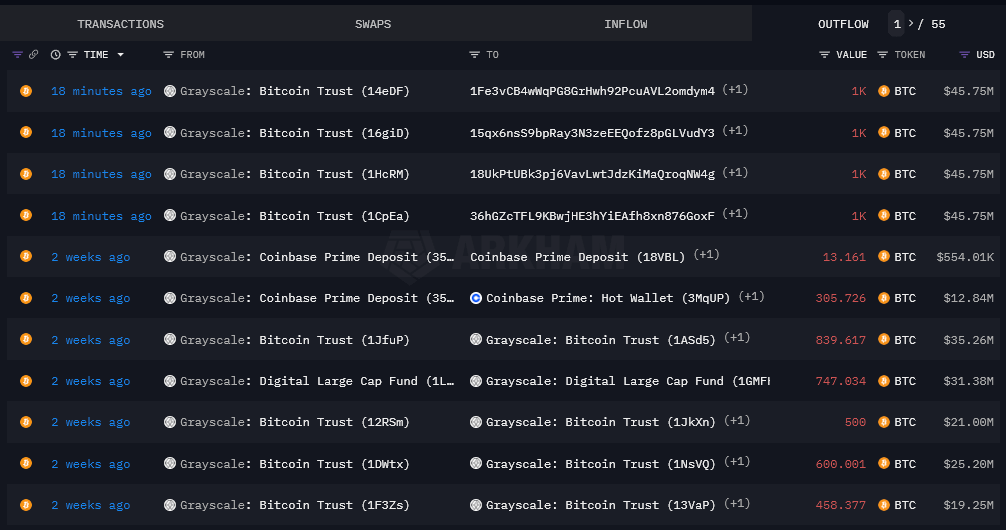

Grayscale has begun moving Bitcoin out of its trust and sending it to Coinbase as of 2 p.m. GMT, Jan. 12. A total of 4,000 BTC (roughly $200M) has been sent as of press time, with all Bitcoin going to Coinbase Prime, one of the key participants in the series of Bitcoin ETFs launched yesterday.

Coinbase acts as the broker and trading counterparty for almost all ETF issuers, including Grayscale. Thus, it is likely that this transfer indicates outflows from the trust from sales yesterday. The last outflows before today were around 2 weeks again, where there were multiple transactions in and out of the Grayscale Bitcoin wallets.

While the spot Bitcoin ETFs track the price of Bitcoin directly, they do not require issuers to buy and sell Bitcoin live during trading hours. The key times when Bitcoin is purchased or sold concerning the creation and redemption of ETF shares in the Grayscale ETF, for example, can be summarized as follows:

Creation of Baskets (Buying Bitcoin):

- The Authorized Participants place creation orders for Baskets with the Transfer Agent by 1:59:59 p.m., New York time, on any business day.

- The Sponsor determines the Total Basket Net Asset Value (NAV) and any Variable Fee as soon as practicable after 4 p.m., New York time.

- The Liquidity Provider transfers the Total Basket Amount (in Bitcoin) to the Trust’s Vault Balance on T+1 or T+2, depending on the order placement time.

Redemption of Baskets (Selling Bitcoin):

- The Authorized Participants place redemption orders with the Transfer Agent no later than 1:59:59 p.m., New York time, on each business day.

- The Sponsor determines the Total Basket NAV and any Variable Fee as soon as practicable after 4 p.m., New York time.

- The Liquidity Provider delivers the Total Basket NAV (less any Variable Fee) to the Cash Account on T+2 (or T+1 on a case-by-case basis, as approved by the Sponsor).

In both scenarios, the crucial time for initiating orders is before 2:00 p.m., New York time, on a business day. The actual transfer of Bitcoin (either to the Trust’s Vault Balance in the case of creations or from the Custodian to the Liquidity Provider in the case of redemptions) occurs on T+1 or T+2, depending on the specific circumstances of the order.

These transactions could potentially affect the spot price of Bitcoin, especially if large orders are placed. However, the exact impact on the spot price would depend on various factors, including the size of the orders relative to the average daily trading volume of Bitcoin and the market conditions at the time of the transactions.

The transfers of Bitcoin from the trust and the timing align with the creation and redemption processes, suggesting that perhaps just $200 million in redemptions was deemed necessary by Grayscale following the first day of trading. It is important to note that this is highly speculative, but one possible reason for the outflows stated above.

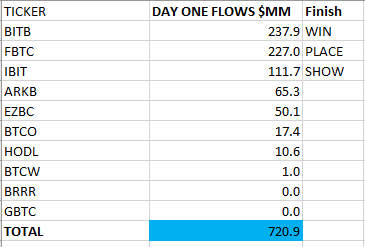

Bitcoin ETF flows.

Furthermore, BlackRock’s day-one inflows were around $112 million, with only $10 million in seed capital. This indicates the fund should require at least $90 million in Bitcoin to match the share purchases.

Bloomberg’s Eric Balchunas shared estimates of around $720 million in inflows into Bitcoin ETFs on day one. However, as of the close of trading, he could not identify how much of these flows may be offset by selling out of the Grayscale trust, which has the highest fee by some margin among the new spot Bitcoin ETFs. Grayscale charges 1.5% annually, while others are as low as 0.2%, with some offering zero fees for a promotional period.

As with Grayscale, the above inflows will require the funds to match shares with Bitcoin, but all share creations must be done with cash. This means that Bitcoin cannot be used to create shares. If an investor sells shares in one ETF and buys shares in another, one fund cannot give Bitcoin to another if outflows go into another. Cash must be used for creation and redemption per the current SEC rulings.

For any funds using a T+2 settlement, with Monday being a bank holiday in the U.S., Bitcoin may not be settled until Tuesday, leaving room for an exciting weekend of Bitcoin price action.

The post Grayscale transfers $200M Bitcoin to Coinbase Prime hinting at possible ETF redemption activity appeared first on CryptoSlate.