JPMorgan analysts say the near-term direction of Bitcoin’s price now depends less on miner behavior and more on the financial resilience of Strategy, the world’s largest corporate holder of Bitcoin, even as mining pressure and market volatility persist.

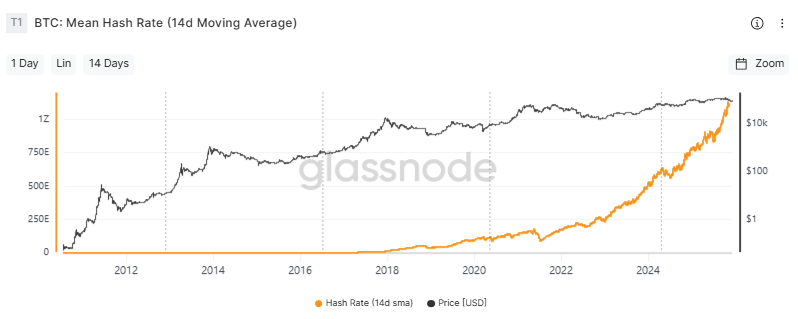

In a report led by managing director Nikolaos Panigirtzoglou, the bank identified two forces currently weighing on Bitcoin. The first is a recent decline in Bitcoin’s network hashrate and mining difficulty.

The second is the growing market focus on Strategy’s balance sheet and its ability to avoid selling its Bitcoin holdings during the ongoing market downturn.

High-Cost Bitcoin Miners Capitulate as Hashrate Slips and Margins Collapse

The decline in hashrate reflects a combination of China reiterating its ban on private mining activity and high-cost miners outside the country retreating as falling Bitcoin prices and elevated electricity costs squeeze profitability.

JPMorgan now estimates Bitcoin’s production cost at $90,000, down from $94,000 last month. The estimate assumes electricity priced at $0.05 per kilowatt hour, with every $0.01 increase adding roughly $18,000 to production costs for higher-cost miners.

With Bitcoin trading near $92,000, JPMorgan said the asset continues to hover close to its estimated production cost, creating sustained selling pressure from miners.

As profits tighten, several high-cost producers have been forced to liquidate Bitcoin holdings in recent weeks to remain solvent.

Despite those pressures, JPMorgan said miners are no longer the key driver of Bitcoin’s next major move. Instead, attention has shifted to Strategy’s ability to maintain its Bitcoin position without being forced into sales.

Strategy’s enterprise-value-to-Bitcoin-holdings ratio currently stands at 1.13. That figure reflects the combined market value of its debt, preferred stock, and equity relative to the market value of its Bitcoin treasury.

According to JPMorgan, the fact that the ratio remains above 1.0 is “encouraging” because it shows that Strategy is unlikely to face pressure to sell Bitcoin to meet interest or dividend obligations.

The company recently reinforced that position by creating a $1.44 billion U.S. dollar reserve through ongoing at-the-market equity sales.

The reserve is designed to cover dividend payments and interest expenses for at least 12 months, with the company targeting coverage of up to 24 months.

JPMorgan said the reserve significantly reduces the risk of forced Bitcoin sales in the foreseeable future.

JPMorgan Sees $170K Bitcoin Scenario Despite Strategy’s MSCI Index Risk

Strategy’s Bitcoin accumulation has slowed sharply in recent months, though it remains deeply exposed to price movements.

In November, it added 8,178 BTC in its largest purchase since July, bringing total holdings to roughly 650,000 BTC. Its basic market capitalization stands near $54 billion, with an enterprise value of about $69 billion.

Markets are also watching an upcoming decision by MSCI on whether to remove Strategy and other digital-asset treasury companies from its equity indices. JPMorgan said the downside risk from exclusion is largely priced in.

Since MSCI launched its review in October, Strategy’s share price has fallen roughly 40%, underperforming Bitcoin by about $18 billion in market value.

JPMorgan estimates that an MSCI exclusion could trigger $2.8 billion in passive outflows, with as much as $8.8 billion at risk if other index providers follow suit.

Even so, the bank said further downside would likely be limited. By contrast, if MSCI keeps Strategy in major indices, JPMorgan said both Strategy and Bitcoin could rebound sharply toward pre-October levels.

Beyond corporate balance sheets, JPMorgan continues to point to broader crypto market structure for longer-term upside. The bank said perpetual futures deleveraging appears largely complete following record liquidations in October.

At the same time, Bitcoin’s volatility ratio relative to gold has improved, strengthening its risk-adjusted appeal to investors.

Based on those metrics, JPMorgan reiterated its volatility-adjusted comparison of Bitcoin to gold, which implies a theoretical Bitcoin price near $170,000 over the next six to twelve months if market conditions stabilize.

Notably, Bitcoin is currently trading about $68,000 below that level.

The post Bitcoin Price Could Hit $170K — But Strategy ‘Resilience’ Is Vital: JPMorgan appeared first on Cryptonews.