Bitcoin traded at approximately $25,900 at the beginning of September, marking a significant shift from its summer performance. Throughout the past three months, Bitcoin maintained a historically unparalleled tight trading range. However, a notable dip below $29,000 in mid-August eradicated billions in leverage from the market, signaling a long-awaited market shift.

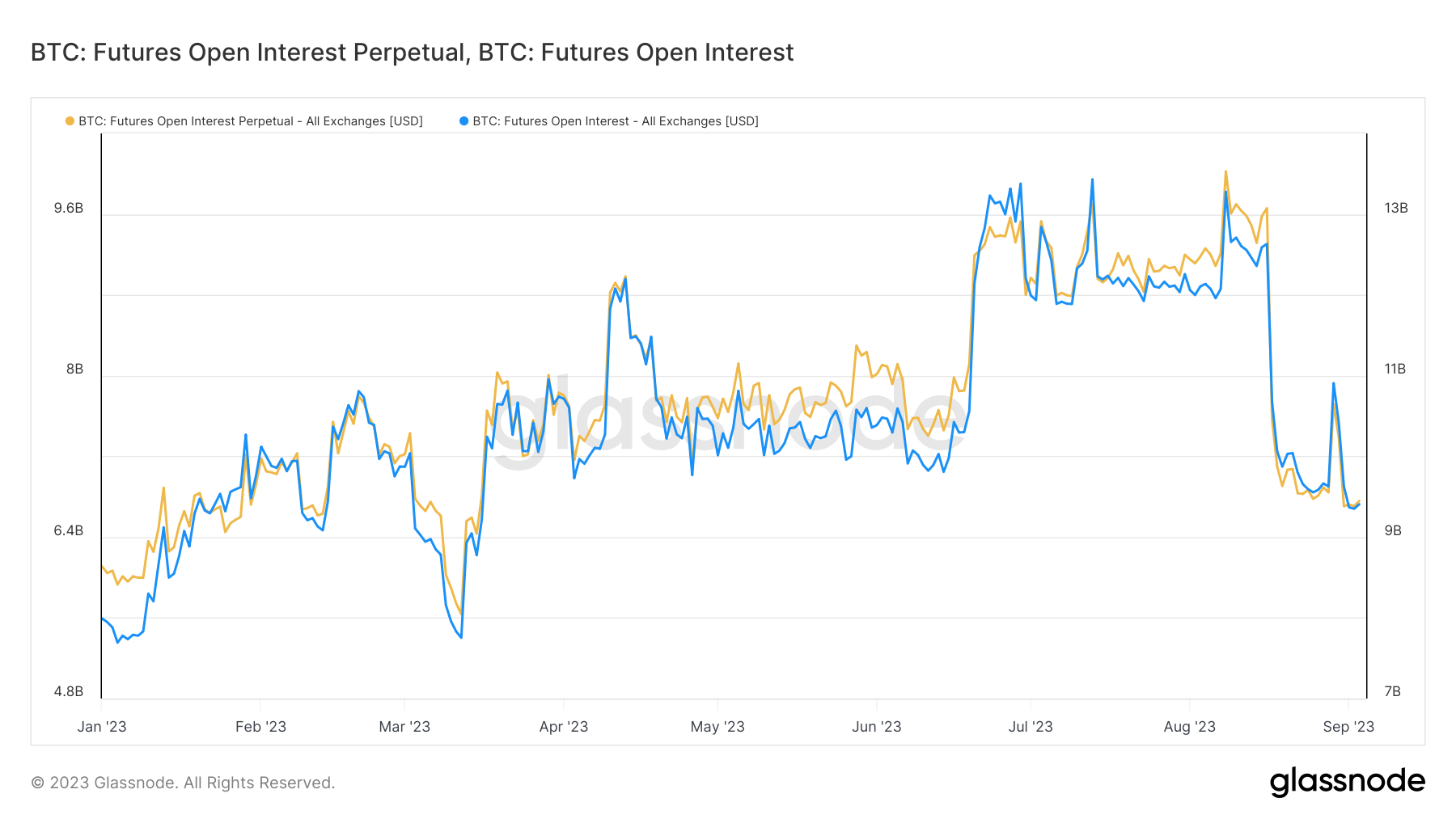

As Bitcoin matures, its derivatives market is evolving in tandem. Products such as futures, options, and perpetual futures have grown exponentially, wielding the power to influence Bitcoin’s price more than the traditional spot market.

This trend underscores the importance of monitoring the derivatives market. Specifically, gauging the amount of leverage in this market can provide insights into the inherent risks associated with potential long/short squeezes and ensuing liquidation cascades.

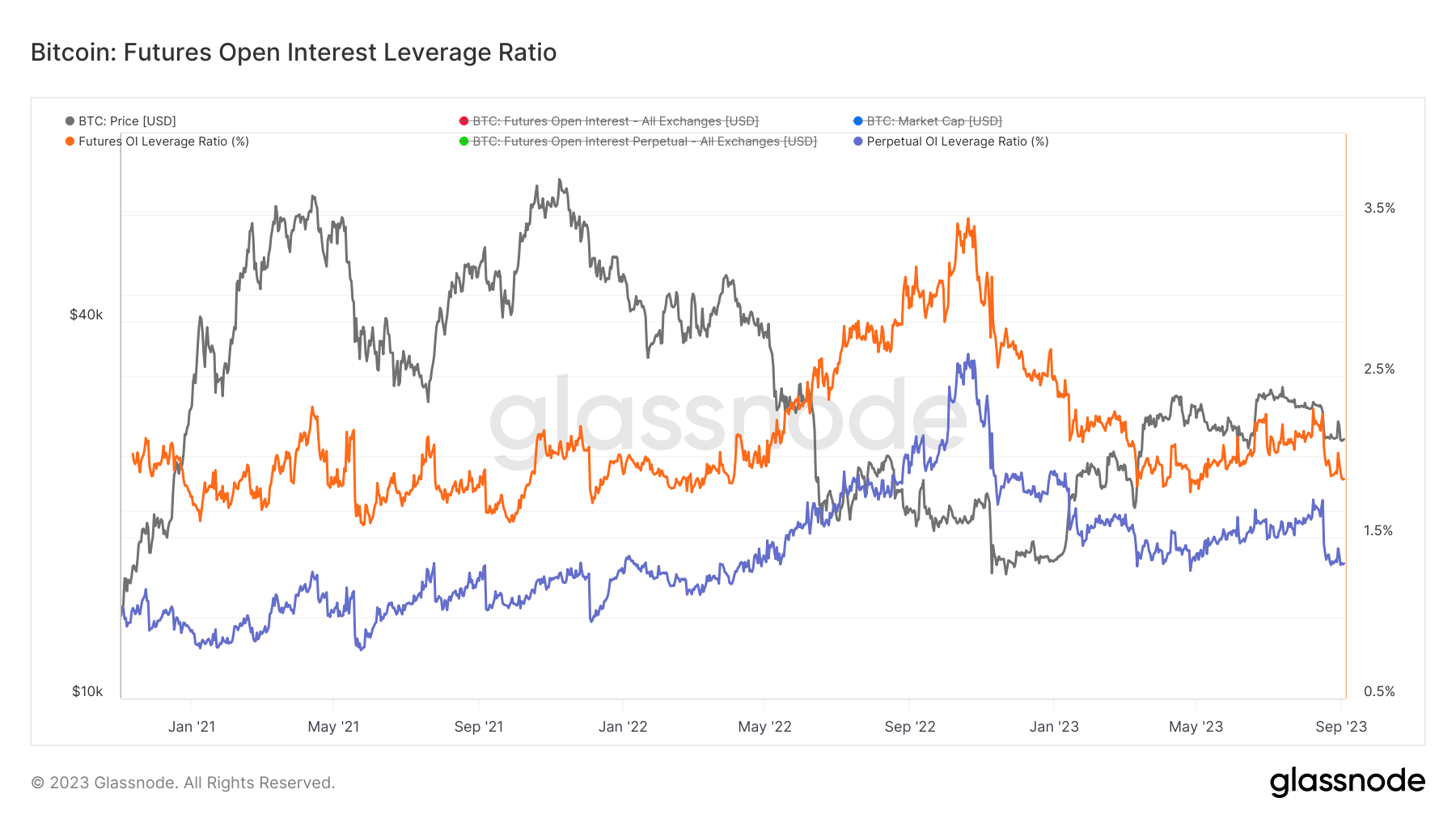

A key metric that offers a window into the market’s health is the Futures Open Interest Leverage Ratio.

This ratio is derived by dividing the market’s open interest by the asset’s market cap, with the result presented as a percentage. Essentially, it estimates the existing leverage in relation to the market size, serving as a barometer for potential deleveraging risks. Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled. It provides insight into the flow of money and trading activity in a particular market.

High values in this metric suggest that the futures market open interest is substantial when juxtaposed with the market size, elevating the risk of events like short/long squeezes or liquidation cascades. Conversely, low values indicate a smaller futures market open interest relative to the market size, typically showing reduced risks of derivative-led forced buying, selling, or volatility.

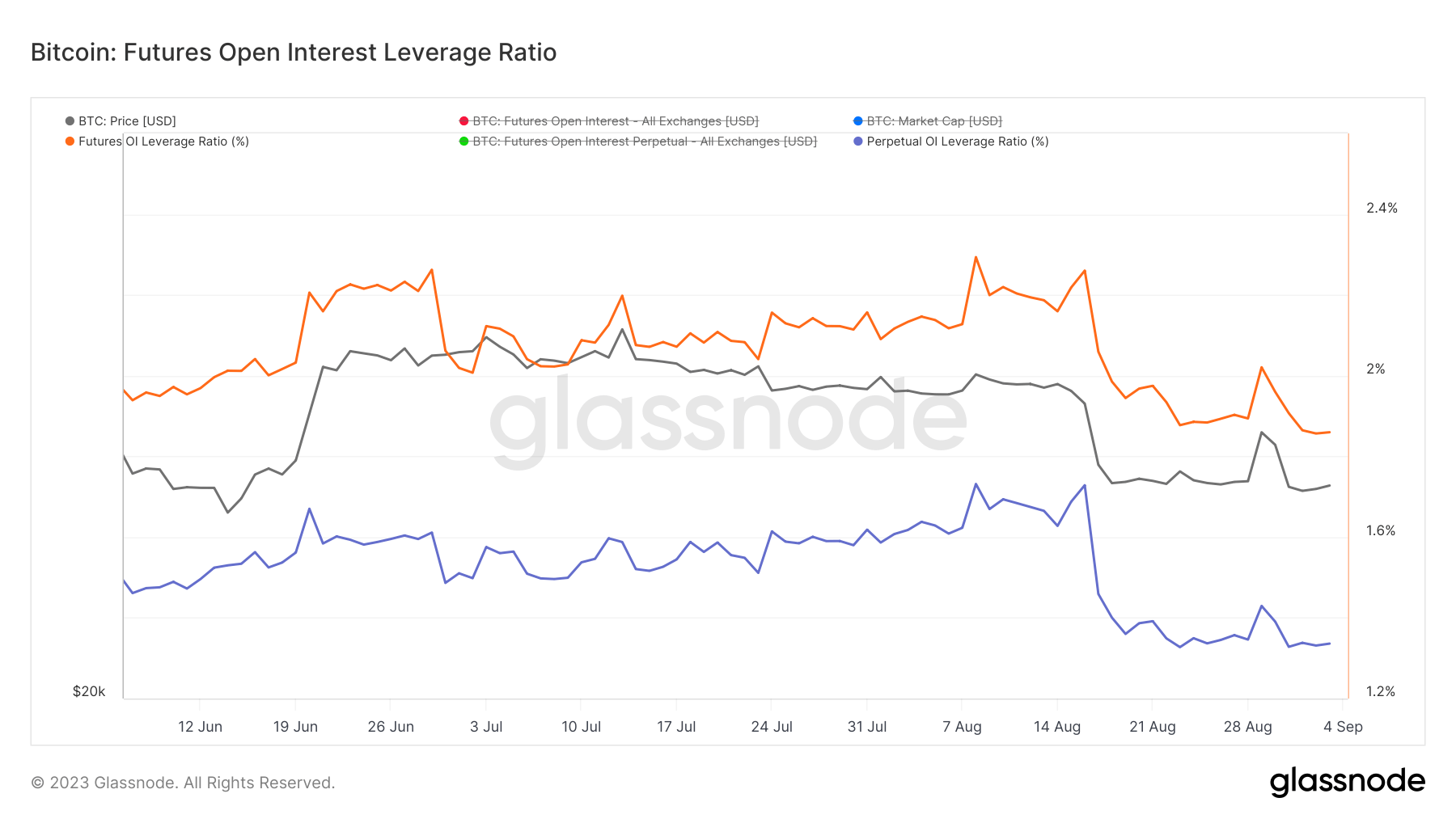

According to data from Glassnode, there was a notable decrease in the futures open interest leverage ratio in August.

On Aug. 16, the futures open interest leverage ratio stood at 2.26%, while its perpetual counterpart was at 1.72%. However, by Aug. 18, these figures had dwindled to 1.94% and 1.36%, respectively. Although there was a brief spike on Aug. 29 during Bitcoin’s short-lived stint at $27,000, the ratios soon plummeted.

In September, the market recorded a 6-month low in futures open interest leverage ratios, with figures of 1.86% and 1.33%.

Historically, the all-time high of the open interest leverage ratio was observed on Oct. 20, 2022, right before the collapse of FTX. The excessive leverage that had permeated the market meant that FTX’s downfall triggered a liquidation cascade, erasing billions from the market. Had the market been less leveraged, the repercussions of FTX’s demise might have been considerably less catastrophic.

The decrease in leverage suggests a shift towards caution among traders and institutions. While high leverage can offer substantial returns, it also comes with increased risks, as evidenced by the FTX debacle. The current low-leverage environment suggests the market is in a consolidation phase, with participants wary of potential external shocks.

The post Bitcoin enters September with diminished market leverage appeared first on CryptoSlate.