As Bitcoin stands at $97,630, down round 0.13% over the previous 24 hours with a market cap of $1.93 trillion, market individuals are intently monitoring the cryptocurrency’s trajectory. Latest developments in regulatory readability, institutional adoption, and political shifts are shaping Bitcoin’s future, with some analysts projecting new highs in 2025.

Trump’s Impression on Bitcoin’s Development

Donald Trump’s re-election in November has considerably influenced BTC’s rally. Beforehand a critic of cryptocurrencies, Trump has shifted gears, calling for the U.S. to change into “the crypto capital of the planet.”

His administration has nominated Paul Atkins, a well known crypto advocate, as SEC Chair, fostering optimism for favorable regulatory modifications.

The countdown has begon!

Paul Atkins is quickly in workplace and can change the crypto panorama #PaulAtkins #Trump #SEC pic.twitter.com/T1nsaDIeqG— Paul Atkins – SEC Chair (@paulatkinsx) January 5, 2025

With discussions of a possible strategic BTC reserve circulating in Washington, the U.S. authorities’s backing of Bitcoin may additional bolster its market place.

Pieran Maru, a fund supervisor at Liontrust, notes, “The incoming Trump administration may create essentially the most crypto-friendly setting on the earth, setting the stage for exponential progress.”

The potential for U.S. authorities involvement in Bitcoin is seen as a game-changer, prone to encourage broader adoption and stabilize its place as a globally acknowledged asset.

Up to date Institutional Adoption Accelerates Bitcoin’s Legitimacy

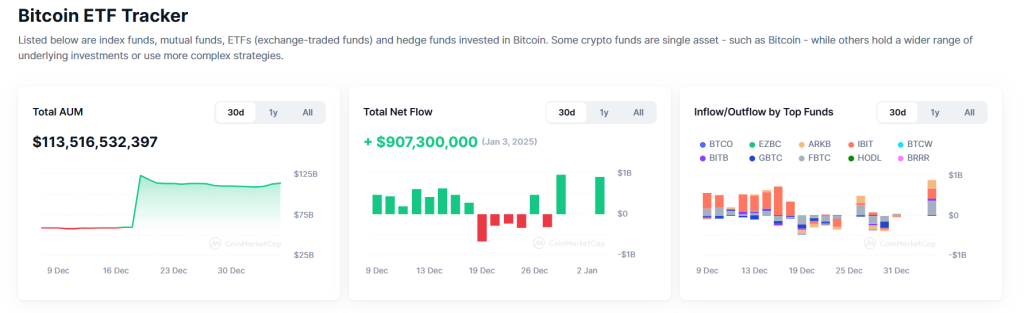

Institutional curiosity in Bitcoin continues to develop, pushed by the rising adoption of spot Bitcoin ETFs. As of January 3, 2025, Bitcoin ETFs handle $113.52 billion in Property Beneath Administration (AUM), with internet inflows of $907.3 million on the identical day, underscoring sturdy demand from institutional traders.

Spot ETFs have simplified entry to Bitcoin for banks, pension funds, and hedge funds, cementing its position in mainstream finance.

BlackRock’s analysis highlights Bitcoin’s diversification advantages, noting {that a} 1-2% allocation in a 60/40 portfolio gives a risk-reward profile akin to main tech shares.

Regulatory shifts additional help Bitcoin’s legitimacy. The U.S. SEC is advancing crypto-friendly insurance policies, whereas the UK’s Monetary Conduct Authority is easing restrictions.

Mixed with rising ETF inflows, these elements reinforce Bitcoin’s standing as a reputable institutional asset.

Bitcoin’s Technical Outlook: Key Ranges to Watch

Bitcoin is testing key resistance close to $98,000, a degree strengthened by a downward trendline. Rapid resistance ranges stand at $98,000, adopted by $100,071 and $102,010.

On the draw back, help zones are positioned at $96,375, $95,446, and $93,344.

The Relative Power Index (RSI) sits at 58, reflecting impartial momentum, whereas Bitcoin stays above its 50-day Exponential Shifting Common (EMA) at $96,375.

This implies reasonable bullish sentiment but additionally highlights the significance of breaking the $98,000 resistance to unlock additional upside potential.

$BEST Pockets: Web3 Simplified, $6.27M Raised in Presale

Greatest Pockets is redefining Web3 with an modern platform that helps hundreds of cryptocurrencies throughout 50+ main blockchains, together with Bitcoin and Ethereum. It allows customers to securely purchase, promote, and swap property inside and throughout chains—with out requiring KYC verification.

The $BEST token presale has already raised a exceptional $6,270,984, and there are lower than 24 hours remaining till the subsequent worth enhance. At present priced at $0.02345, $BEST gives unique rewards and early entry to initiatives inside its quickly increasing ecosystem.

Why Spend money on $BEST?

- Utility-Pushed: Designed for seamless use in DeFi, staking, and token claims.

- Early-Mover Benefit: Acquire entry to presale perks and unique challenge launches.

- Increasing Ecosystem: Quickly rising neighborhood with partnerships on trending platforms like Pepe Unchained.

Greatest Pockets continues to draw consideration, as mirrored by energetic engagement on its Twitter and Telegram channels.

The publish Markets Await Trump Return to White Home: What to Anticipate From Bitcoin Value? appeared first on Cryptonews.