Grayscale’s Bitcoin Trust (GBTC) has become a crucial instrument in the cryptocurrency world since its launch by Grayscale Investments. As one of the pioneers in providing a bridge between the traditional investment landscape and the nascent cryptocurrency domain, GBTC allows investors to tap into the Bitcoin market without directly buying, storing, or managing it. Monitoring GBTC’s price movement has become paramount, especially for analysts aiming to gauge market sentiment.

Crafted in the mold of a traditional investment trust, GBTC’s unique proposition lies in its method of holding Bitcoin. Instead of individual investors grappling with cryptographic keys and wallets, Grayscale centralizes the holding process, using high-security measures, including cold storage mechanisms, to ensure the safety of the assets.

GBTC shares, representing ownership of a fraction of the trust’s underlying Bitcoin, are traded on the OTCQX market. The OTCQX, or the Over-The-Counter QX, is a top-tier, regulated marketplace for stocks and securities that don’t trade on conventional, large-scale exchanges. It offers a platform for companies to access U.S. investors while complying with high financial standards and disclosure practices.

One distinguishing feature of GBTC, setting it apart from some ETFs (Exchange Traded Funds), is its lack of a redemption mechanism. In simple terms, investors can’t exchange their GBTC shares directly for Bitcoin. Instead, they can only trade these shares on the open market. This design choice aids in providing more price stability, preventing large investors from abruptly cashing out and significantly affecting the market dynamics.

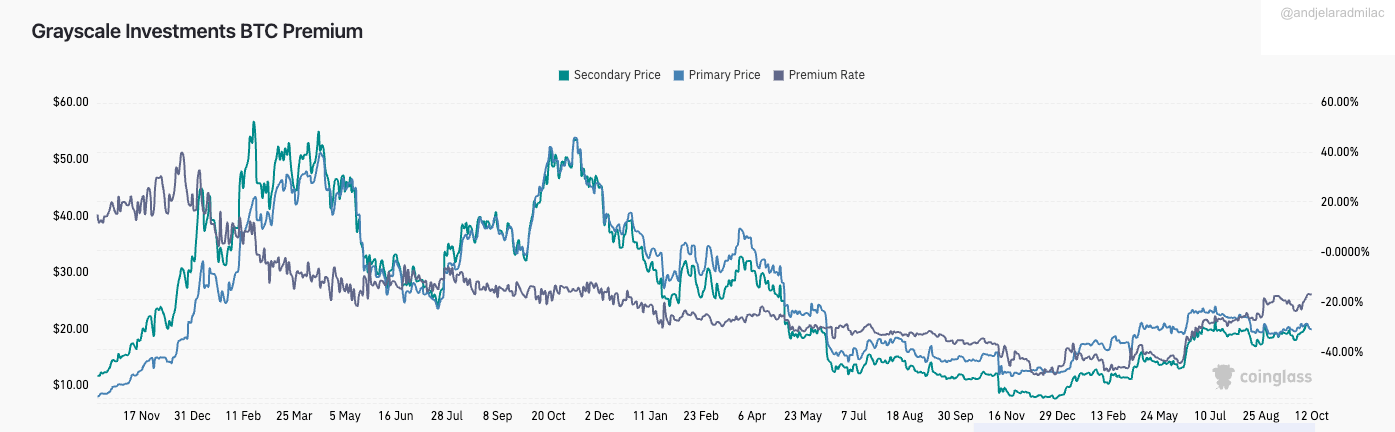

The uniqueness of GBTC lies in its premium, a term denoting the difference between the market price of GBTC shares and the actual value of the Bitcoin it holds, known as the Net Asset Value (NAV).

This premium arises due to several factors. Initially, GBTC was one of the scarce channels for institutional players to access Bitcoin exposure, especially in restricted jurisdictions. This exclusivity led to GBTC trading at a substantial premium. Moreover, GBTC’s liquidity and convenience added to its appeal, driving a wedge between its price and the actual Bitcoin value. However, this premium isn’t static and can oscillate based on market conditions and transform into a discount.

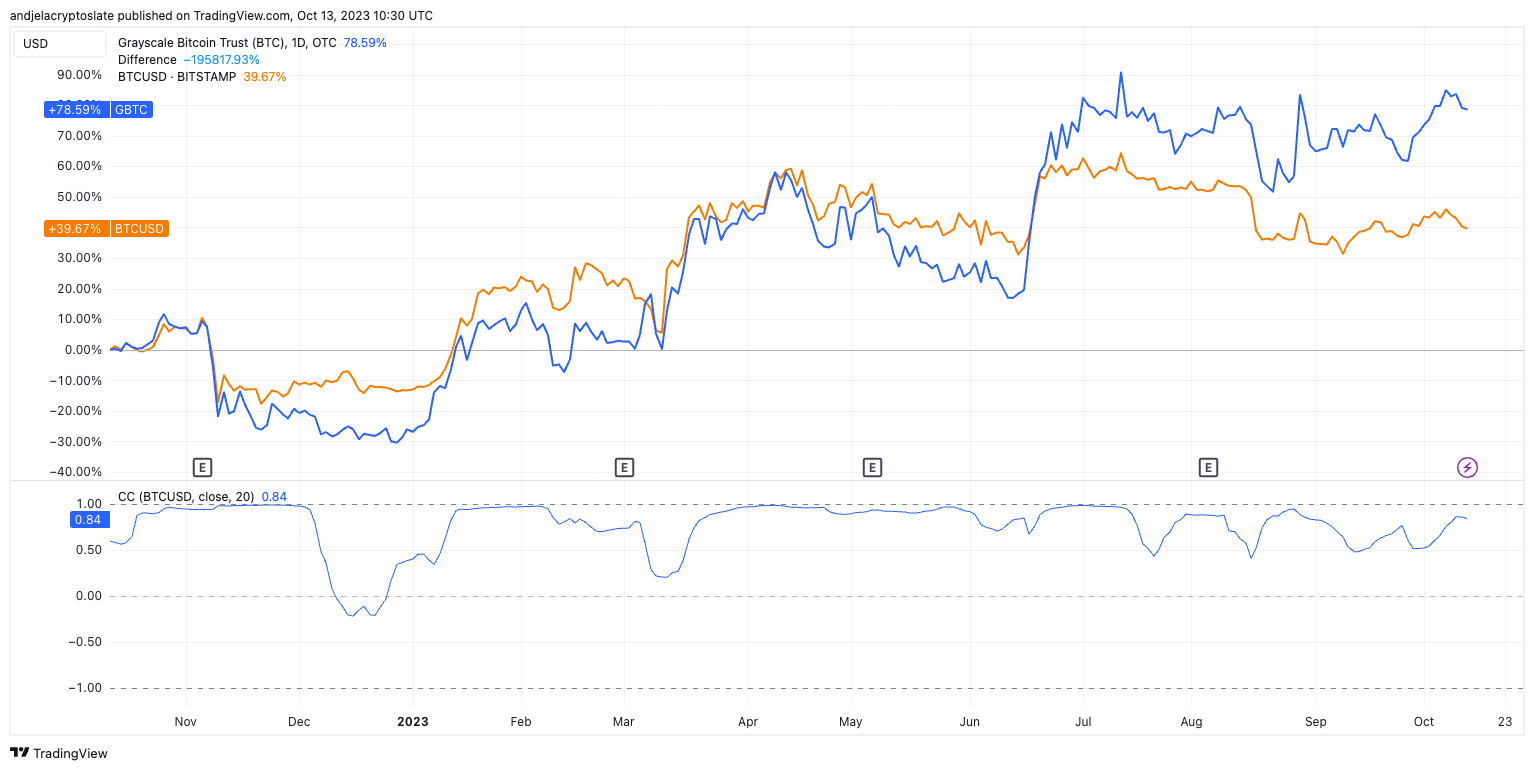

Historically, GBTC has shown a high degree of correlation with Bitcoin (BTC). This is expected since the primary asset underlying GBTC is Bitcoin. As BTC prices move, the value of the Bitcoin held by the trust also shifts, influencing GBTC’s NAV. However, the market price of GBTC, affected by supply and demand dynamics for its shares, can deviate from this NAV, leading to the mentioned premium or discount.

If regulations around cryptocurrency investment vehicles change, it could affect GBTC’s attractiveness to investors, leading to price movements independent of Bitcoin’s price. As more cryptocurrency investment vehicles emerge, especially those offering features GBTC doesn’t (like redemption features), it could reduce demand for GBTC, affecting its correlation with BTC.

One such looming regulatory decision is the potential approval of a Grayscale spot Bitcoin ETF. The market is abuzz with speculation, with many believing that Grayscale might be the frontrunner in securing this approval. This transformation would address the longstanding premium/discount issue and serve as a monumental step in integrating cryptocurrencies into mainstream finance.

The potential benefits are manifold. An ETF structure would streamline the trading process, possibly bringing in a fresh influx of institutional money. Moreover, it would further solidify Bitcoin’s position as a legitimate and recognized asset class.

However, a Grayscale Bitcoin ETF could also introduce heightened volatility, especially during its initial days, as the market adjusts to the new dynamics. And while the GBTC premium has historically been a bellwether for market sentiment, an ETF conversion might dilute this indicator’s potency.

The post Grayscale’s GBTC: Understanding its premium and market impact appeared first on CryptoSlate.