Key Takeaways:

- The US Senate has passed a stablecoin legislation called the GENIUS Act.

- The legislation paves the way for regulated stablecoins in the U.S., one of the many crypto promises from President Trump on the campaign trail.

- WisdomTree digital assets chief Maredith Hannon says the Act will foster innovation and improve the U.S. financial services sectors.

WisdomTree digital assets chief Maredith Hannon says the GENIUS Act, a new stablecoin legislation in the U.S., will foster innovation and improve the crypto and financial services industries in a huge way.

Hannon, head of business development for digital assets at Wisdom Tree, spoke as the United States Senate passed the Guaranteeing Essential National Infrastructure Using Stablecoins (GENIUS) Act on Tuesday.

The bill passed with bipartisan support in a 68-30 vote, paving the way for regulated stablecoins in the U.S. It’s the first major stablecoin legislation to pass a chamber of Congress, as Trump’s crypto election promise appears to take shape.

The Genius Act now heads to the House of Representatives, which is also working on another stablecoin bill, for a final vote before President Trump signs it into law. Both the Senate and House bills will be reconciled into one.

Senator Bill Hagerty, who co-sponsored the Act, said on X that the law will “cement US dollar dominance, protect customers, drive demand for US Treasuries, & ensure that digital asset innovation happens in the U.S., not overseas.”

Today, on a bipartisan basis, the Senate passed its first piece of major legislation this Congress with my bill — the GENIUS Act.

With GENIUS, the United States is one step closer to becoming the crypto capital of the world. (1/7)— Senator Bill Hagerty (@SenatorHagerty) June 17, 2025

A stablecoin is a type of cryptocurrency that is pegged to a stable reserve asset like the U.S. dollar. As the name implies, stablecoins are designed to maintain a stable, consistent value, unlike Bitcoin (BTC), which is volatile.

This stability makes stablecoins ideal for payments and remittances and as a settlement layer for DeFi protocols. About $230 billion worth of stablecoins are currently in circulation, led by Circle’s USDC and Tether’s USDT.

Why Stablecoins Matter Now

Yet, the regulatory environment around stablecoins has remained somewhat murky, fragmented, and, in some cases, even hostile. The spectacular collapse of LUNA’s $40 billion algorithmic stablecoin UST in May 2021 only helped to spook regulators. The lack of standards raised fears over reserve backing, systemic risks, and transparency.

In an interview with Cryptonews, Maredith Hannon, the WisdomTree business development head for digital assets, said regulation “is important for fostering innovation and advancing our industry,” lauding Trump’s approach.

“We believe it’s critical that clear, enforceable standards are put in place to ensure the safety, transparency, and integrity of this emerging industry. We strongly support requirements that stablecoin issuers hold reserves in high-quality, highly liquid assets.”

WisdomTree was among the earliest recipients of a New York Trust license, which allowed the $119 billion asset manager to issue stablecoins and custody crypto assets. It has so far issued physically-backed stablecoins, gold tokens, and other assets that can be traded on regulated platforms.

The company operates a tokenized money market fund dubbed WTGXX, a so-called Rule 2a-7 U.S. government money market fund that “invests exclusively in high-quality government securities,” like U.S. Treasury Bills.

The assets are selected “to meet stringent liquidity and diversification requirements” — standards that Hannon believes are a blueprint for how innovation in crypto and regulation could co-exist. She said:

“We view this as a prime example of the type and quality of reserves that stablecoin issuers should be held to when safeguarding user funds.”

WTGXX is an Ethereum-based token. The U.S. Senate’s approval of the GENIUS Act is a culmination of spirited lobbying and engagement from different figures in the cryptocurrency ecosystem.

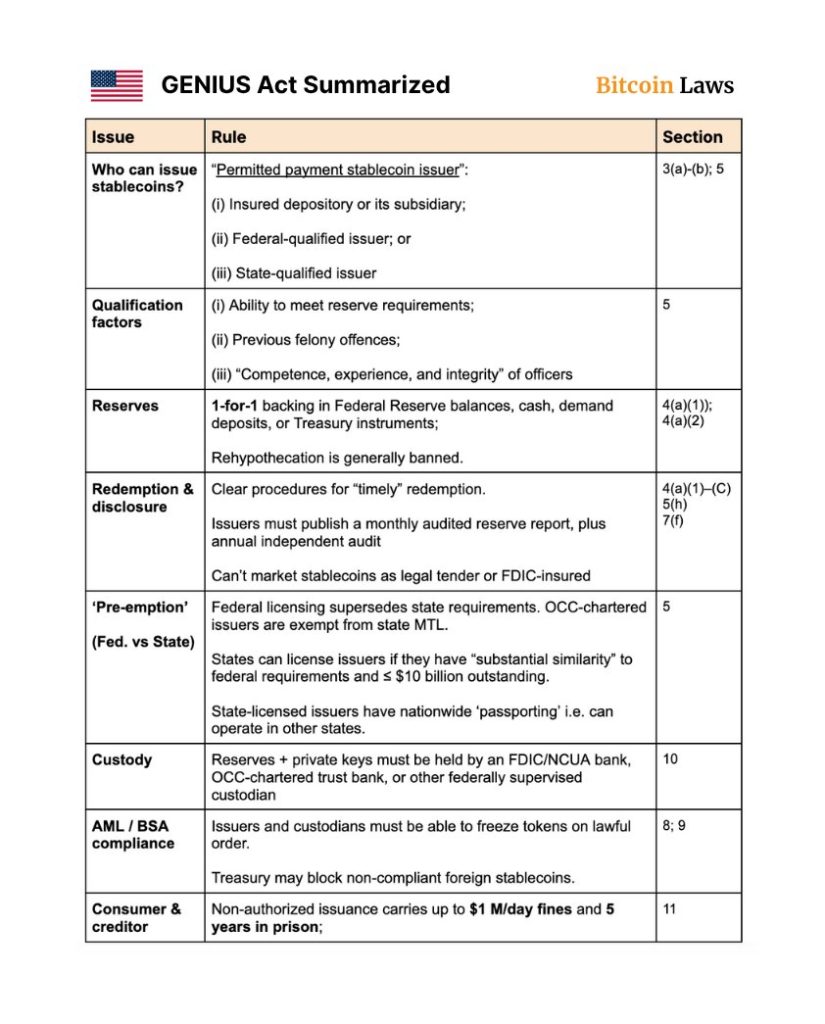

As crypto lobby group Bitcoin Laws noted, the GENIUS Act provides a clear framework for U.S. stablecoin issuers (see image below) while it also bars non-compliant foreign issuers.

Among other things, stablecoin issuers will be required to submit regular audits and undergo regulatory supervision, maintain full backing by high-quality, highly liquid assets, and disclose real-time data on reserves.

Tokenization: The Bigger Picture

Hannon, who attended the White House Digital Assets Summit in March, described the meeting as pivotal because it promised a transition from discussion to policy, validated by the passing of the stablecoin law.

But stablecoins are only the beginning. Hannon says the tokenization of real world assets brings in new use cases that go beyond the limits of traditional finance (TradFi), including instant settlements and cross-border payments.

“Beyond solely crypto as an asset class, tokenization is creating a user experience with the new utility of traditional assets that doesn’t exist in traditional finance today,” she explained by email, adding:

“Stablecoins are the first example of mainstream adoption and we are encouraged by the progress being made towards stablecoin legislation and regulatory clarity.”

While the final implementation of the GENIUS Act remains unclear, “the strongest signal is the bipartisan effort that materialized in legislation,” according to Jesse Shrader, cofounder and CEO of AI-driven stablecoins firm Amboss.

“The Act may be the stamp needed for broader adoption of efficient payment tech by the most conservative financial institutions,” Shrader, whose company runs on Bitcoin’s Lightning Network, told Cryptonews.

“As effects, we should expect to see a greater push for the integration of stablecoins in banks and fintechs as well as increases in transaction volumes that follow,” he added.

Data from CryptoQuant shows that total stablecoin market capitalization reached a record high of nearly $230 billion in June, up 17% or $33 billion since the beginning of this year.

The increase is thanks to higher crypto trading activity, rising use of stablecoins for payments and transfers, and improved regulatory clarity in the U.S. since the start of the Trump administration, the firm said.

Circle’s USDC and Tether’s USDT account for the lion’s share of the total stablecoin market cap. USDC’s market cap has soared 39% to $61 billion year-to-date, while USDT stands at $155 billion, up 13% since January.

WisdomTree’s Hannon said while the firm awaits to see if the stablecoin bill will be passed into law without any alterations, the prospect of peer-to-peer treasury management running outside of allotted hours is exciting.

Is the Stablecoin Law for the People or Just a Few?

The Trump administration’s positive outlook towards crypto barely comes as a surprise. His campaign received around $270 million from tech bros, dominated by those in crypto. He also runs his own meme coin, TRUMP.

However, the connection between President Trump and the crypto ecosystem has prompted red flags from critics, including Massachusetts Senator Elizabeth Warren, who said the GENIUS Act is flawed.

“Through his crypto business, Trump has created an efficient means to trade presidential favors like tariff exemptions, pardons, and government appointments for hundreds of millions, perhaps billions of dollars from foreign governments, from billionaires, and large corporations,” Warren recently told the U.S. Senate.

The criticism of the impending legislation is not limited to politicians. Academics have raised questions, too. In an opinion after a perusal of the bill, Professor Arthur Wilmarth at the George Washington University says the strong are likely to get stronger.

According to Wilmarth, there is a chance of an already strong economic player purchasing a stablecoin concern, in a way that flies in the face of competition laws, in the same way that Alibaba now owns Alipay in China.

For Hannon, however, the GENIUS Act is building trust where skepticism once reigned.

“Ultimately, a well-regulated stablecoin environment will support innovation while protecting consumers and systemic stability,” she said.

The post As Stablecoin Bill Passes, Trump’s Crypto Election Promise Takes Shape appeared first on Cryptonews.