The United States Consumer Price Index (CPI) rose to 3.0% year-over-year in September, coming in below economists’ expectations of 3.1% and marking the first time inflation has reached or exceeded 3% since January.

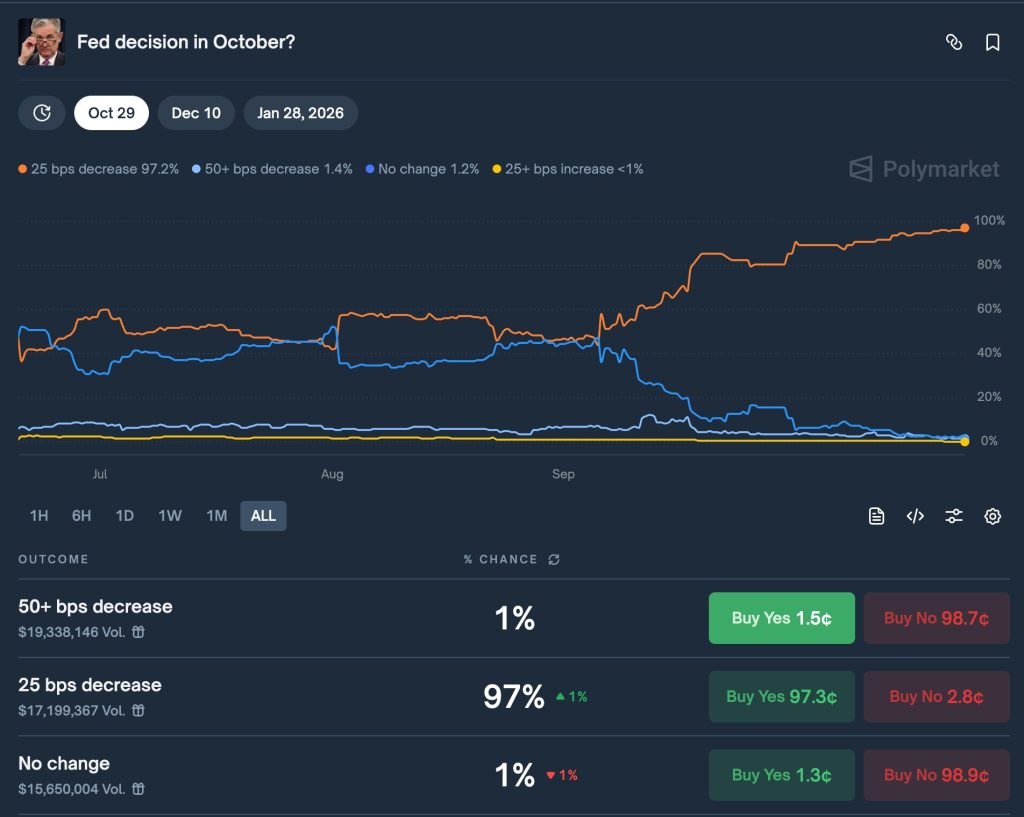

The cooler-than-expected reading came as a shock, with odds of a 25-basis-point Federal Reserve rate cut in October surging to 97% on Polymarket immediately after the data release.

Bitcoin responded by climbing back above $111,000.

Inflation Data Beats Expectations Across All Metrics

The September inflation uptick was driven primarily by rising gas and food prices, with tariffs also contributing, according to market observers.

However, the monthly increase of just 0.3% came in well below the projected 0.4%. In comparison, core CPI, excluding food and energy, moderated slightly to 3.0% annually with a monthly gain of only 0.2% versus expectations of 0.3%.

The softer-than-anticipated figures across all inflation metrics, combined with recent labor market instability, have market participants now pricing in a 25 to 50 basis point rate cut at the Fed’s upcoming policy meeting.

Speaking with Cryptonews, Farzam Ehsani, co-founder and CEO of VALR, explained how the macro environment could benefit Bitcoin moving forward.

“Should the U.S. CPI print come out soft and trade talks yield a, investors may pivot from pure protection to growth participation,” Ehsani said.

“This shift would strengthen Bitcoin’s relative appeal as it straddles both narratives—a hedge when things worsen, and an investment play when conditions stabilize.“

He noted that favorable macro developments could support a potential rally toward $130,000-$132,000 in Q1 2026.

However, he cautioned that “Bitcoin’s path higher is not guaranteed” given its hybrid nature as both a store of value and a risk asset.

Market Participants Position for Fed Shift

An anonymous trader with a reported 100% win rate opened long positions in Bitcoin and Ethereum worth $155 million immediately after the CPI release.

Pre-market stock trading showed strong risk appetite with Nasdaq futures climbing 0.83% and S&P futures advancing 0.57%, which means broader market participants view the data as supportive for risk assets.

$BTC is back above $111,000 level.

Today's CPI print was lower than expected, and it resulted in an initial pump.

Pre-market stock trading insights:Nasdaq futures is up 0.83%

S&P futures is up 0.57%

pic.twitter.com/HgRFEkK25y

— Ted (@TedPillows) October 24, 2025

Crypto analysts, including Michael van de Poppe, suggested that lower-than-expected inflation readings could drive Bitcoin to a new all-time high within the next 30 days.

At the same time, Global M2 money supply continues to explain more than half of Bitcoin’s price variance, according to VanEck analysis, which they claim is “reaffirming Bitcoin’s role as an anti-money-printing asset”.

Bitcoin futures open interest hit $52 billion before a wave of liquidations triggered an 18% price decline in early October.

However, VanEck analysts interpret this as a typical mid-cycle pullback rather than the beginning of a prolonged bear market, noting that leverage metrics have returned to normal levels at the 61st percentile.

Additionally, they see growing correlations between blockchain network revenues and token prices, alongside continued corporate Bitcoin accumulation, as a sign of increasing institutional integration of digital assets into traditional investment frameworks.

Bitcoin Technical Analysis: Will Historical MACD Pattern Repeat or Break?

According to analyst Ali Martinez, Bitcoin’s monthly MACD indicator shows concerning historical patterns, with every previous bearish cross on the monthly timeframe coinciding with average price drops of around 70% based on four instances since 2012.

Every time the MACD has crossed bearish on the monthly chart, Bitcoin $BTC has seen an average price drop of around -70%. pic.twitter.com/Vr12Rp6BHw

— Ali (@ali_charts) October 24, 2025

These declines included an 80.46% drawdown in February 2012, a 73.23% drop around March 2018, a 60.20% correction in December 2019, and a 70.77% plunge around September 2021.

However, these bearish crosses occurred after major bull-market peaks and served as lagging confirmation of trend changes rather than predictive warnings.

The current price of around $110,000 represents approximately a 12% decline from recent highs around $126,000.

This means if a bearish MACD cross materializes, it would confirm the already evident weakness rather than serve as a warning.

The monetary policy environment with imminent rate cuts differs substantially from previous bearish MACD periods that occurred during Fed tightening cycles.

As it stands now, extended consolidation between $95,000 and $120,000 appears most likely in the near term as markets digest competing forces.

However, a breakout above $120,000 on sustained volume could accelerate movement toward the $130,000- $132,000 range by Q1 2026 if macroeconomic conditions remain supportive.

The post Fed Rate Cut Odds Jump to 97% as CPI Comes in Cool at 3% – Bullish for BTC? appeared first on Cryptonews.