By 2023, crypto markets have entered a fundamentally new stage of structural complexity. The shift from a single-chain paradigm to a multi-chain ecosystem has reshaped not only where capital flows, but how it behaves. Analysts who once monitored liquidity within a single network must now track capital migration across dozens of chains, bridges, rollups, and application-specific environments. This transformation exposed a new analytical challenge: liquidity no longer exists as a unified layer — it is fragmented, dynamic, and deeply dependent on cross-chain infrastructure.

During the bull market cycles of previous years, liquidity was relatively centralized. Most of it lived on Ethereum or major exchanges, forming predictable patterns of accumulation and distribution. But by 2023, the landscape changed dramatically. Rollups grew into fully functional ecosystems, alternative L1s continued attracting niche communities, and new bridging technologies multiplied the possible paths for capital movement. As a result, liquidity ceased to reflect a single coherent sentiment. Instead, it became a mosaic of micro-sentiments formed within individual environments.

One of the defining features of this period is the rise of cross-chain liquidity gradients — differences in yield, fees or execution efficiency that cause capital to flow from one chain to another. These gradients often emerge long before market participants notice any visible price changes. For analysts, the key insight is that the earliest signs of trend formation now appear not in trading behavior but in cross-chain capital positioning. A pool on one chain may show outflows, while the same asset on a different chain experiences early accumulation. Without multi-chain visibility, these patterns look random; with it, they reveal coordinated shifts in capital preference.

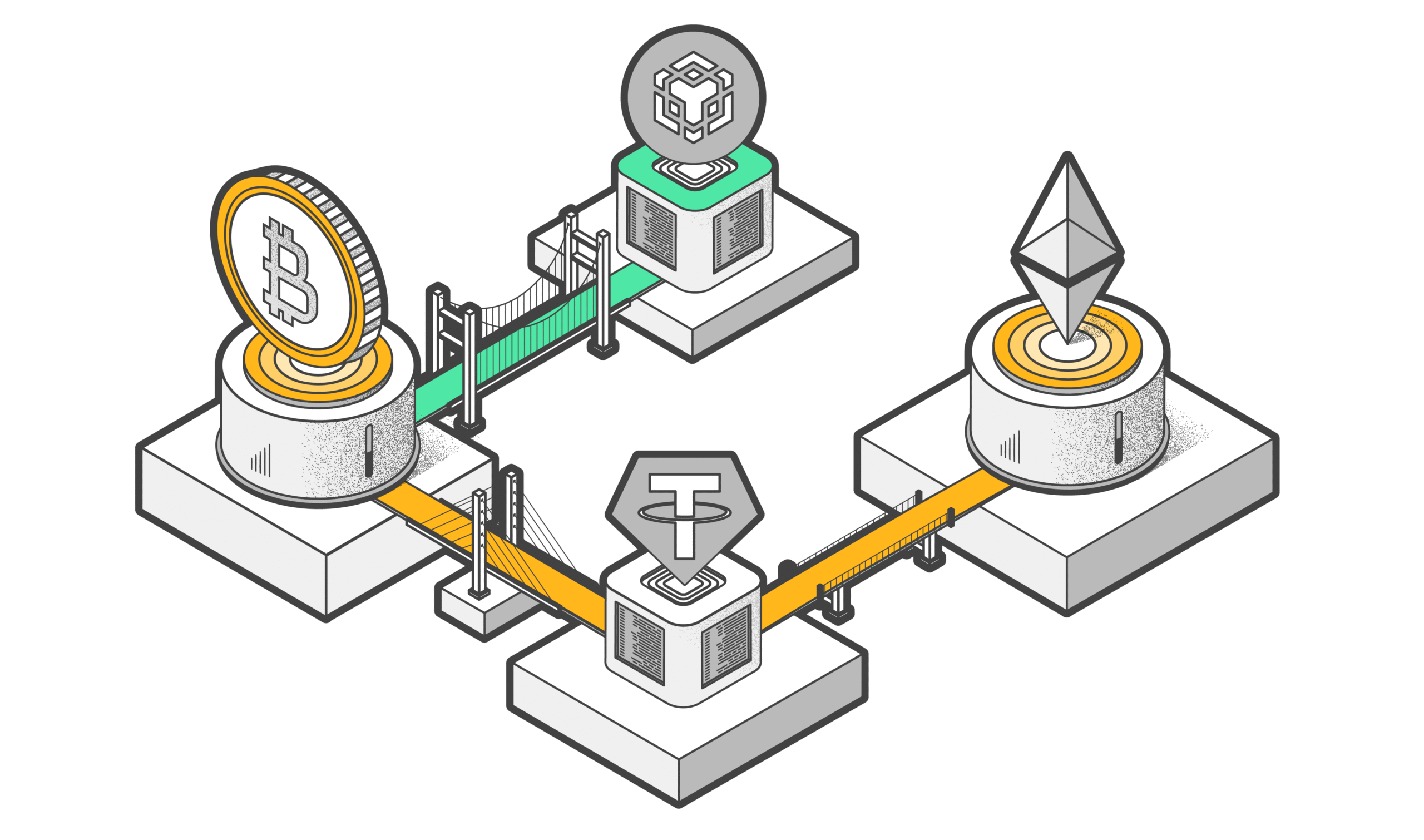

Another important factor is the structural role of bridges. By 2023, they became the arteries of the multi-chain economy — yet they also introduced new latency and risk layers. Liquidity stuck in bridging queues, delayed confirmations, and fragmented execution environments all affect how traders react to volatility. This means that cross-chain friction itself becomes a measurable market variable. A sudden increase in bridge utilization can signal capital seeking safety or chasing yield elsewhere. Conversely, a decrease may indicate rising uncertainty or a shift toward more isolated ecosystem behavior.

On-chain analytics in 2023 requires understanding not just how liquidity moves, but why it chooses a particular route. Network fees, blockspace demand, application incentives, arbitrage conditions, and user trust in specific bridges all influence capital pathways. The result is a highly adaptive system in which liquidity behaves more like a migratory organism than a static pool.

This environment demands new analytical methodologies. Traditional chain-specific metrics lose explanatory power when viewed in isolation. Multi-chain synchronized indicators — such as relative liquidity density, risk-adjusted yield deltas across chains, and capital velocity between ecosystems — provide far more accurate signals. Analysts who incorporate these cross-network dynamics can detect macro-momentum shifts significantly earlier than those relying on single-chain data.

Ultimately, 2023 marks the year when liquidity stopped being a localized market property and became a network-level phenomenon. Capital now continuously evaluates not just assets, but entire ecosystems, moving with increasing fluidity between environments that offer the most favorable structural conditions. Understanding this behavior is essential for risk assessment, market forecasting, and evaluating the sustainability of emerging protocols. The multi-chain world is not a temporary phase — it is the architectural direction of the industry. And liquidity fragmentation is no longer a challenge to overcome, but a foundational reality analysts must embrace to understand the market as it truly operates.

Denys Yakushev, cryptanalyst, expert in virtual asset risk management