Bitcoin Cash (BCH) fell 7.8% this week as $BCH crashed through $485, just as futures open interest pumped 24%, exposing a dangerous gap between speculative bets and a six-year low in network activity.

The altcoin’s 20% rally in June now appears to be built on quicksand. While derivatives traders piled in, daily active addresses cratered to 2018 levels. With RSI flashing bearish divergences, BCH must hold $400 support to avoid surrendering all recent gains.

Can $BCH Sustain Its Speculative Rally Into a Real Bull Run?

Launched in August 2017 as a Bitcoin fork, Bitcoin Cash ($BCH) was designed to facilitate faster and cheaper transactions by increasing the block size limit from 1 MB to 8 MB.

BCH is a peer to peer electronic cash system.

BTC is not. pic.twitter.com/0L3xtKN1sX— Roger Ver (@rogerkver) September 16, 2018

The network, secured by a proof-of-work consensus mechanism, currently has approximately 19.8 million $BCH in circulation, with a maximum supply capped at 21 million $BCH.

A major upgrade on May 15, 2025, introduced targeted virtual-machine limits, high-precision arithmetic, and an adaptive block-size algorithm to improve scalability and reliability.

While these enhancements are intended to support more complex on-chain applications, adoption remains low—daily active addresses recently hit six-year lows, indicating that recent price movements may be driven more by speculation than utility.

Despite muted on-chain activity, institutional engagement has increased.

$BCH is defying gravity, up 5% in 24h and +20% vs $BTC in 4 weeks, just as the golden cross hits on the BCH/BTC pair.

Volume surged 3x, but here’s the catch: on-chain activity is at a 6-year low.

Speculators are partying, but the fundamentals? Still on vacation.

Bull trap? pic.twitter.com/PXsxog01rz— Joe Swanson (@Joe_Swanson057) July 1, 2025

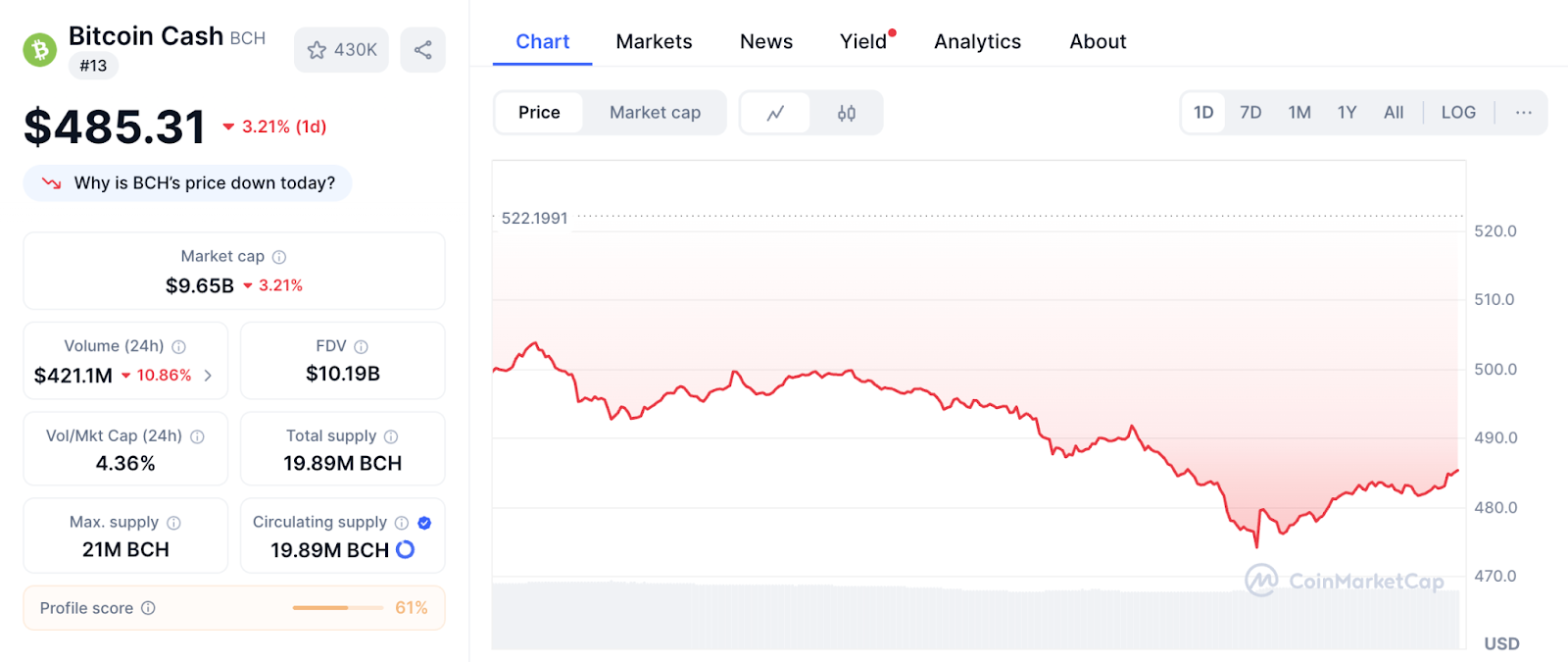

Open interest in $BCH futures rose by over 24% in June, while trading volume more than doubled after $BCH surpassed $500 on June 27. This briefly pushed its market capitalization above $10 billion, ranking it 12th, though it has since slipped to 13th with a $9 billion valuation.

Analysts point to $BCH’s scalability and stability above $400 as key bullish factors but warn that bearish RSI divergences could curb further gains.

$BCH zoooomed out view, dates back to late 2022, weekly tf, the highlight of this chart is notice the wave counts, early stages of a macro 3rd wave, price currently early stage wave 1 of a larger 3rd degree wave…not familiar with elliot wave? Ask GPT or Grok about 3rd waves… pic.twitter.com/JWzHNcxfVR

— Disrupt Yourself (@EasychartsTrade) June 28, 2025

Bitcoin Cash’s DeFi ecosystem shows potential but struggles for traction. Despite $BCH’s low fees and high throughput—advantages that attract niche developers—the chain’s $7.9 million total value locked (TVL) and meager $13,841 daily DEX volume reveal scant real-world usage.

This disconnect grows starker when examining recent price action. While $BCH rocketed 20% in June, on-chain activity hit six-year lows, confirming the rally was fueled by derivatives speculation rather than organic growth.

$BCH is defying gravity, up 5% in 24h and +20% vs $BTC in 4 weeks, just as the golden cross hits on the BCH/BTC pair.

Volume surged 3x, but here’s the catch: on-chain activity is at a 6-year low.

Speculators are partying, but the fundamentals? Still on vacation.

Bull trap? pic.twitter.com/PXsxog01rz— Joe Swanson (@Joe_Swanson057) July 1, 2025

BCH must convert its technical strengths (like May’s scalability upgrades) into merchant adoption and developer incentives for sustainable adoption. The 24% increase in futures open interest suggests that market confidence exists; now, the network needs to deliver corresponding on-chain utility.

For $BCH to sustain long-term growth, it must strengthen merchant adoption and developer incentives. While recent upgrades and rising futures interest provide a foundation, broader adoption will depend on whether the network can translate technical improvements into real-world usage.

BCH/USDT Chart Analysis: From Bullish Breakout to Bearish Retracement and Potential Reversal

The BCH/USDT chart reflects a clear transition through multiple market phases, beginning in late June and continuing into early July.

Initially, the price exhibited a strong uptrend, characterized by a steep breakout and large green candles with substantial volume support. This rapid rally propelled BCH from around $475 to just under $510.

This bullish momentum stalled as the price entered a sideways consolidation phase, forming a range-bound pattern between approximately $500 and $510. During this period, volume declined, and MACD flattened, indicating indecision and weakening buying pressure.

As consolidation broke to the downside, BCH entered a steady downtrend, creating a sequence of lower highs and lower lows. Price declined consistently with minor relief bounces, eventually breaking below the $480 support region. The downtrend was accompanied by increasing red volume bars, suggesting rising selling pressure.

Most recently, the chart shows signs of a bullish bounce, with a sharp reversal from the $472–$474 zone. This was confirmed by a bullish MACD crossover beneath the zero line, indicating that bearish momentum has slowed and buyers are stepping in. The volume also picked up slightly, reinforcing the short-term bullish reversal.

However, for this recovery to be sustainable, BCH needs to reclaim the $488–$490 resistance zone and maintain momentum above the MACD baseline. If rejected, the price risks retesting the $474 support.

The post Bitcoin Cash Futures Jump 24% as Active Addresses Hit Six-Year Low – Risk Ahead? appeared first on Cryptonews.