoin and Ethereum exchange-traded funds saw over $1 billion in outflow in a single trading day on January 21, as investors moved out of the two largest cryptocurrencies during a broader market downturn.

Meanwhile, smaller altcoin-linked products linked to Solana and XRP experienced net inflows, which points to an apparent institutional positioning difference during the most recent volatility.

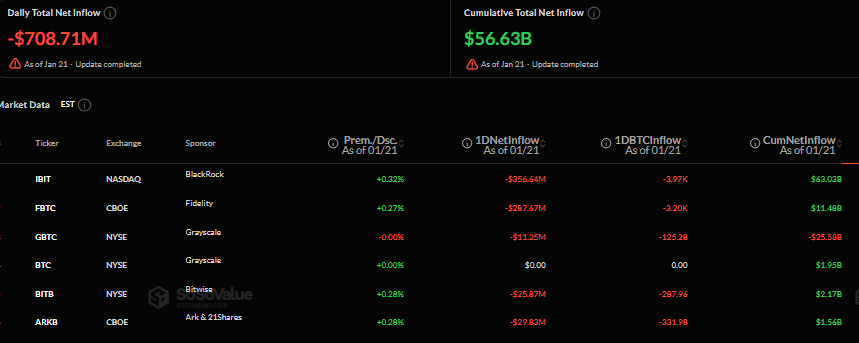

According to SoSoValue, on January 21(ET), Bitcoin spot ETFs saw a total net outflow of $709 million yesterday, marking three consecutive days of net outflows, while Ethereum spot ETFs recorded a total net outflow of $298 million. Meanwhile, Solana spot ETFs saw a total net… pic.twitter.com/rQZrHfM8LK

— Wu Blockchain (@WuBlockchain) January 22, 2026

Bitcoin and Ethereum ETFs recorded more than $1 billion in withdrawals, despite both asset classes recording positive cumulative inflows since inception.

Bitcoin ETFs Post November-High Redemptions During Global Market Rally

Bloomberg reported that outflows from Bitcoin ETFs were the biggest one-day redemption since November, and came at a time when the conventional risk assets reversed against calmer geopolitical tensions.

The remarks by U.S. President Donald Trump at Davos, where he dismissed military action over Greenland and indicated a halt to tariffs imposed on Europe, contributed to the boost in equities in the U.S., Europe, and Asia.

The iShares Bitcoin Trust at BlackRock recorded the highest outflow of $356.64 million, with Fidelity’s FBTC in second place at $287.67 million. Grayscale’s GBTC still experienced smaller yet steady redemptions and has had a total cumulative net outflow of over $25 billion since conversion.

The HODL was the only big Bitcoin ETF that recorded a net inflow, which was $6.35 million.

Bitcoin ETFs have already registered weekly net outflows of $1.19 billion, while January remains slightly positive overall, with net inflows of $17.56 million.

At the time of writing, Bitcoin was trading at approximately $89,100, a loss of almost 7% over the past week, and the trading volume was decreasing, indicating a low level of activity in the short term.

Selling Pressure Hits Ethereum ETFs, Led by BlackRock’s ETHA

Ethereum ETFs mirrored the pressure seen in Bitcoin. On January 21, spot Ether ETFs posted net outflows of $297.51 million, following another heavy outflow the previous day.

BlackRock’s ETHA accounted for the bulk of the redemptions, shedding more than $250 million, while Fidelity’s FETH and Grayscale’s ETHE also saw net withdrawals. Grayscale’s lower-fee ETH mini trust was a notable exception, recording a modest inflow.

Despite the outflows, Ethereum ETFs still managed close to $18.3 billion in assets, roughly 5% of Ethereum’s market capitalization.

Ethereum itself briefly reclaimed the $3,000 level before slipping back, trading near $2,900, and was down nearly 13% over the past week.

Capital Shifts to Solana and XRP ETFs Amid Broader ETF Selloff

In contrast to the sell-off in Bitcoin and Ethereum products, Solana and XRP spot ETFs attracted fresh capital. Solana ETFs recorded net inflows of $2.92 million on January 21, lifting cumulative inflows to nearly $870 million.

Assets under management rose to about $1.10 billion, supported by steady interest in products from Fidelity, VanEck, and Grayscale, even as SOL’s price fell more than 11% on the week.

XRP ETFs also rebounded, posting $7.16 million in net inflows after starting the week with outflows. Cumulative inflows since launch now stand at $1.23 billion, with total assets around $1.39 billion.

Funds from Bitwise, Franklin Templeton, and Canary Capital led the day’s inflows, despite XRP trading lower alongside the broader market.

Market watchers said the divergence reflected positioning, not fundamentals, with Bitcoin and Ethereum ETFs reacting to macro-driven rebalancing, while smaller Solana and XRP funds drew selective inflows after earlier declines.

The post Bitcoin & Ethereum ETFs Shed Over $1B – But Solana and XRP See Inflows appeared first on Cryptonews.