Liquidity staking has turn into an necessary technique for enhancing funding effectivity and taking part in DeFi in in the present day’s blockchain trade. As its recognition grows, extra builders are looking for to construct platforms to satisfy this growing demand.

Creating a liquidity staking platform requires a deep understanding of blockchain expertise’s core ideas and utilizing a spread of specialised improvement instruments. On this article, we’ll introduce the instruments for builders constructing staking merchandise, serving to you leverage the precise instruments to create an environment friendly, safe, and scalable platform with most outcomes.

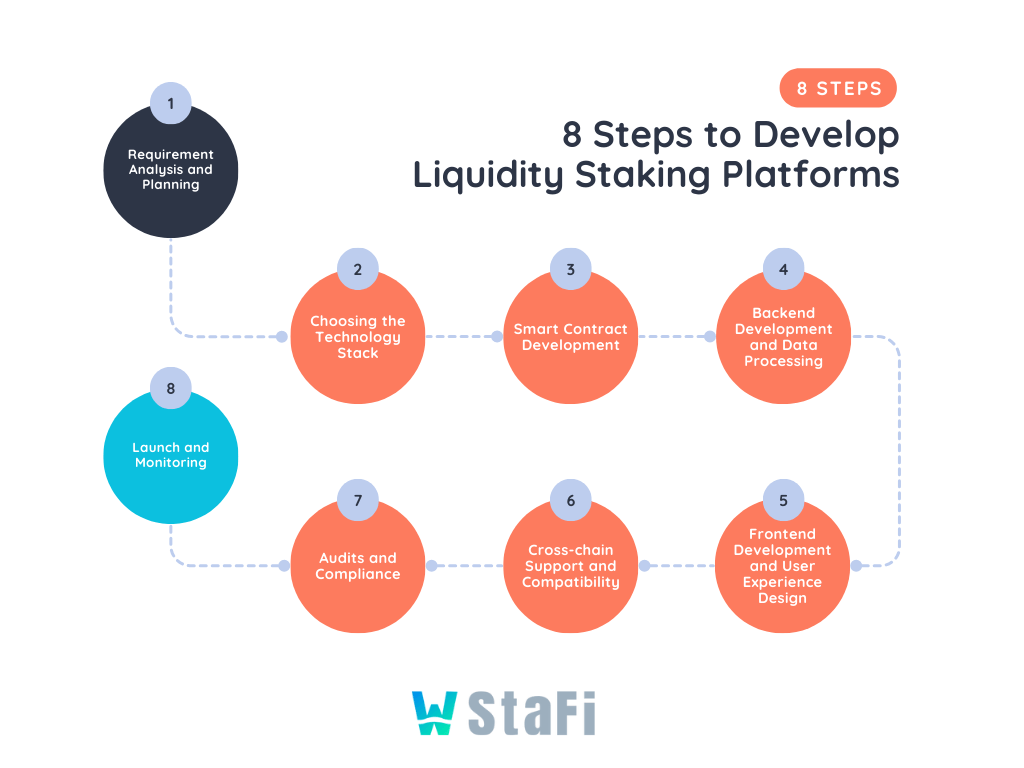

Steps to Develop a Liquidity Staking Product

When creating a liquidity-staking product, the next are the important thing steps from planning to launch, with every step being essential:

- Necessities Evaluation and Planning: First, outline the goal customers of the platform, the blockchains and asset varieties supported, and the core features of the platform, akin to staking, redemption, and reward distribution.

- Selecting the Tech Stack: Choose the suitable blockchain protocols and improvement instruments, together with sensible contract platforms, improvement frameworks, and API providers. Make sure the chosen expertise helps the platform’s scalability and safety.

- Sensible Contract Growth: Design and develop sensible contracts to securely and effectively deal with features akin to staking, reward distribution, and token redemption.

- Backend and Information Processing: Design an environment friendly backend system to course of person requests, handle staking knowledge, and supply real-time data. This contains database design and API implementation.

- Frontend and Person Expertise Design: Develop an intuitive and user-friendly interface, guaranteeing that customers can simply stake, view rewards, and redeem tokens. Optimizing the person expertise is essential to the platform’s success.

- Cross-Chain Help and Compatibility: To boost the platform’s scalability, combine cross-chain expertise to assist asset transfers and staking between completely different blockchains. If the platform is meant to function inside a single blockchain ecosystem, this step may be briefly skipped.

- Safety Audits and Compliance: Conduct multi-layered safety testing, together with audits for sensible contracts, backend programs, and person knowledge safety. Moreover, make sure the platform complies with related rules and requirements.

- Launch and Monitoring: After launching the product, constantly monitor the platform’s operation to make sure environment friendly and secure efficiency. Accumulate person suggestions and constantly enhance options and person expertise.

Now that we all know the requirements for a wonderful liquidity staking platform and the important thing steps in improvement, what developer instruments are vital to attain this? Right here, we introduce the instruments you’ll want.

Finest Developer Instruments for Constructing Liquidity Staking Merchandise

- LSaaS Liquidity Staking Platform Infrastructure

LSaaS (Liquid Staking as a Service) is a liquidity staking-as-a-service resolution that helps builders shortly construct liquidity staking merchandise with out ranging from scratch. As a number one supplier of PoS blockchain liquidity staking infrastructure, StaFi Protocol‘s LSaaS resolution simplifies the event and deployment course of for liquidity staking platforms. Builders now not must construct staking infrastructure from the bottom up; as a substitute, they will leverage skilled instruments and providers for speedy deployment.

StaFi LSaaS helps multi-chain ecosystems akin to Ethereum, Solana, Polygon, Cosmos, Eigenlayer, and extra, enabling builders to deploy LST (Liquidity Staking Tokens) and LRT (Liquidity Re-Staking Tokens) inside weeks and even days.

The platform options quick deployment, modular design, customizable assist, and multi-chain compatibility. Builders can simply alter staking instruments and reward mechanisms, and challenge liquidity staking tokens (LST) or liquidity re-staking tokens (LRT) with out operating validator nodes. This boosts asset yields and liquidity within the DeFi ecosystem.

To expertise StaFi LSaaS, be part of the Discord channel and submit your request.

- Sensible Contract Growth

Sensible contracts are the core of a liquidity staking platform, and builders want a safe and environment friendly improvement setting. Frequent instruments embody:

- Hardhat and Foundry: Sensible contract improvement frameworks for EVM-compatible chains, providing assist for testing, debugging, and deployment.

- Solidity: Used for writing contracts on EVM chains.

- Rust: Used for writing contracts on ecosystems like Solana.

- OpenZeppelin: Offers audited Solidity contract libraries, decreasing safety dangers.

- Through the use of StaFi LSaaS, builders can instantly deploy its SDK and optimized modules, or customise particular characteristic necessities. This drastically shortens the event cycle for liquidity staking merchandise, decreasing the timeline from a number of months to just some weeks and even days.

- Instruments to Maximize Staking Returns

Optimizing staking returns is crucial for enhancing the person expertise. Key instruments embody:

- LlamaRisk: Analyzes the dangers and returns of liquidity staking property.

- Yield Aggregators (e.g., Yearn Finance): Routinely optimizes DeFi staking returns.

- Re-staking Protocols (e.g., EigenLayer, Karak): Help re-staking to spice up yield.

- Validator Administration Instruments

Environment friendly validator administration is essential for liquidity staking merchandise. The next instruments simplify operations:

- SSV.Community: A decentralized validator administration resolution that enhances safety and stability.

- Obol Community: Helps distributed validator expertise (DVT) to scale back single factors of failure.

- Eth2 Launchpad: An official Ethereum validator administration instrument, appropriate for each people and establishments.

- Frontend Growth Instruments

The person interface of a liquidity staking platform should steadiness smoothness and visualization capabilities. Really helpful instruments embody:

- React.js, Subsequent.js: For constructing high-performance Web3 frontend functions.

- wagmi and RainbowKit: Optimizing EVM pockets connections and interplay experiences.

- D3.js, Chart.js: For knowledge visualization, bettering person comprehension.

Why Ought to You Use StaFi LSaaS Providers?

StaFi LSaaS providers provide a number of key benefits for builders and mission groups, making liquidity staking deployment extra environment friendly, safe, and cost-effective. Listed here are the explanations to decide on StaFi LSaaS:

- Save Time: Launch in weeks and even days. StaFi LSaaS considerably shortens the event cycle in comparison with constructing from scratch, enabling speedy market entry with minimal effort.

- Secure and Dependable: Use examined and audited code. StaFi LSaaS presents safe and secure options, eliminating the necessity for builders to jot down and audit code from scratch, saving prices and decreasing dangers.

- Market-Confirmed Reliability: StaFi LSaaS is extensively adopted and acknowledged. Utilizing a confirmed tech stack ensures stability and reduces safety vulnerabilities.

- Seamlessly Combine into the DeFi Ecosystem: StaFi LSaaS is suitable with LSTFi, enabling simple integration into DeFi, enhancing yield potential and market enchantment.

- Developer Toolkit: Speed up improvement. StaFi LSaaS offers a complete toolkit with modules and interfaces that permit simple customization and sooner deployment.

- Customizable: StaFi LSaaS presents robust customization assist, enabling modular design and cross-chain compatibility to satisfy numerous market and technical wants.

Through the use of StaFi LSaaS, builders can save time, cut back prices, guarantee safety, and shortly deploy environment friendly and safe liquidity staking options. StaFi LSaaS helps improve market competitiveness and offers complete assist for improvement wants.

How A lot Does It Value to Develop a Liquidity Staking Product?

The event value of a liquidity staking product depends upon the event strategy, required options, on-chain deployment prices, and safety audit wants. The estimated value ranges are as follows:

- Prices for Self-Growth (Constructing from Scratch)

Interested by exploring collaboration alternatives? Contact StaFi Protocol now to begin a brand new chapter in liquidity staking!

How Lengthy Does It Take to Develop a Liquidity Staking Product?

The event timeline depends upon the event strategy and crew expertise. The everyday phases are as follows:

- If work with StaFi LSaaS:

StaFi LSaaS offers an ordinary toolkit that makes liquidity staking integration simpler. The service is extensively adopted, decentralized, and extremely safe, guaranteeing builders can shortly get began. Through the use of StaFi LSaaS, builders can considerably shorten the event cycle for liquidity staking merchandise, decreasing it from a number of months to just some weeks and even days, drastically bettering effectivity and enabling sooner time-to-market. Contact StaFi Protocol now to avoid wasting months of improvement time.

Conclusion

As a number one Liquidity Staking-as-a-Service (LSaaS) resolution, StaFi LSaaS considerably shortens improvement cycles, lowers technical boundaries, and presents market-validated safety and multi-chain compatibility. In comparison with full self-development, StaFi LSaaS allows builders to deploy LST and LRT inside hours to weeks, decreasing prices by over 80% and dashing up product launches.

Sooner or later, StaFi Protocol will introduce AI-powered options and launch the Open Stack Platform and Open Modularity Platform to speed up LSaaS ecosystem growth and promote modular development and clever improvement of liquidity staking merchandise.

Whether or not you’re a DeFi protocol, trade, pockets improvement crew, or PoS chain mission, StaFi LSaaS may help you shortly and securely construct staking merchandise. If you wish to pace up your launch, contact StaFi Protocol now to begin a brand new chapter in liquidity staking.

The publish The best way to Construct an Excellent Liquid Staking Protocol appeared first on Cryptonews.