BitMine, once hailed as a potential digital-asset equivalent of Berkshire Hathaway, envisioned itself locking down 5% of all Ethereum’s circulating supply.

Its core strategy was to turn its corporate balance sheet into a long-term, high-conviction bet on the blockchain network’s infrastructure.

Today, that ambitious vision has collided with a brutal market reality. With Ethereum tumbling by over 27% in a single month and trading below $3,000, BitMine is staring down more than $4 billion in unrealized losses.

This massive drawdown is not an isolated incident; it mirrors a deeper, systemic crisis engulfing the entire Digital Asset Treasury (DAT) sector, which is buckling under the very volatility it was created to capitalize on.

ETH’s accumulation thesis meets existential stress

BitMine currently holds nearly 3.6 million ETH, representing about 2.97% of Ethereum’s circulating supply. However, the balance sheet tells a story of acute pressure.

The value of its holdings has shriveled from a peak well over $14 billion to just under $10 billion, translating to an estimated $3.7 billion to $4.18 billion in paper losses, depending on the valuation method.

Independent analysis by 10x Research suggests the company is effectively down about $1,000 for every ETH purchased.

For a standard, diversified corporation, such an impairment might be manageable. But for a pure-play DAT company, whose central and often sole purpose is to accumulate and hold crypto, the impact is existential.

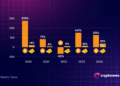

And BitMine is not alone. Capriole Investments’ data shows that major ETH treasury companies have recorded negative returns between 25% and 48% on their core holdings. Firms like SharpLink and The Ether Machine have seen their holdings fall by as much as 80% off their yearly highs.

Across the DAT landscape, the rapid pullback in ETH has swiftly converted corporate balance sheets into liabilities, pushing the sector into a genuine stress test.

This pressure is forcing a dramatic reversal of corporate intent. FX Nexus, formerly Fundamental Global Inc., had filed a shelf registration to raise $5 billion to acquire Ethereum, aiming to become the world’s largest corporate holder of the cryptocurrency.

Yet, as prices spiraled downward, the firm reversed course, selling more than 10,900 ETH (roughly $32 million) to finance share repurchases.

This contradiction, in which companies created to accumulate crypto now sell it to protect their equity value, highlights the fundamental strain in the DAT model. Instead of being accumulators of last resort, as the bullish narrative suggested, DATs are rapidly becoming forced deleveragers.

When the mNAV premium collapses

The operational viability of a DAT firm rests on a crucial metric: the market-value-to-net-asset-value ratio (mNAV). This ratio compares the company’s stock market valuation to the actual value of its net crypto holdings.

In a bull market, when a DAT trades at a premium (mNAV> 1), it can issue new shares at a high price, raise capital cheaply, and use the proceeds to acquire additional digital assets. This virtuous cycle of accumulation and premium-fueled growth breaks down entirely when the market turns.

According to BitMineTracker, BitMine’s basic mNAV now sits at 0.75, with its diluted mNAV at 0.90. These figures signal that the market values the firm at a steep discount to the crypto it holds.

When the premium shrinks or disappears entirely, raising capital becomes nearly impossible; issuing new shares simply dilutes existing holders without producing meaningful treasury expansion.

Markus Thielen of 10x Research aptly termed the situation a “Hotel California scenario.” Like a closed-end fund, once the premium collapses and a discount emerges, buyers disappear, sellers pile up, and liquidity evaporates, leaving existing investors “trapped in the structure, unable to get out without significant damage.”

Crucially, DAT firms layer on opaque fee structures that often resemble hedge-fund-style management compensation, further eroding returns, especially during a downturn.

Unlike Exchange-Traded Funds (ETFs), which maintain tight arbitrage mechanisms to keep their share price close to their Net Asset Value (NAV), DATs rely solely on sustained market demand to close the discount. When prices fall sharply, that demand vanishes.

What remains is a precarious structure where:

- The underlying asset value is falling.

- The share valuation trades at a widening discount.

- The complex revenue model cannot be justified by performance.

- Existing shareholders are stuck unless they exit at steep, realized losses.

Capriole’s analysis confirms this is a sector-wide issue, showing that most DATs now trade below mNAV. This loss of premium effectively shuts down the main channel for financing growth through equity issuance, thereby collapsing their ability to fulfill their core mission of accumulating crypto.

What next for DATs?

BitMine, while pushing back against the narrative by citing broader liquidity stress, likening the market condition to “quantitative tightening for crypto,” is still grappling with the structural reality.

Treasury companies are fundamentally dependent on a triple-whammy of success: rising asset prices, rising valuations, and rising premiums. When all three reverse simultaneously, the model enters a negative spiral.

The rise of the DAT sector was inspired by MicroStrategy’s success with a debt-financed Bitcoin treasury. But as Charles Edwards of Capriole put it plainly:

“Most treasury companies will fail.”

The distinction is critical: ETH’s volatility profile is unique, DAT business models are far thinner, and their capital structures are more fragile than MicroStrategy’s.

Most critically, they often lack the strong, independent operating cash flows needed to withstand extended market downturns without succumbing to asset sales.

For the DAT model to survive this stress test, three difficult conditions must be met:

- ETH prices must execute a strong, sustained rebound.

- mNAV ratios must return well above 1 to re-unlock capital raising.

- Retail and institutional investors must regain confidence in a structure that has erased billions in paper value.

Currently, all three conditions are moving in the wrong direction. BitMine may continue to hold its massive ETH reserve and could still hit its 5% supply target if the market stabilizes.

However, the company and the sector as a whole now serve as a cautionary case study.

They highlight the extreme dangers of building an entire corporate strategy and capital structure on a single, highly volatile digital asset without the structural safeguards, regulatory discipline, or balance sheet diversification required to weather a major market reversal.

The digital-asset treasury era has entered its first genuine moment of truth, and the resulting billions in losses are revealing a business model far more fragile than its creators ever anticipated.

The post Ethereum’s crash just exposed a $4B time bomb — and why regular investors should pay attention appeared first on CryptoSlate.