Key Takeaways:

- XDC Community and Archax have launched tokenized variations of 4 main cash market funds (MMFs) managed by abrdn, Constancy Worldwide, BlackRock, and State Road.

- The initiative presents institutional traders safe and compliant entry to high quality yield-generating property.

- The tokenized real-world asset (RWA) sector is predicted to achieve $16 trillion by 2030.

Blockchain agency XDC Community introduced on Monday that it had launched its first tokenized funds via a partnership with Archax, a UK-based FCA-regulated digital asset change.

XDC Community & Archax Convey Cash Market Funds On-Chain!

XDC Community is thrilled to announce the launch of the primary fund tokens on our blockchain in collaboration with @ArchaxEx , the FCA-regulated digital asset change. This milestone builds on our earlier partnership for…— XDC Community (@XDC_Network_) February 24, 2025

In a press launch shared with Cryptonews, the agency mentioned Archax has tokenized 4 cash market funds (MMFs) from the next monetary establishments: abrdn, Constancy Worldwide, BlackRock, and State Road. These funds are actually out there on the XDC Community platform.

XDC Community and Archax acknowledged that they search to supply institutional traders expanded entry to conventional monetary devices via blockchain expertise.

“Offering digital representations of main MMFs opens up a possible new viewers for these kind of yield-bearing merchandise that traditionally have been difficult for some to entry,” mentioned Keith O’Callaghan, Head of Asset Administration and Structuring at Archax.

The partnership includes utilizing XDC Community’s proof-of-stake (DPoS) consensus mechanism, permitting transaction settlement and sustaining near-zero fuel charges.

“With our platform’s sturdy efficiency and performance, we now have the best protocol for real-world asset tokenization for establishments who wish to work with regulated entities like Archax,” mentioned Angus O’Callaghan, Head of Buying and selling and Markets at XDC Community.

Development and Potential of Tokenized RWAs

Tokenized cash market funds have already skilled rising investor demand, signaling rising market curiosity.

The tokenization of RWAs (real-world property) is more and more prioritized throughout main markets globally. This shift is basically pushed by the normal monetary (TradFi) sector.

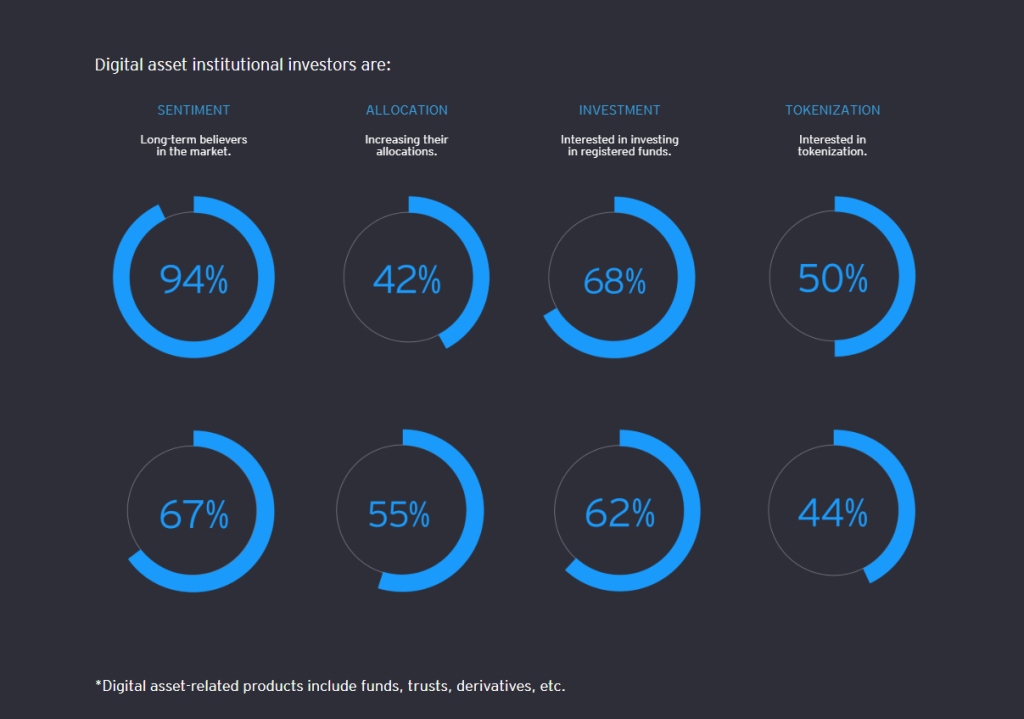

Analysis from Ernst & Younger discovered that fifty% of institutional traders have expressed particular curiosity in investing in tokenized property.

In accordance with Customary Chartered, the tokenized RWA market might develop to $30.1 trillion by 2034.

Most not too long ago, the sector reached a brand new all-time excessive of $17.4 billion, studies Rachel Wolfson for Cryptonews.

RWA tokenization refers to monetary merchandise and tangible property minted on a blockchain community, permitting elevated investor accessibility and higher buying and selling alternatives.

The RWA market has expanded by 80% over the previous two years and is predicted to see robust development shifting ahead.

Charting the Way forward for Funding

Reworking conventional cash market funds into digital tokens encourages traders to rethink the boundaries between standard finance and digital expertise.

This initiative introduces other ways to handle danger and liquidity, prompting stakeholders to reevaluate longstanding funding methods.

As tokenized real-world property proceed to broaden, new discussions round portfolio diversification and effectivity emerge.

Every tokenized asset contributes to shaping the continued evolution of asset administration practices.

Finally, this growth bridges historic monetary practices with present technological capabilities, providing a balanced strategy to future investments.

The put up XDC Community and Archax Launch 4 Tokenized Funds appeared first on Cryptonews.