The world’s largest asset manager, BlackRock, is drawing scrutiny after blockchain data revealed THAT the firm moved millions of dollars’ worth of Bitcoin just days after executing some of its largest-ever ETF purchases.

The activity has sparked debate among market participants, with some calling it “manipulation” while others point to routine portfolio rebalancing.

BlackRock Moves Millions in Bitcoin Days After $1B ETF Buys

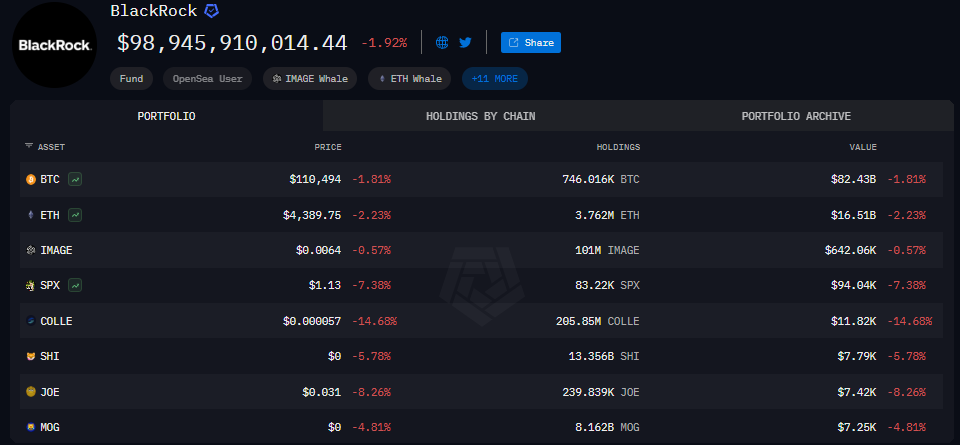

According to on-chain intelligence platform Arkham, BlackRock’s tracked cryptocurrency portfolio is currently valued at $98.95 billion, with Bitcoin and Ethereum making up nearly its entire exposure.

Bitcoin accounts for the lion’s share at 746,016 BTC, worth approximately $82.43 billion, or 83% of the portfolio.

Ethereum follows with 3.762 million ETH, valued at $16.51 billion, representing around 16.7%. Together, BTC and ETH represent 99.7% of BlackRock’s total crypto holdings, leaving other assets negligible by comparison.

The data shows dozens of structured transactions involving 300 BTC each, worth roughly $33.5 million per transfer, sent to various addresses within the past 24 hours. Some smaller transfers were also observed, including one for 201.7 BTC, valued at $22.6 million.

The consistency of the transactions suggests ETF settlement flows or rebalancing activity rather than irregular wallet movements.

Additionally, Ethereum holdings showed no such transfers, implying that ETH is being held passively in custody while Bitcoin remains the centerpiece of ETF-related liquidity management.

The transactions come on the heels of a massive accumulation spree last week. On August 14, just hours after hotter-than-expected U.S. Producer Price Index data sent crypto markets into a sharp pullback, BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA) executed one of their largest daily purchases on record.

The firm acquired 4,428 BTC, worth approximately $526 million, and 105,900 ETH, valued at $488 million, totaling more than $1 billion in a single day.

The timing was striking. The Bureau of Labor Statistics reported that the PPI for July rose 0.9%, far exceeding forecasts of 0.2% and marking the sharpest increase since February 2025.

Despite the downturn, BlackRock continued to aggressively add to its ETF products. On August 18, the firm purchased 568 BTC, valued at $62.6 million, alongside 65,901 ETH, valued at $292.6 million.

The following day, it acquired another 413 BTC for $46 million and 73,864 ETH valued at $342.6 million. In two days, BlackRock added nearly $750 million in fresh crypto exposure.

The moves show the firm’s growing influence over digital asset markets. BlackRock’s 746,000 BTC position alone represents more than 3.5% of Bitcoin’s total circulating supply, while its 3.7 million ETH holdings amount to around 3.1% of Ethereum’s supply.

Bitcoin remains the core reserve asset in its portfolio, actively cycled through ETF operations, while Ethereum plays a complementary role as a long-term strategic reserve.

The aggressive accumulation contrasts with recent investor sentiment. U.S.-listed spot Bitcoin ETFs recorded six straight days of outflows last week, totaling more than $1 billion.

The largest daily redemption came on August 19, with $523 million withdrawn as Bitcoin corrected from record highs.

Ethereum ETFs Outpace Bitcoin as Inflows Hit $4B in August

Ether spot exchange-traded funds (ETFs) have staged a sharp rebound in August, drawing billions in fresh capital and eclipsing Bitcoin counterparts in daily flows.

According to data from SoSoValue, U.S.-listed Ether ETFs have attracted $4 billion in net inflows this month, lifting their total assets to $30.17 billion, equal to 5.4% of Ethereum’s market capitalization.

Since their launch in July 2024, Ether ETFs have absorbed $13.6 billion, with August marking their second-strongest month on record.

The turnaround follows a volatile start to the month. On August 19, Ether ETFs suffered their worst trading day to date with $429 million in outflows, led by heavy redemptions from Fidelity and Grayscale.

Just a day later, however, inflows surged. BlackRock’s iShares Ethereum Trust (ETHA) added $233.6 million on August 21, while Fidelity’s FETH gained $28.5 million, pushing net inflows near $288 million. Momentum carried forward with $337.7 million on August 22, $443.9 million on August 25, and a record $455 million on August 26.

BlackRock has emerged as the clear leader in Ether ETFs. Its ETHA product alone holds $17.2 billion in net assets, more than half the market. Fidelity follows with $3.7 billion, while Bitwise’s ETHV has climbed to $3.2 billion. Grayscale’s ETHE, long dogged by redemptions, has recently posted rare positive inflows, including $5.7 million on August 27.

The surge underscores shifting institutional sentiment. Between August 21 and 26, Ether ETFs absorbed $1.83 billion, compared with just $171 million for Bitcoin funds. On August 26, Ethereum ETFs drew $455 million, while Bitcoin counterparts managed only $81 million.

Analysts say the flows reflect accelerating institutional demand for Ethereum, positioning it as Wall Street’s second major crypto investment vehicle alongside Bitcoin.

The post BlackRock Offloads Millions in BTC After Weekly Buys – Market ‘Manipulation’ or Routine Rebalance? appeared first on Cryptonews.