In complete contrast to yesterday’s picture, the crypto market is down today, with nearly all of the top 100 coins per market cap seeing their prices fall over the past 24 hours. At the same time, the cryptocurrency market capitalization has dropped 4.2% to $3.43 trillion. The total crypto trading volume is at $97.3 billion, notably down compared to yesterday’s $120 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, only one of the top 10 coins per market cap is green.

Bitcoin (BTC) is down 0.4%, meaning it’s mostly unchanged, currently trading at $108,836.

Ethereum (ETH) has seen a drop of 2.1%, currently changing hands at $2,547.

Dogecoin (DOGE) saw the highest decrease in this category: 4.4% to the price of $0.1673.

At the same time, Tron (TRX) is the only green coin, but with a rise of 0.4%, meaning it’s practically unchanged over the past day at $0.2856.

Moreover, five of the top 100 coins saw increases, but only one of them was high enough to move the price. Pudgy Penguins (PENGU) is up 1.8% to $0.01576.

On the other hand, Pepe (PEPE) saw the highest decrease of 8.3% to $0.000009791.

The Pudgy Penguins team recently summarized their accomplishments over the past few months, including a partnership with NASCAR, going live on Upbit and Revolut, CBOE filing for the CANARY PENGU ETF, and more.

It feels like @pudgypenguins are taking over the world this year…

Nascar partnership

Live on @Official_Upbit

Live on @RevolutApp

Collab with @PEZCandyUSA

CBOE $PENGU ETF filing

Book partnership with @randomhousekids

@PenguClash game

Partnership with… pic.twitter.com/cmZncjqFdZ

— Cryptotwits (Stocktwits) (@CryptotwitsHQ) July 2, 2025

Meanwhile, shares of DeFi Development Corp. jumped 17% on Thursday after the company revealed it had acquired $2.7 million worth of Solana as part of its crypto treasury strategy. Earlier this week, it said it planned to raise $112.5 million through private placements, expected to close Monday.

News: DeFi Development Corp (Nasdaq: $DFDV) has purchased 17,760 Solana coins for $2.72 million.

This brings the company’s total Solana holdings to 640,585 $SOL, currently worth around $98.1 million—making it one of the largest public holders of Solana.

The newly acquired… pic.twitter.com/bDftGzhBH4— Crypto Coin Show (@CryptoCoinShow) July 4, 2025

‘Traders are Betting on a Big July’

Sean Dawson, Head of Research at decentralized onchain options platform, Derive.xyz, commented that “June’s biggest price swings were geopolitical.” We saw major drawdowns during key escalation points in the Middle East on June 13 and 22.

That said, “limited volatility spikes tell us markets were betting on limited fallout. That’s exactly what played out,” Dawson says. “The muted response in monthly volatility suggests traders correctly anticipated that hostilities would be contained.”

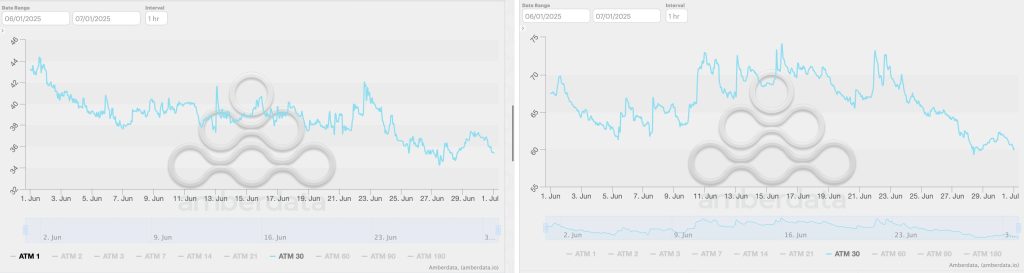

Moreover, volatility trended lower across both ETH and BTC. The former’s 30-day implied volatility fell from 44% to 36% and the latter’s from 68% to 60%.

BTC and ETH 30-day volatility

Dawson continues: “Traders are betting on a big July, with volatility suppressed and positioning split, all eyes are now on the Fed, macro data, and further geopolitical developments. ETH has the stronger momentum narrative, but BTC’s options market is coiled for a decisive move.”

Upside catalysts for BTC to hit $130,000 include the US Federal Reserve rate cuts at the 29 July meeting (25% chance) and de-escalation in Israel’s war against Iran and Palestine.

Downside catalysts that could result in the price retreating to $90,000 include a hawkish Fed tone, hot inflation print, increased tensions in the Middle East, ETF outflows, and miner capitulation.

Finally, per Dawson, there’s a 10% chance that BTC will surpass $130,000 by the end of August, and a 15% chance ETH will surpass $3,300 in that same period.

ETH sentiment is significantly more bullish than BTC’s, he says. “Robinhood’s announcement of an L2 on Arbitrum for tokenized stocks in the EU could reignite the real-world asset (RWA) narrative around Ethereum.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $108,836. It has seen quite choppy trading over the past day. The price fell to the $180,830 level twice, and its current price is its intraday low. This follows a drop from a daily high of $110,386.

At the same time, Ethereum is currently trading at $2,547. As the chart shows, the coin went on a continual drop from the daily high of $2,630 to the lowest daily point so far of $2,532, before rising slightly to the current price.

Meanwhile, the crypto market sentiment remains mostly unchanged within neutral territory. The Fear and Greed Index increased from 55 yesterday to 55 today. Investors continue to wait for additional news and signals that would prompt a further rise to greed or a drop to fear.

Notably, on 3 July, US BTC spot exchange-traded funds (ETFs) recorded inflows of a whopping $601.94 million. This marks the highest positive daily flow in six weeks, since 22 May. Of the total amount, Fidelity accounts for $237.13 million, BlackRock $224.04 million, and Ark & 21 Shares $114.25 million.

Also, on 3 July, US ETH ETFs recorded inflows of $148.57 million, significantly higher than the 2 July outflow of $1.82 million. BlackRock and Fidelity saw the highest positive flows of $85.38 million and $64.65 million, respectively.

Meanwhile, Singapore-based crypto firm Amber International completed a $25.5 million private placement for its $100 million crypto ecosystem reserve fund. The Nasdaq-listed company announced its crypto reserve strategy early this year diversifying allocations in Bitcoin, Ethereum, and Solana. It’s now expanding to Binance Coin, XRP, and SUI.

Amber International is aiming to progress its $100 million crypto reserve strategy with a $25.5 million private placement.#AmberInternational #Cryptostrategyhttps://t.co/hKCJsVwdHl

— Cryptonews.com (@cryptonews) July 4, 2025

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has dropped over the past 24 hours, while the US stock market saw another day of mixed performance on Wednesday. For example, the S&P 500 increased by 0.83%, the Nasdaq-100 went up by 0.99%, and the Dow Jones Industrial Average rose by 0.77%.

However, Ruslan Lienkha, Chief of Markets at YouHodler, argues that Bitcoin “stands poised to follow equities to new highs.” This week saw a surge in optimism across US equity markets, with the S&P 500 hitting a new ATH. “If the S&P 500 holds above its previous February peak following the release of the Non-Farm Payrolls data in the coming weeks, it could serve as a strong technical and psychological catalyst not just for equities but also for the cryptocurrency market.”

- Is this dip sustainable?

This appears to be another short-term dip in the market, marking minor decreases before additional pushes higher. In the medium term, analysts expect the prices to continue increasing overall, regardless of unavoidable drops.

You may also like: (LIVE) Crypto News Today: Latest Updates for July 4, 2025 The crypto market is showing mixed signals today, with the total crypto market cap falling 2.9%. Bitcoin is up 0.5% over the past 24 hours, currently trading just above $109,000 after briefly crossing $110,300. Ethereum has held strong position, rising over 0.7% and trading above $2,570. But what else is happening in crypto news today? Follow our up-to-date live coverage…

The post Why Is Crypto Down Today? – July 4, 2025 appeared first on Cryptonews.