Ethereum exchange-traded funds (ETFs) have crossed the $5.5 billion threshold in inflows since their debut, with more than $3.3 billion flowing into these Ether investment vehicles since mid-April alone.

Bloomberg ETF Analyst James Seyffart disclosed in a July 17 X post that these substantial inflows stem primarily from the basis yield on Ethereum, which has climbed back into double-digit territory for the first time since December 2024, alongside increased open interest in CME Ethereum futures contracts.

Part of this is almost certainly from the Basis yield on Ethereum jumping back up and into double digits but its definitely not the whole story pic.twitter.com/rXAAOIGLZH

— James Seyffart (@JSeyff) July 17, 2025

Ethereum’s valuation has responded favorably to this institutional purchasing pressure, reaching a six-month high of $3,481.58 before stabilizing at around $3,427 at the time of publication.

BlackRock’s ETHA Dominates Ethereum ETFs Record Inflows With $489M Single-Day Buy

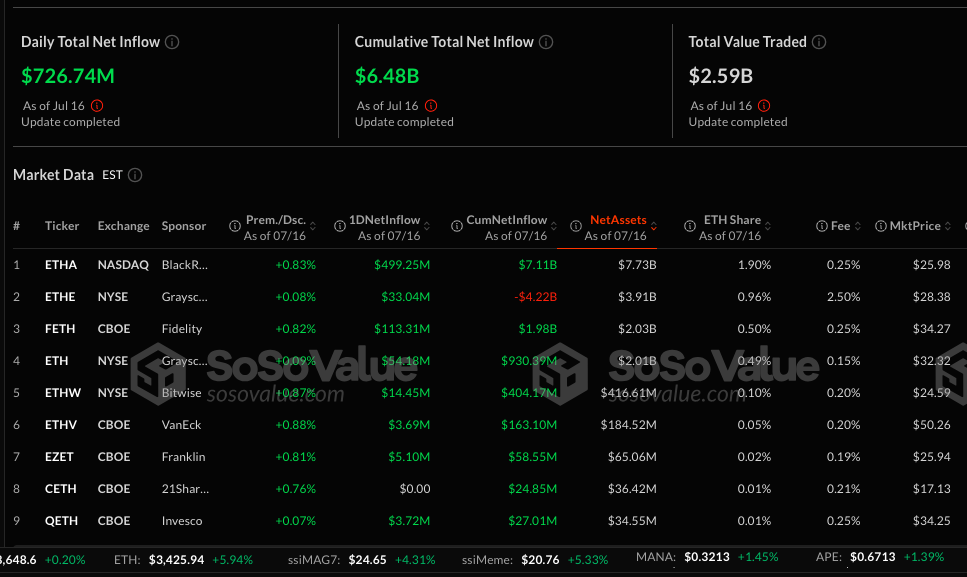

According to SosoValue data, BlackRock’s iShares Ethereum Trust (ETHA) emerged as the primary catalyst, achieving its strongest performance ever with $489 million in inflows on July 17.

BLACKROCK RECORD BUY: HALF A BILLION USD OF ETH

BlackRock just set a new daily record, buying $499.2M ETH in one day yesterday.

BlackRock currently holds $6.94 Billion USD of Ethereum. pic.twitter.com/o1c2mNal6D— Arkham (@arkham) July 17, 2025

Throughout the previous five trading sessions, ETHA alone captured $1.25 billion, accounting for nearly 20% of its total accumulation since its launch. BlackRock’s current Ethereum holdings now total $6.94 billion USD.

The momentum extended beyond BlackRock’s offering. Collectively, all U.S. Ethereum ETFs registered record daily inflows of $726.74 million, surpassing the previous benchmark of $430 million.

Fidelity’s FETH contributed $113.31 million, while Grayscale’s mini trust added $54.18 million, both achieving their strongest performance in months.

Supply-Demand Dynamics: ETFs Control 4.02% of Total Ethereum Market Cap

With ETFs currently managing 5 million ETH (representing 4.02% of Ethereum’s $413 billion market capitalization), demand strongly exceeds available supply.

Ethereum-focused treasuries hold $5.3 billion worth of ETH and are acquiring tokens at a rate 36 times the daily ETH production rate.

Additionally, ETH investment funds have maintained 12 consecutive weeks of positive inflows, including $996 million in the most recent week alone.

SharpLink Gaming, currently the largest corporate Ethereum holder, recently purchased an additional $68.4 million of Ethereum, elevating its total holdings to $1.10 billion worth of ETH.

En-route to our first stop:

1,000,000 $ETH pic.twitter.com/hzlwD4x2Sp— SBET (SharpLink Gaming) (@SharpLinkGaming) July 17, 2025

Meanwhile, Bit Digital liquidated its entire Bitcoin position, redirecting those funds into an Ether allocation.

President Trump-affiliated World Liberty Financial (WLFI) has also recently acquired$4.99 million worth of ETH.

While Ethereum lacks Bitcoin’s scarcity characteristics, potentially diminishing its store-of-value proposition, its staking reward capability makes institutional adoption particularly appealing to certain firms.

New SEC crypto guidance just dropped: certain staking activities aren't securities transactions — but not everyone’s on board. https://t.co/Igzg1Nm7zX

— Cryptonews.com (@cryptonews) May 30, 2025

With the SEC apparently relaxing its stance on staking-as-a-service enforcement, companies are increasingly comfortable incorporating ETH staking into their treasury strategies without regulatory concerns.

Analysts Signal $4,000 Price Target

Crypto investor and OKX exchange partner Ted Pillows notes that ETH is following a similar trajectory to the 2016-17 market cycle.

History doesn't repeat itself, but it often rhymes. $ETH is following the same path as the 2016-17 cycle.

Just the breakout above $4,000 and you'll see an even bigger rally. pic.twitter.com/ckwNXo7g19— Ted (@TedPillows) July 17, 2025

Following the recent $3,200 breakout, he anticipates a $4,000 price recovery in the near term, followed by a more substantial rally thereafter.

Prominent market maker Wintermute has also indicated that minimal ETH remains available through OTC desks, suggesting demand is overwhelming supply.

When such conditions emerge, price movements typically accelerate rapidly, which many view as another catalyst supporting the $4,000 target.

Technical Analysis: Rising Channel Confirms Bullish Structure

The ETH/USD chart displays upward momentum supported by an ascending channel formation.

Following a decisive breakout within the channel, Ethereum is currently experiencing minor consolidation below the $3,519 resistance level.

Price action maintains position above the Ichimoku cloud, indicating bullish momentum and underlying support, with the cloud providing a foundation around $3,200.

Technical analysis suggests two potential scenarios: a brief retracement toward the previous breakout zone (approximately $3,400), followed by a recovery, or a direct continuation to challenge the $3,519–$3,664 resistance range.

Ethereum 9.65% away from massive 4-year breakout targeting $3,500 before weekend as BlackRock accumulates $5B and Sharplink explodes to $974M ETH portfolio dominance.#Ethereum #ETHhttps://t.co/2EiTKiqcHW

— Cryptonews.com (@cryptonews) July 16, 2025

Provided the price remains above the cloud and the ascending channel structure holds, the bullish perspective remains valid, with probable targets around $3,650–$3,664 in the short term.

A sustained breach below $3,300 would threaten the bullish configuration and potentially reactivate the $3,100 support zone.

The post Ethereum ETFs Surge Past $5.5B in Record Inflows – Can ETH Break $4,000 Next? appeared first on Cryptonews.