Ethereum could emerge as the biggest winner from the rise of digital asset treasuries (DATs), with analysts at Standard Chartered arguing that the proof-of-stake blockchain is better positioned than either Bitcoin or Solana as market pressures intensify.

In a report published Monday, Geoffrey Kendrick, the bank’s global head of digital assets research, said Ethereum treasuries are set to play a larger role in driving demand for the token compared with their Bitcoin and Solana counterparts.

The assessment comes as publicly listed companies that hold cryptocurrencies on their balance sheets face increasing pressure from falling market valuations.

Standard Chartered Sees Consolidation Ahead in Bitcoin-Focused DATs

Digital asset treasuries have been one of the defining investment trends of 2025, helping push crypto prices to fresh highs earlier in the year.

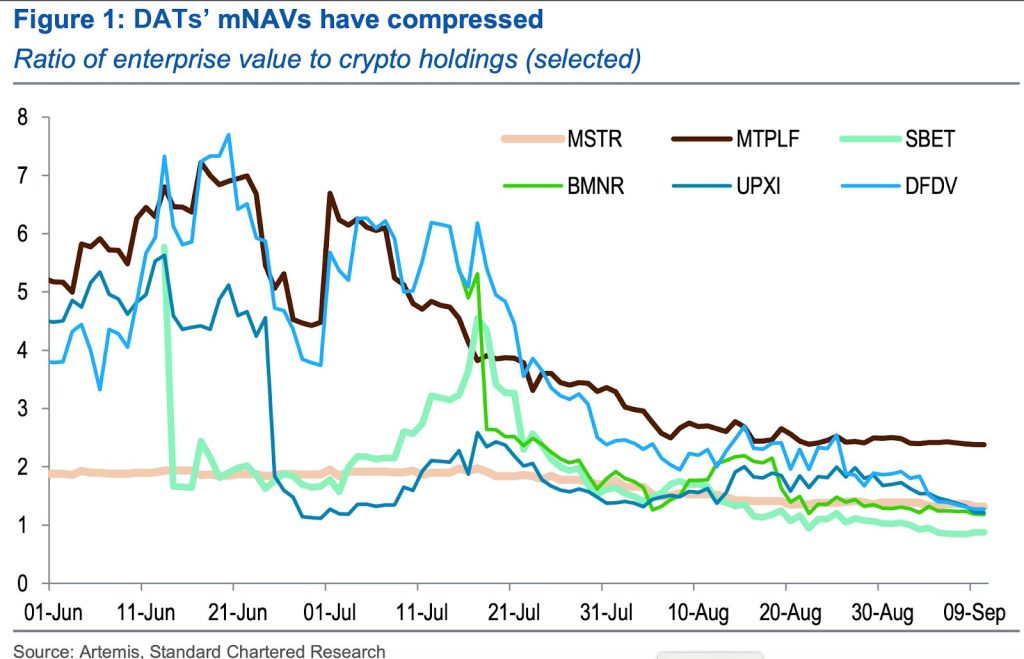

These firms rely on trading at a premium to the value of their holdings, known as market NAV (mNAV), to raise funds for further purchases.

But in recent weeks, mNAVs for many DATs have slipped below 1, reducing their ability to buy additional tokens and triggering concerns about sustainability.

Kendrick argued that this phase would mark a shakeout in the sector, with success depending on three factors: the ability to raise cheap funding, scale that attracts liquidity, and the generation of staking yield.

He noted that Ethereum and Solana treasuries have an advantage over Bitcoin in this regard, as both networks offer staking rewards.

“We think ETH and SOL DATs should be assigned higher mNAVs than BTC DATs due to staking yield,” Kendrick said.

The analyst also noted market saturation among Bitcoin-focused firms. Inspired by Strategy’s aggressive accumulation of BTC, nearly 90 companies have launched similar models, collectively holding more than 150,000 BTC, six times more than at the start of the year.

With valuations under pressure, Standard Chartered expects consolidation in this space, suggesting that acquisitions of smaller DATs by larger players could become more common.

Such moves, however, would represent coin rotation within the sector rather than new demand for Bitcoin.

Ethereum treasuries, by contrast, continue to expand. Kendrick said companies holding ETH have already accumulated about 3.1% of the cryptocurrency’s circulating supply since June.

BitMine Immersion Technologies, listed on the NYSE American, is currently the largest ETH-focused DAT with more than 2 million ETH, representing about 5% of supply.

Bitcoin miner turned Ethereum accumulator Bitmine now owns a total of 2,126,018 ETH worth $9.24 billion following the latest buy.#Bitmine #ETH #ETHTreasuryhttps://t.co/e3MvMrg7lT

— Cryptonews.com (@cryptonews) September 11, 2025

The firm is still only one-third of the way to its target and has continued buying despite the broader market pressure.

Solana treasuries are smaller and less developed, with about 0.8% of the token’s supply held by DATs.

Questions also remain over regulatory treatment, with reports suggesting Nasdaq-listed firms may need shareholder approval before allocating to crypto.

Kendrick noted that this leaves Ethereum in a stronger relative position.

According to Standard Chartered, DATs already hold 4% of all Bitcoin, compared with 3.1% of Ethereum and 0.8% of Solana.

The bank sees Ethereum treasuries as better placed to maintain demand, thanks to staking rewards, a clearer regulatory outlook, and aggressive accumulation strategies.

Ethereum is currently trading at $4,492, down 2.6% on the day but still up more than 150% since July, following institutional adoption and ETF inflows.

Despite recent volatility, Kendrick concluded that DAT activity remains a more positive driver for ETH than for BTC or SOL going forward.

Ethereum Treasury Firms Gain Ground as ETFs Attract Record Inflows

Standard Chartered has doubled down on its view that Ethereum treasury companies may offer stronger upside than spot exchange-traded funds (ETFs).

Kendrick said in August that firms buying Ether (ETH) for balance-sheet strategies are becoming increasingly attractive to investors as their net asset value (NAV) multiples normalize.

According to Kendrick, the NAV ratios of treasury firms, market capitalization relative to ETH holdings, are now stabilizing near 1.0.

This adjustment, he argued, makes them “very investable” for investors seeking ETH exposure, particularly as these companies provide a form of regulatory arbitrage compared with direct crypto ownership.

He pointed out SharpLink Gaming, whose NAV multiple peaked at 2.5 before falling closer to parity, and BitMine Immersion Technologies, the sector leader with 2.15 million ETH ($9.7 billion) on its books.

@SharpLinkGaming one of the largest corporate holders of Ethereum, has officially launched its $1.5B share buyback program.$SBET #Ethereum https://t.co/bWNct5LKjO

— Cryptonews.com (@cryptonews) September 9, 2025

Together, Ethereum treasury companies now hold nearly 5 million ETH, or about 4.1% of the circulating supply, according to industry trackers.

That figure rivals the holdings of U.S.-listed spot ETFs, which collectively manage 6.69 million ETH ($30.2 billion), equal to 5.5% of supply. BlackRock’s ETHA leads the pack with $17.25 billion in assets.

The post Ethereum Treasuries Set to Outperform Bitcoin and Solana as DAT Shakeout Looms: Standard Chartered appeared first on Cryptonews.