Layer 1 blockchain tokens suffered severe depreciation in 2025, with major assets losing up to 73% of their value despite sustained developer activity, according to the latest End-of-Year report from OAK Research.

While Bitcoin maintained relative strength throughout the year, alternative Layer 1 tokens experienced brutal sell-offs that exposed structural weaknesses in tokenomics and market positioning.

The report reveals a decisive shift from speculation to fundamental value creation, with the market punishing protocols unable to show genuine economic activity.

User Reallocation Masks Market Stagnation

The year witnessed massive user redistribution rather than overall growth, with total Monthly Active Users declining 25.15% across major chains, according to the report’s blockchain metrics analysis.

Solana suffered the steepest decline, losing nearly 94 million users (a drop of more than 60%), while BNB Chain almost tripled its user base by capturing fleeing participants.

Layer 2 networks experienced similar divergence. Base demonstrated the strongest growth, with TVL rising 37.2% to $4.41 billion, according to the report, solidifying its position through Coinbase’s distribution advantage.

Meanwhile, Optimism saw TVL contract 63%, dropping from nearly $2 billion to $786 million as capital rotated toward more aggressive competitors.

Token Performance Reflects Brutal Reality

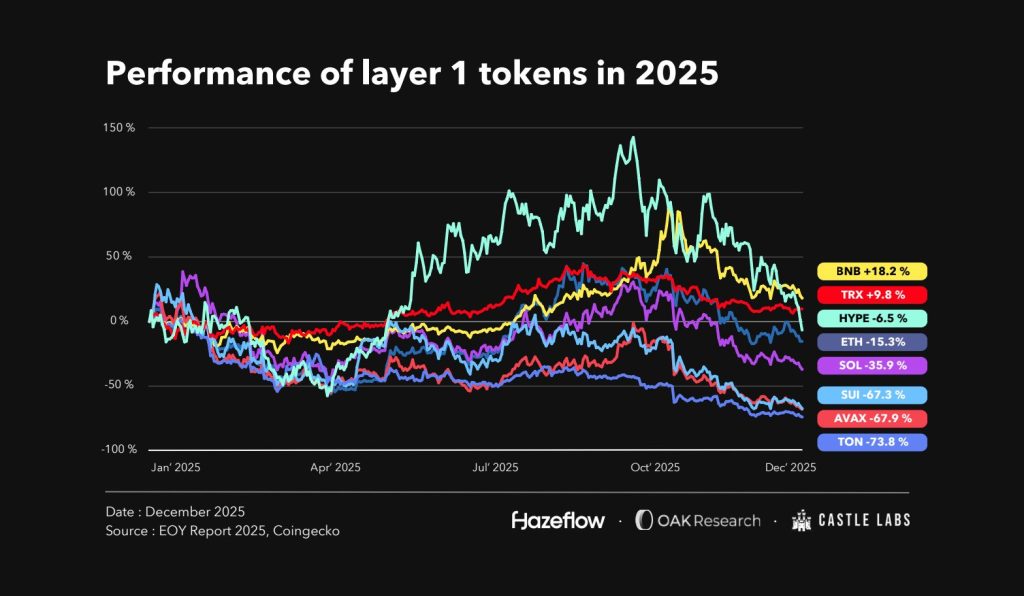

Price action told an unforgiving story. Among major Layer 1 tokens monitored since January, only two finished positive:

- BNB gained 18.2%.

- TRX rose 9.8%.

The remainder suffered catastrophic losses, with Solana dropping 35.9% and newer entrants like TON and AVAX falling over 67%.

Layer 2 tokens fared even worse despite technical progress.

The report documents that Optimism and zkSync Era both posted declines exceeding 84%, while Polygon and Arbitrum fell by more than 73%.

Only Mantle managed a modest 8.3% gain, attributed to concentrated supply control rather than fundamental strength.

The report identifies several converging forces behind the decline. They can be summed up into three main reasons:

- Overleveraged tokenomics with continuous unlock schedules.

- Lack of credible value-capture mechanisms linking network usage to token demand.

- Institutional preference for Bitcoin and Ethereum over smaller-cap alternatives.

Developer Activity Diverges From Price

Despite price carnage, developer activity remained robust across select ecosystems, according to data from Electric Capital cited in the report.

The EVM Stack maintained the largest developer base, with 17,473 total contributors (updated), including 5,405 full-time developers, representing over 32% of activity.

Bitcoin posted the strongest two-year growth in full-time developers among major ecosystems, rising 90.5% to 1,003 contributors.

Solana and the broader SVM Stack grew 75.8% over two years to 4,578 full-time developers, demonstrating sustained technical ambition despite brutal token performance.

Overall, the developer ecosystem is growing, but the disconnect between their activity and token prices revealed what the report terms as “market maturation.”

Teams continued building through down cycles, but speculative capital no longer rewarded infrastructure without clear paths to revenue generation.

Revenue Meta Emerges as Criterion

The fundamental lesson of 2025 became inescapable, according to the report’s economic analysis. The report asserts that protocols without credible revenue streams are at risk of extinction.

The industry pivoted decisively toward the “revenue meta,” where actual cash flows mattered more than narrative.

Stablecoin issuers dominated revenue generation, accounting for 76% of income among top protocols.

Tether and Circle combined generated $9.8 billion annually, while derivatives platforms like Hyperliquid added $1.1 billion through sustainable fee-based models.

The report also pointed out a harsh truth that generic Layer 1s and Layer 2s lacking differentiation could not compete.

Networks required 10x improvements in speed, cost, or security to justify independent existence.

Outlook Remains Challenging

Looking toward 2026, infrastructure tokens face continued headwinds despite regulatory clarity in key markets, the report concludes.

The combination of high inflation schedules, insufficient demand for governance rights, and concentration of value capture in base layers suggests further consolidation ahead.

The overall sentiment in the altcoin market heading into 2026 remains cautious, particularly as they’re experiencing a steep decline never seen before.

Protocols that generate meaningful revenue may stabilize, but they remain subject to Bitcoin’s volatility and persistent unlock pressure from early investors.

For existing Layer 1 tokens, the report asserts that survival depends on Ethereum and Solana, and that renewed institutional adoption might restore hope.

Without leadership from market majors, generic infrastructure tokens will continue to trend toward irrelevance as capital concentrates in protocols that show economic value rather than technological novelty alone.

The post L1 Tokens Crushed in 2025 as SOL, AVAX Drop Over 65%: Report appeared first on Cryptonews.