Bitcoin’s narrow trading range and lack of liquidity have considerably impacted centralized exchanges. Given their importance for the market, analyzing volumes across centralized exchanges is becoming instrumental in gauging crypto market sentiment.

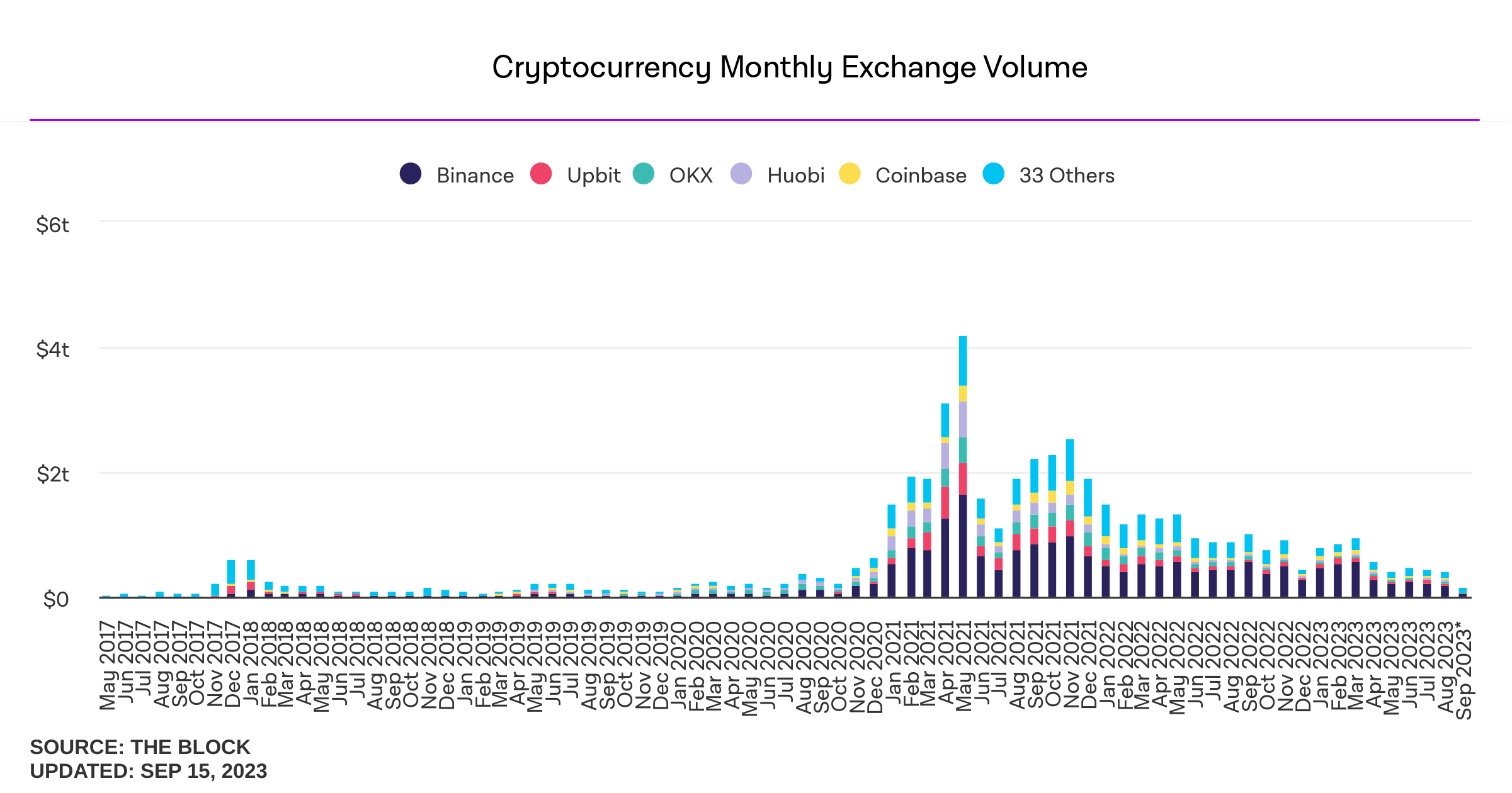

In May 2021, centralized exchanges saw an all-time high in monthly trading volumes – reaching $4.1 trillion. Dominating this monumental volume was Binance, which accounted for $1.64 trillion in monthly volume. However, this peak was short-lived, as exchanges began seeing notable drops in trading volume almost every month since May 2021.

Trading volumes spiked briefly in November 2021, likely due to FTX’s downfall and the subsequent massive market selloff—nevertheless, the predominant trend since May shows a noticeable descent in volume.

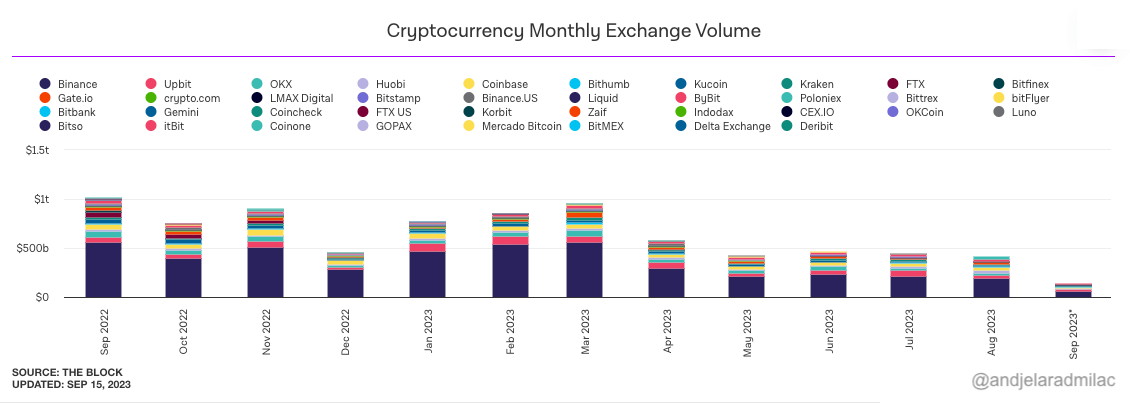

According to data from The Block, December 2022 saw the most significant dip in the past year. The cumulative monthly trading volume across exchanges plummeted from $905.32 billion in November to just $458.32 billion in December 2022.

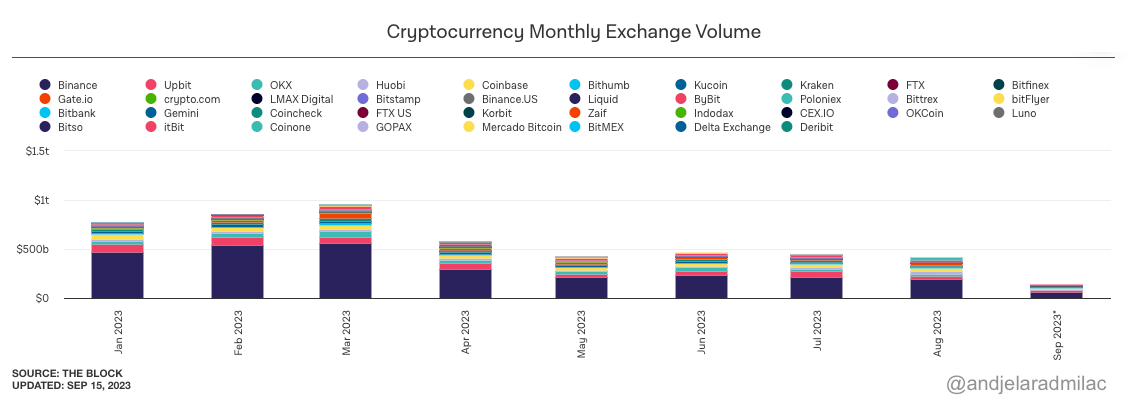

Fast forward to January 2023, the volume stood at $778.47 billion. By August 2023, it decreased to a $422.95 billion. This represents a $24 billion decrease from the monthly trading volume recorded in July 2023.

Binance bore the brunt of this decline. While it posted a trading volume of $474.11 billion in January, August saw it retract to $192.12 billion. The most significant monthly drop for Binance occurred between March and April this year, tumbling from $556.36 billion to $293.83 billion.

In contrast, Coinbase weathered the storm better. Despite ending January with a volume of $55.32 billion and a drop to $26.59 billion by August, Coinbase’s monthly trading volume has impressively remained stable at around $26 billion since May.

Binance’s fluctuating volumes can be attributed to the significant regulatory and internal challenges the exchange has faced this year. Initially, the SEC’s lawsuit against Binance and its CEOs signaled tumultuous times ahead for the platform. Subsequently, Belgium’s financial regulators mandated a halt in its services. The departure of two high-ranking executives from Binance US added to the platform’s vulnerabilities—strained regulatory pressures manifested in a significant 70% drop in spot trading. The company’s European operations faced setbacks, and most recently, substantial staff reductions and extensive asset withdrawals have marked the latest in its series of challenges.

Conversely, Coinbase’s resilience can be attributed to its strategic positioning. The green light from CFTC to offer regulated futures to U.S. customers, an expansion into the Canadian market post-Binance’s exit, and combating SEC actions have painted Coinbase in a favorable light, enhancing its market share amidst adversities.

Dwindling trading volumes, especially on dominant exchanges like Binance, indicate caution and a market in introspection. A mix of global regulatory pressures, company-specific challenges, and the market’s natural cyclic behavior contribute to this. While Coinbase’s stability offers a glimmer of hope, Binance’s struggles warrant more caution.

The post Centralized exchanges grapple with declining trading volume appeared first on CryptoSlate.