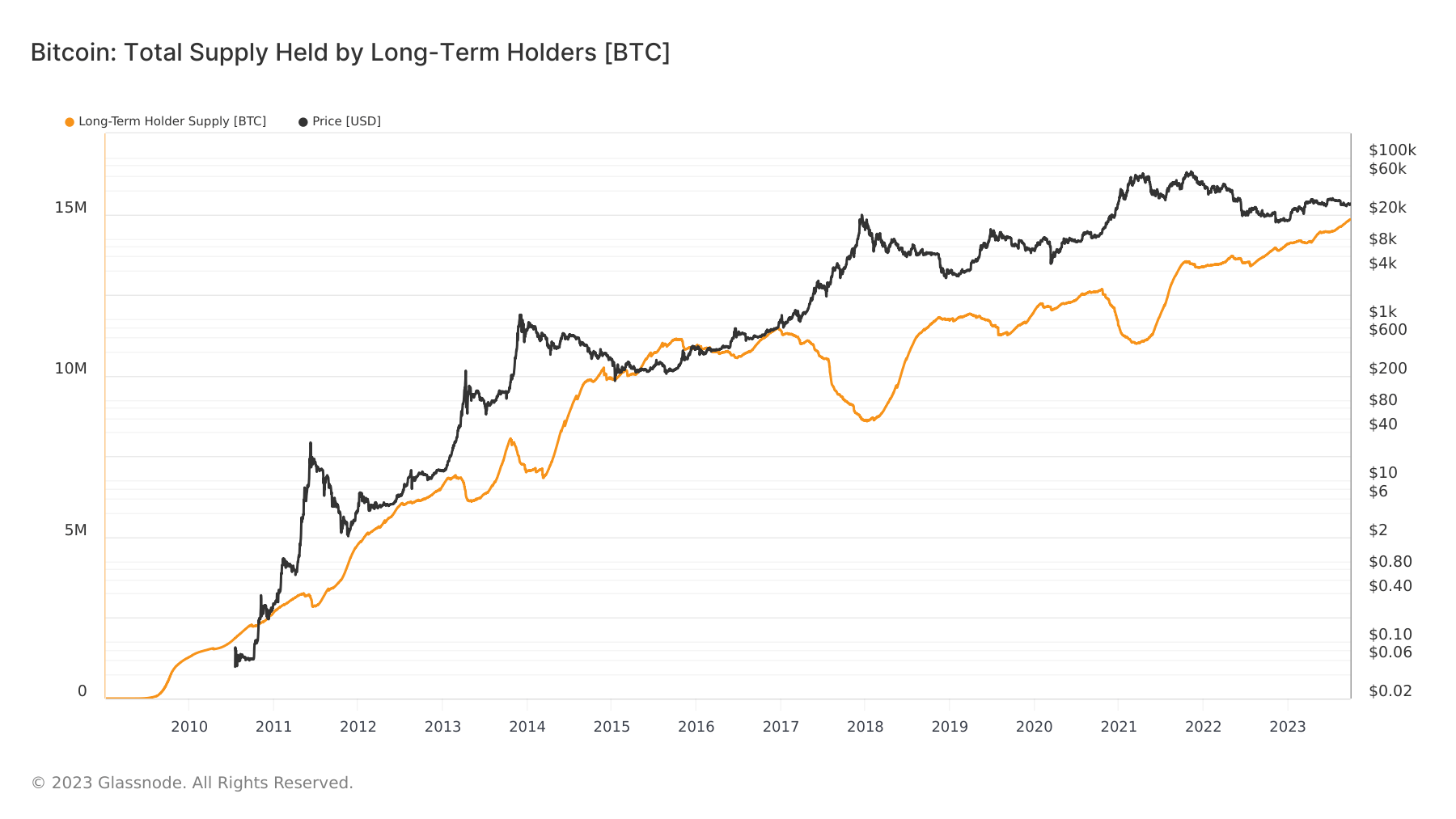

Bitcoin’s long-term holders are addresses that have held onto their Bitcoin for over 155 days. And while 155 days might not sound like a lot of time in the context of Bitcoin, addresses that have held onto their assets for longer than that have a statistically lower chance of selling their BTC.

Therefore, the actions and decisions of this particular entity can significantly influence the crypto market and Bitcoin’s price trajectory. Historically, long-term holders have shown resilience during Bitcoin’s price fluctuations, often holding onto their assets during downturns and selling during peaks.

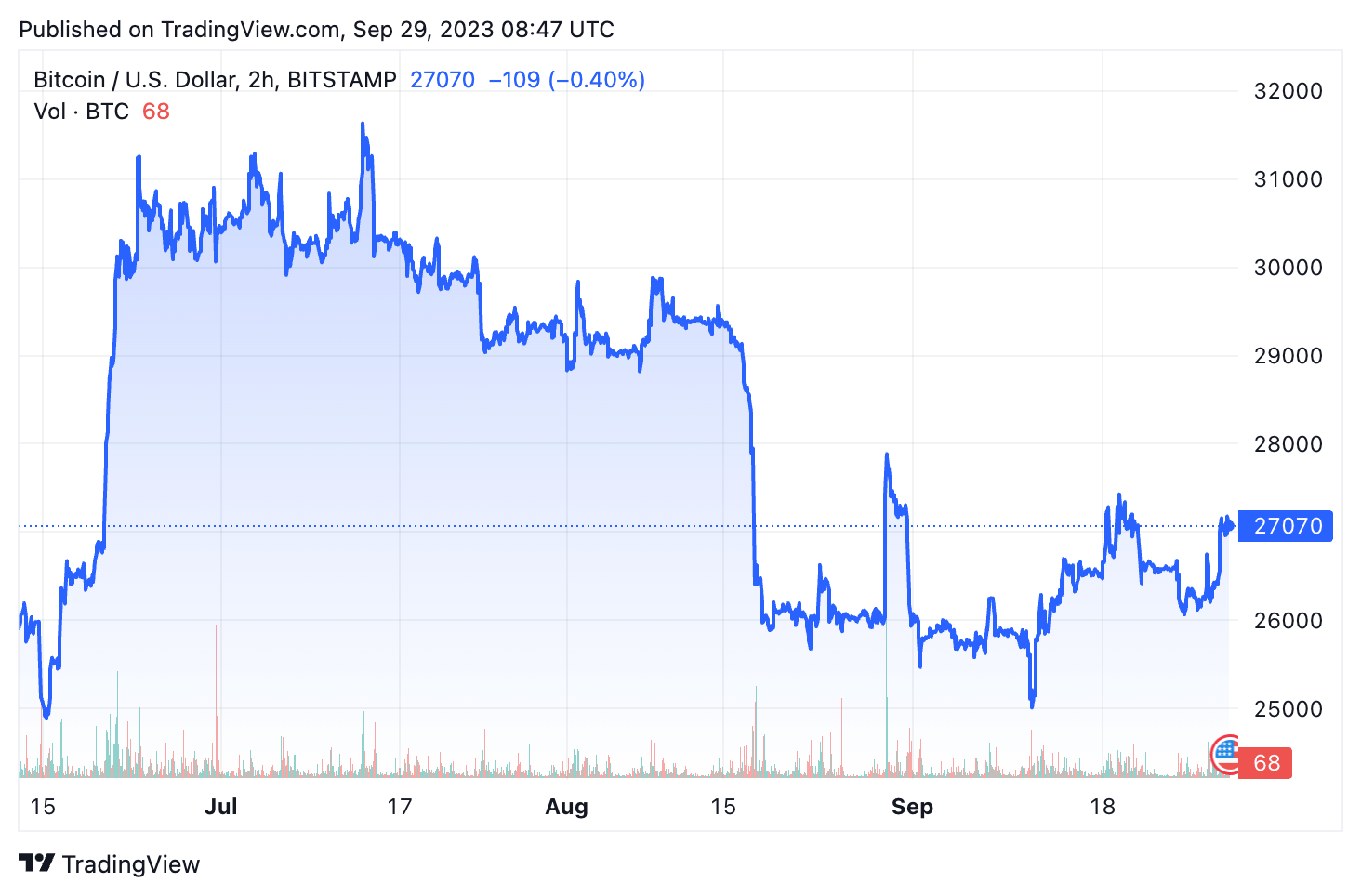

Recently, Bitcoin’s price has shown a relatively flat trading pattern, hovering around the $26,200 mark after reclaiming its $26,000 support just last week. This stabilization comes on the heels of a tumultuous month, where Bitcoin’s price plummeted to lows of $25,000, a stark contrast to the preceding months of sideways movement between $29,000 and $30,000.

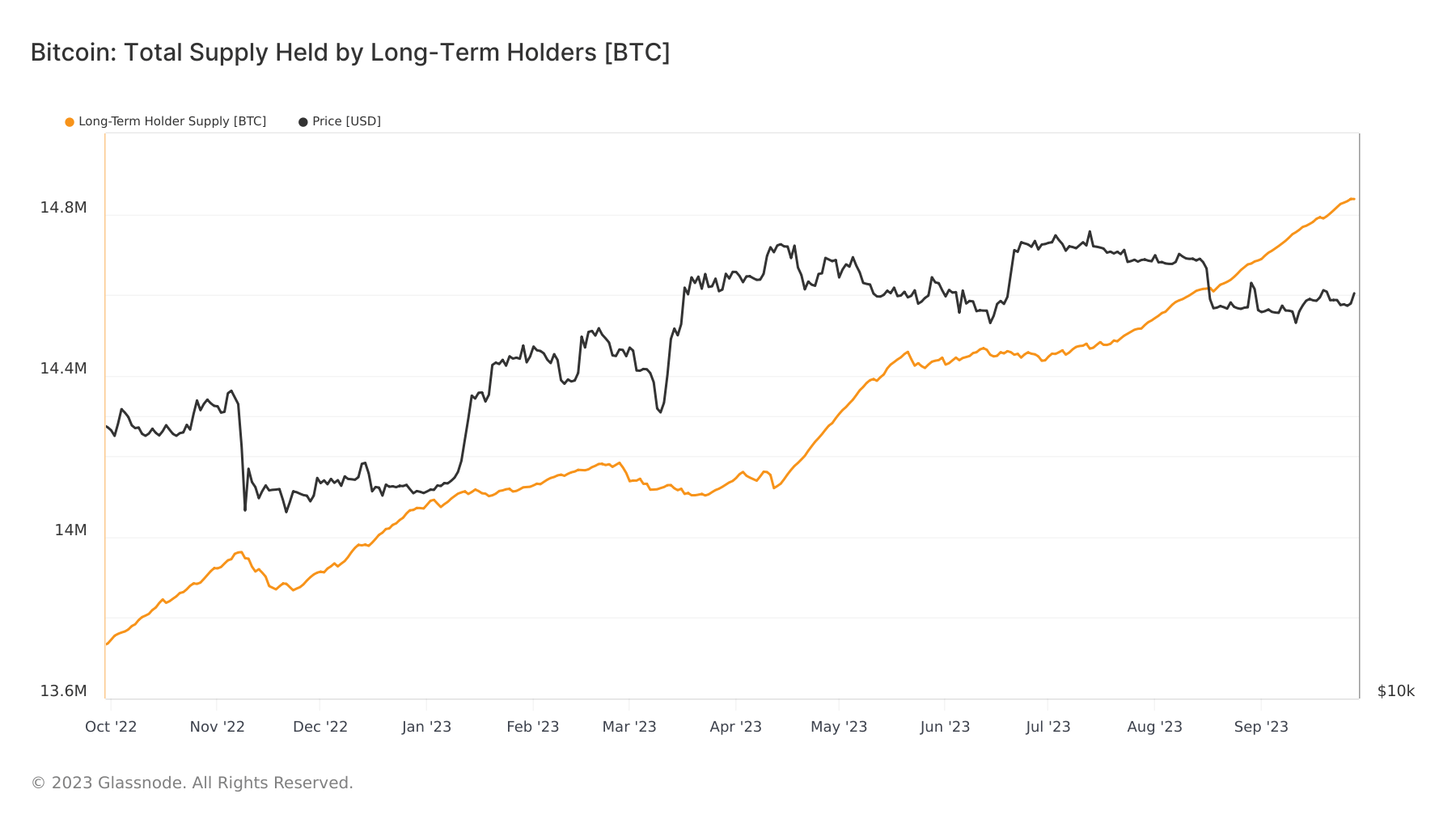

Despite the price volatility, the Bitcoin supply held by long-term holders has surged to an all-time high.

The long-term holder supply now stands at 14.83 million BTC. Since the beginning of 2023, this supply has seen an addition of 757,177 BTC. Over the past year, it has grown by 1.07 million BTC, with 152,216 BTC added in just the last 30 days.

This surge in long-term holder supply underscores these holders’ confidence in Bitcoin’s long-term potential. Even amidst price fluctuations, their willingness to hold suggests a belief in the cryptocurrency’s enduring value. Moreover, with such a significant portion of Bitcoin’s supply being held long-term, there’s reduced liquidity in the market, which can lead to increased price volatility.

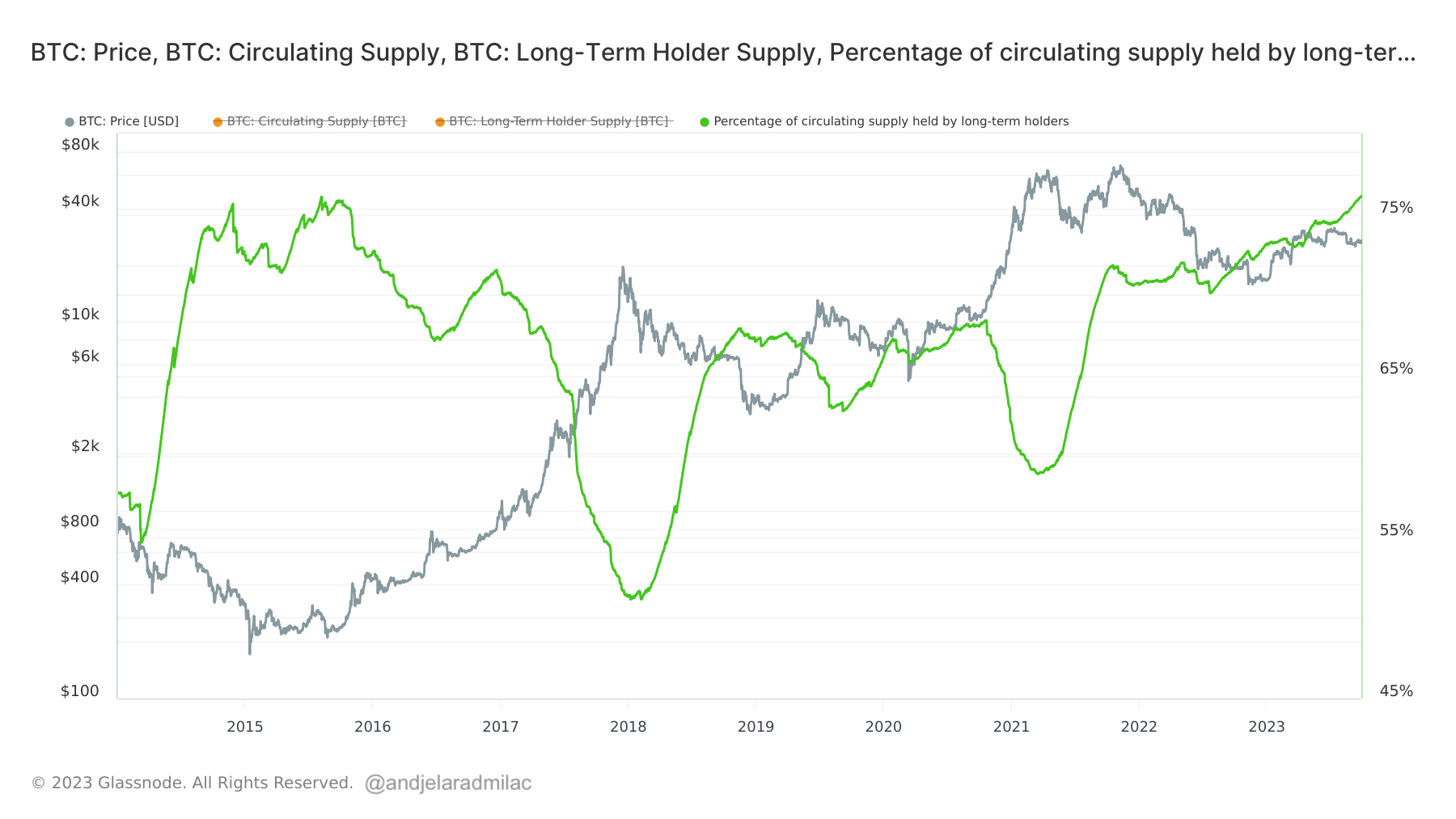

Currently, the long-term holder supply constitutes a whopping 76.09% of Bitcoin’s circulating supply. The last time this percentage was surpassed was in August 2015, when it briefly exceeded 76%. This indicates that most of Bitcoin’s circulating supply is now in the hands of those who believe in its long-term value proposition.

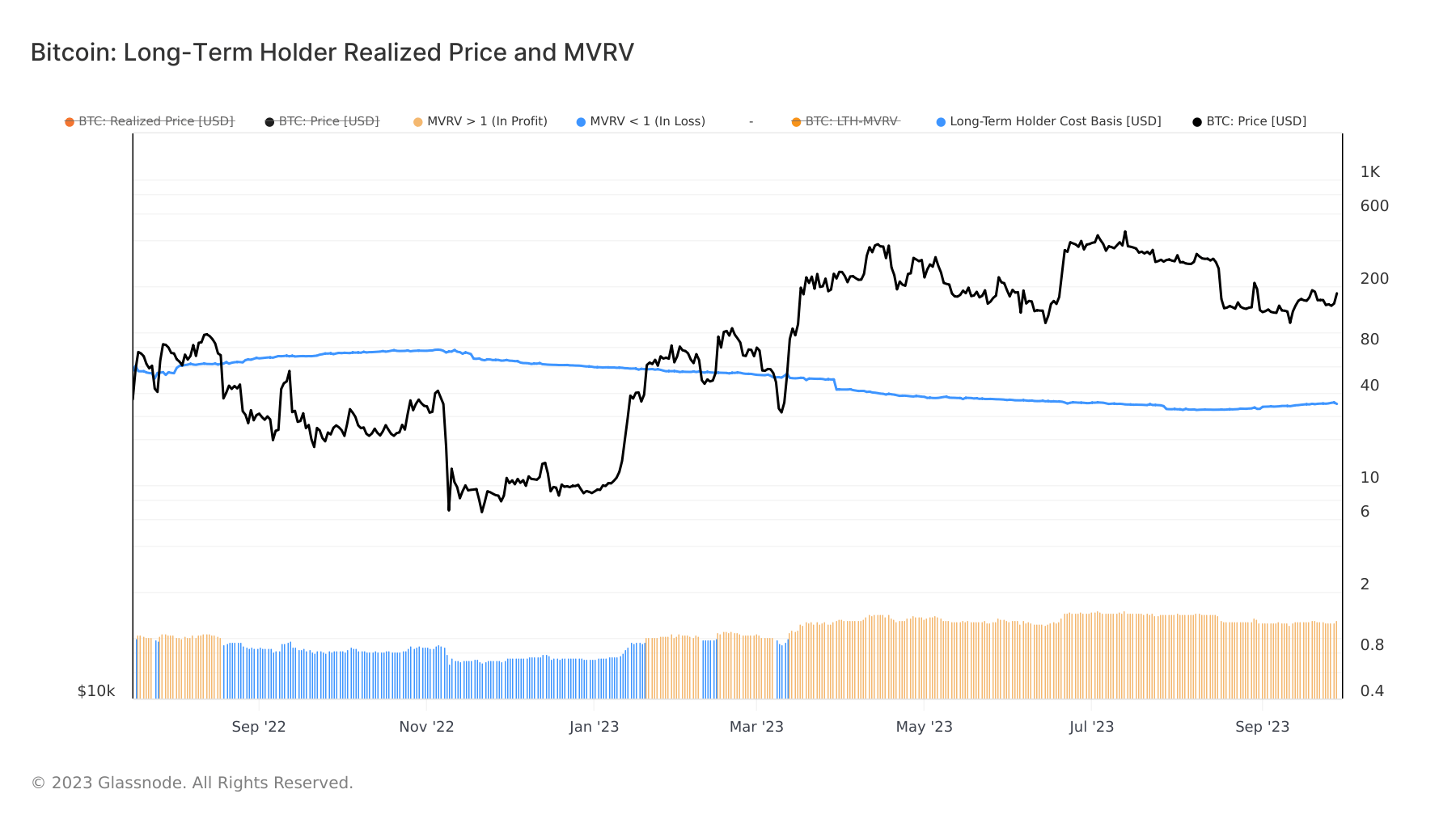

The long-term holder realized price and the MVRV ratio offer further insights. The realized price is the average price of the long-term holder Bitcoin supply, calculated based on the last transaction date of each coin on-chain. It’s often viewed as this group’s ‘on-chain cost basis.’ Data from Glassnode reveals that the realized price for long-term holders is currently $20,599. This has declined since November 2022, when it was pegged at $23,500.

The MVRV ratio, on the other hand, is a measure of the market value (spot price) relative to the realized value (realized price) for the long-term holder cohort. An MVRV ratio of 1.311, as it stands now, suggests that the current price is 31.1% above the average cost basis for long-term holders.

These metrics indicate that a significant portion of Bitcoin’s supply is currently in profit. The MVRV ratio, in particular, can be a valuable tool to gauge market sentiment. Extreme high or low values can signal periods where the market is overheated or undervalued.

The surge in Bitcoin’s long-term holder supply, coupled with the insights from on-chain metrics, paints a picture of a market that remains optimistic about Bitcoin’s future. While price volatility is a given in the crypto realm, the steadfastness of long-term holders suggests a continued belief in Bitcoin’s long-term potential.

The post Record highs in Bitcoin’s long-term holder supply signal market confidence appeared first on CryptoSlate.