World Liberty Financial’s governance token, WLFI, rose 8% on Tuesday, adding around $400 million to its market capitalization after project leaders froze the holdings of crypto entrepreneur Justin Sun.

The move locked up nearly 3 billion tokens, drastically altering the token’s liquidity profile just days after its volatile launch.

WLFI Price Rebounds Above $0.18 After Blacklisting Justin Sun’s Wallet

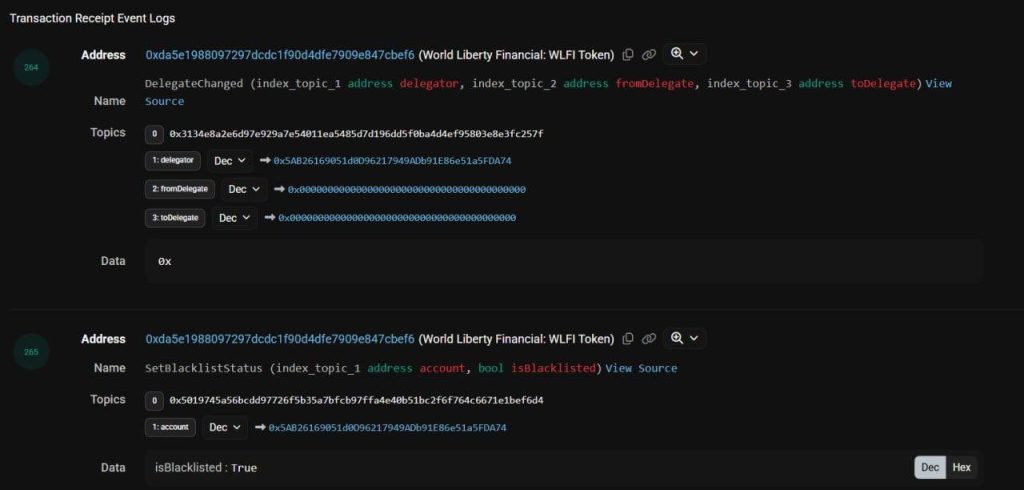

According to the project, Sun’s wallet address was blacklisted, freezing 540 million unlocked WLFI tokens valued at about $101 million and 2.4 billion staked tokens worth approximately $452 million. In total, the freeze applied to 2.94 billion tokens.

The decision followed allegations that an exchange systematically sold user deposits in a way that pressured the market. Core project leaders and several major exchanges were reportedly involved in the decision-making process.

The freeze immediately tightened the circulating supply, curbing potential selling pressure and boosting the price back above $0.18. The surge provided temporary relief for investors after a bruising launch that saw insiders offload nearly 700 million tokens within hours of trading opening.

World Liberty Financial debuted its token on September 1, initially priced at $0.46. Within two hours, heavy selling on Binance, OKX, and Gate drove the price down to $0.25.

Early backers, who had purchased tokens in presale rounds at $0.015 and $0.05, exited with gains of up to 20 times their investment, while retail investors absorbed losses.

The token’s economics have drawn criticism. Roughly 56% of the supply was controlled by insiders, while entities linked to the Trump family retained 22.5 billion tokens alongside rights to 75% of the project’s revenues.

Despite being marketed as a decentralized Trump-backed initiative, critics said the structure pointed to centralization.

Sun became involved earlier this year, investing $75 million and later being named an advisor. Data from Arkham Intelligence showed that he recently claimed $178 million worth of unlocked WLFI, giving him total holdings of nearly $900 million before the freeze.

JUSTIN SUN JUST CLAIMED $178 MILLION $WLFI

Justin Sun just claimed his 20% unlock of WLFI – worth almost $200 Million. In total, he holds $891.2 MILLION of WLFI!

He says he is not selling anytime soon. https://t.co/o1qft2IuvB pic.twitter.com/G2ggEjbqxC— Arkham (@arkham) September 1, 2025

On-chain movements also revealed transactions between his wallets and HTX, an exchange he is associated with. These activities fueled accusations of market manipulation, though Sun rejected them.

In a statement, he argued that his addresses only conducted “generic exchange deposit tests with very low amounts” and denied that any activity could have influenced WLFI’s price. Nevertheless, the blacklisting of his wallet marked a major escalation in the dispute.

我们的地址只是笼统地做了几笔交易所充值测试,金额非常低,然后做了一个地址分散,没有涉及任何买卖,不可能对市场产生任何影响。

— H.E. Justin Sun

(Astronaut Version) (@justinsuntron) September 4, 2025

WLFI’s official account attempted to calm concerns, clarifying that tokens in project-controlled wallets are governed by community votes rather than the team’s discretion.

The group emphasized that allocations can only be deployed through on-chain proposals approved by holders. The freeze has also raised questions about investor redemptions.

Analysts noted that if HTX sold WLFI deposits while Sun’s tokens are now illiquid, users seeking to reclaim their assets may need to repurchase them on the open market.

The controversy capped a turbulent opening for WLFI. Prior to launch, derivatives trading linked to the token spiked, with Coinglass reporting a 530% increase in 24-hour trading volume to $3.95 billion.

Open interest surged over 60% to $931.9 million as traders speculated on the Trump-linked asset. By the time spot trading began, WLFI briefly touched a fully diluted valuation near $40 billion, placing it within the top 50 cryptocurrencies.

However, sustained selling quickly drove the price down. By September 2, WLFI was trading at $0.24 with a market cap just below $7 billion. According to CoinGecko, the token has since fallen to around $0.18, representing a 41.7% decline from launch and an 18.8% drop over the past 24 hours.

Despite the market turbulence, WLFI’s team maintains that its governance framework will allow the community to steer future decisions.

WLFI Burns 47M Tokens as Price Falls, Whales Absorb Heavy Losses

World Liberty Financial burned 47 million tokens in its first week of trading, attempting to stabilize a market shaken by steep losses.

On-chain data shows the tokens, equal to 0.19% of the circulating supply, were sent to a verified burn address on Wednesday. The move followed a sharp 31% drop from WLFI’s launch price of $0.33 to just over $0.23.

The team has also proposed a broader buyback-and-burn program, to be funded by protocol fees and subject to a community vote.

The Trump family’s wealth ballooned by $6B after $WLFI, their flagship crypto token, made its debut on major exchanges and opened for trading.#TrumpFamily #WLFI https://t.co/IcK4AYdI4D

— Cryptonews.com (@cryptonews) September 2, 2025

WLFI’s debut resembled a public listing, opening spot trading for the first time after a July investor vote. Trading volumes topped $1 billion in the first hour across Binance and other exchanges.

Prices briefly touched $0.30, valuing the Trump family’s nearly 25% stake at more than $6 billion. That paper fortune has since shrunk as WLFI’s value plunged 41% in less than a week.

Whales have borne the brunt of the decline. Blockchain data shows wallet 0x432 lost over $1.6 million after reentering WLFI on leverage, erasing a $915,000 profit made just hours earlier.

Whales are reeling from steep losses after a sharp selloff in World Liberty Financial (WLFI), a token linked to the Trump family. #Whale #Trumphttps://t.co/Kt0NExbf2j

— Cryptonews.com (@cryptonews) September 4, 2025

Another large holder, wallet 854RaR, was down $650,000 on a $2 million position, while wallet 0x1527 faced over $2.2 million in unrealized losses. Some traders have profited from the sell-off, including wallet 0x92bb, which gained $1.8 million on a short.

The burn failed to reverse momentum. WLFI dropped an additional 18% in 24 hours after the announcement, with bearish sentiment intensifying. Critics argue the strategy may ease short-term pressure but shows the fragility of celebrity-driven crypto projects.

As WLFI attempts to shift from hype to utility, investor confidence remains shaky, and whales are left counting heavy losses.

The post WLFI Jumps 8% as Justin Sun’s Entire Allocation Frozen – $400M Gained appeared first on Cryptonews.